10/2/24

The Livestock Markets had a strong move higher. The Fats took off today. December’24 Live Cattle was 2.52 ½ higher today and settled at 187.70. Today’s high was 187.75 and that is the new 1-month high as well. Today’s low was 185.02 ½ and the 1-month low is 173.50. Since 8/30 December’24 Live Cattle are 10.15 higher or almost 6%. The Feeders shot straight up today. November’24 Feeder Cattle were 3.87 ½ higher and settled at 248.55. Today’s high was 248.70 and that is the new 1-month high as well. Today’s low was 244.42 ½ and the 1-month low is 226.27 ½. Since 8/30 November’24 Feeder Cattle are 13.30 higher or about 5 ½%. The Hogs were flying higher today. December’24 Lean Hogs were 2.15 higher today and settled at 76.75. Today’s high was 76.80 and that is the new 1-month high as well. Today’s low was 74.60 and the 1-month low is 70.55. Since 8/30 December’24 Lean Hogs are 3.97 ½ higher or almost 5 ½%. The Cattle Market shot higher today and it was hard to figure out why. I received a phone call again today from the Gentleman in Texas and he told me the packers were bidding 186 and it was being passed on, holding out for a stronger bid. (Thank you again for call) I also heard that there could be panicked buying because of the port strike, but that should not have any effect on the price or access to beef supplies here. Then again, Cattle is a Globally Traded Commodity, and if you can trade Widgets to the downside, then you can trade them to the upside as well. It is day two of the Dock Strike and already there are multiple ships anchoring outside of the ports on the East Coast and outside of Houston. The strike could affect some beef and Pork exports, but it’s too soon to tell.

The Grains were mixed today, with the Wheat closing much higher. November’24 Soybeans were 1 ¼ cents lower today and settled at 1056. Today’s high was 1063 ¾ and the 1-month high is 1069 ¾. Today’s low was 1042 ½ and the 1-month low is 995 ¼. Since 8/30 November’24 Soybeans are 56 cents higher or more than 5 ½%. The Corn Market made new highs again today. December’24 Corn was 3 ½ cents higher today and settled at 432 ½. Today’s high was 434 ¼ and that is the new 1-month high as well. Today’s low was 428 ½ and the 1-month low is 397. Since 8/30 December’24 Corn is 31 ½ cents higher or almost 8%. The Wheat Market headed higher again as well. December’24 Wheat was 16 ¼ cents higher today and settled at 615 ¼. Today’s high was 617 ¼ and that is the new 1-month high as well. Today’s low was 596 ¼ and the 1-month low is 544 ¼. Since 8/30 December’24 Wheat is 63 ¾ cents higher or more than 11 ½%. StoneX raised their Corn and Soybean crop estimates this morning. They increased their Corn yield by 1.10 bushels per acre, to 184 bushels per acre. They also increased their Soybean production by ½ a bushel per acre, to 53.5 bushels per acre. So, it has already begun… The yields for Corn and Soybeans this year is probably going to be Big. I recommend selling some Corn and Soybeans now and before the Report. Russia’s Wheat crop could be in trouble and get even worse. They are still dealing with dry conditions, and it looks like the dry weather could stick around for a while. Wheat can also continue to rally if tensions between Israel and Iran continue to intensify, as Wheat is considered a ‘political grain’. If the Wheat continues to rally, it can pull the Corn higher in the short-term, but I don’t expect to see Corn over 450 or rallying after the WASDE Report. The Soybeans rallied about a dollar off the lows, and that was mostly due to short covering. The record shorts decided to take the profit and not worry about potential dry weather in South America. It looks as though the Market has stabilized and the Facts can start to be important in the Market again. The Brazilian weather reports are starting to change. There are more forecasts showing potential rains arriving in the Central part of the Country next week. If or when the rains do arrive it will be a game changer in the Soybean Market, and just before the WASDE Report is released. The European Union also pushed back their start of the deforestation rules in regard to Brazilian Soybeans. It will now begin in 2026, not at the start of next year. With StoneX already raising their Soybean Production estimates just before the Report, it makes me think the Pro Farmer Soybean production numbers could be more accurate than the USDA’s Production numbers. I have new trades ready specifically for this report. There are a couple trades to put on now, and a couple to put on the day before the report. If you are interested, there is still time to get setup and put on a position before the WASDE Report just 7 trading days away.

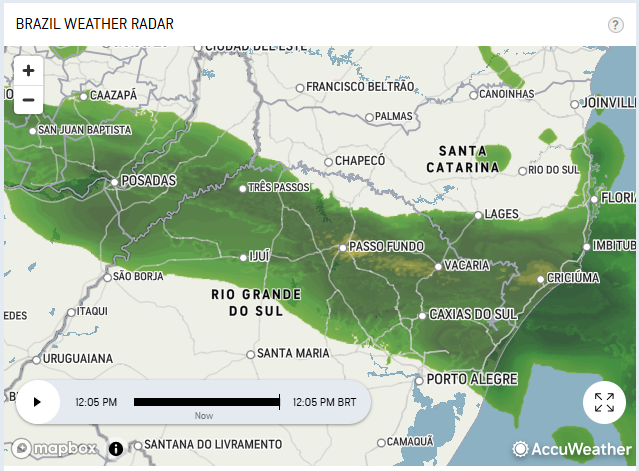

Map Below is Southern Brazil Radar Around Noon Local Time Today, in Rio Grande Do Sul

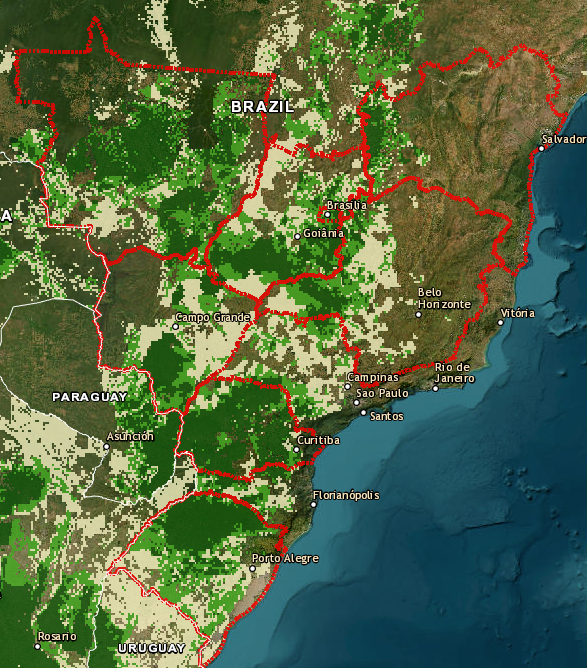

There are two maps below, one is a closeup, and they show where the Soybeans are typically planted in Brazil. This way you can see if the rain falls where the Soybeans are grown. The 7 major planting areas are: Mato Grasso 26%, Parana 15%, Rio Grande Do Sul 14%, Goias 10%, Mato Grasso Do Sul 8%, Minas Gevais 5%, Bahia 5%.

.

NOT A WEATHER MAP – This is where Soybeans are typically planted in Brazil. The 7 Red Outlines Represents Approximately 80% of Brazil’s Soybean Planting – NOT A WEATHER MAP

NOT A WEATHER MAP – This is where Soybeans are typically planted in Brazil. The 7 Red Outlines Represents Approximately 80% of Brazil’s Soybean Planting – NOT A WEATHER MAP

NOT A WEATHER MAP

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.