12/22/23

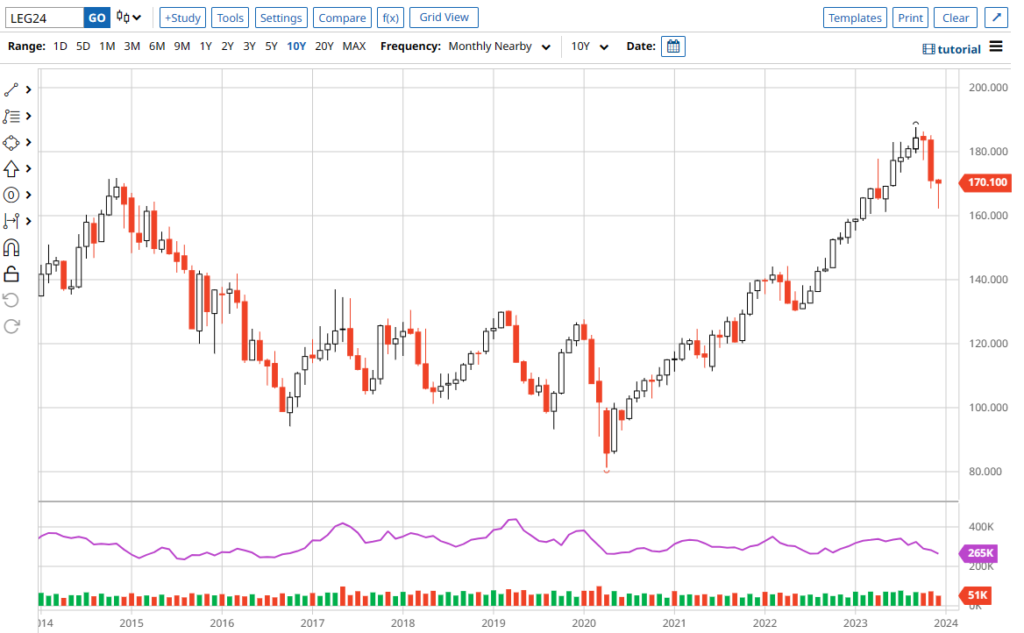

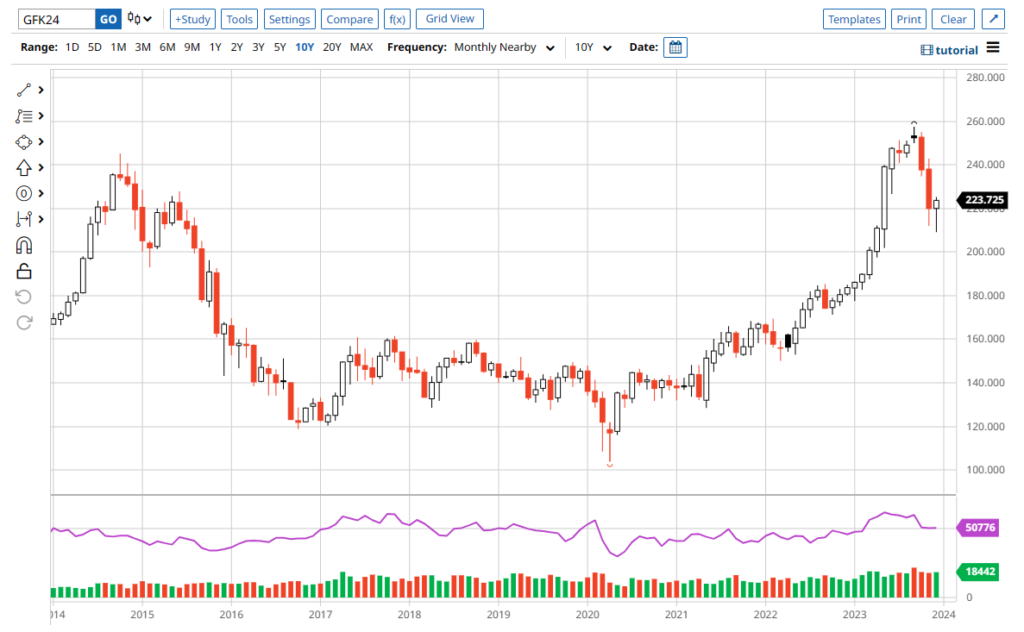

I believe the Cattle Markets are in trouble…Today February’24 Live Cattle was down 0.150 and settled at 168.525, above today’s low of 167.850. Since 1½2 February’24 Live Cattle are down 6.750 or almost 4%. The Feeders posted a gain today. March’24 Feeder Cattle was 1.025 higher today and settled at 224.400, in the middle of today’s range. Since 1½2 March’24 Feeder Cattle are down 5.725 or about 2 ½%. February’24 Lean Hogs gained 0.700 today and settled at 71.350, also in the middle of the sessions range today. Since 11/22 February’24 Lean Hogs are down 0.475, or just above ½%. I have been Bearish the Cattle Markets for a while, and I diffidently still am. The Cattle on Feed Report was released this afternoon, and it did not look good. Here is what Pro-Farmer had to say “Today’s cattle-on-feed report stated the December 1, 2023, large-lot feedlot population at 12.006 million head, up 2.7% from year-ago. That topped industry expectations for a 2.2% annual increase. The industry expected November feedlot placements to fall 3.8% short of year-ago, but the official USDA figure came in at 1.868 million, down just 1.9% annually. November marketings sank 7.4% from last year, which may have a somewhat negative impact on the market since traders expected a 6.7% annual drop. Look for live cattle futures to drop on next Tuesday’s opening”. I think Cattle is still heading lower. Live Cattle toward the 145 level and Feeder Cattle toward the 185 level. The Cattle charts below resemble 2014. I still like the idea of selling into any strength in the Cattle Markets. I still believe this is still the right environment to hedge or put on option trades in the Cattle markets. Next year’s prices: August’24 Live Cattle 171.000, August’24 Feeder Cattle 247.625, August’24 Lean Hogs 94.300.

LIVE CATTLE CALLS

| MONTH | STRIKE | PRICE | COST |

| FEB’24 168.525 | 175C | 1.200 | $480 |

| 180C | 0.525 | $210 | |

| 185C | 0.175 | $70 | |

| ATM 169C 3.125 | ATM STRADDLE 6.700 | EXPIRES 2/2/24 | |

| APR’24 172.125 | 180C | 2.575 | $1,030 |

| 185C | 1.350 | $540 | |

| 190C | 0.825 | $330 | |

| ATM 172C 5.575 | ATM STRADDLE 11.025 | EXPIRES 4/5/24 | |

| JUN’24 170.125 | 180C | 2.925 | $1,170 |

| 190C | 1.300 | $520 | |

| 200C | 0.550 | $220 | |

| ATM 170C 6.725 | ATM STRADDLE 13.325 | EXPIRES 6/7/24 |

LIVE CATTLE PUTS

| MONTH | STRIKE | PRICE | COST |

| FEB’24 168.525 | 160P | 0.975 | $390 |

| 155P | 0.475 | $190 | |

| 150P | 0.200 | $80 | |

| ATM 169P 3.575 | ATM STRADDLE 6.700 | EXPIRES 2/2/24 | |

| APR’24 172.125 | 165P | 2.825 | $1,130 |

| 160P | 1.775 | $710 | |

| 155P | 1.075 | $430 | |

| ATM 172P 5.450 | ATM STRADDLE 11.025 | EXPIRES 4/5/24 | |

| JUN’24 170.125 | 160P | 3.025 | $1.210 |

| 150P | 1.275 | $510 | |

| 140P | 0.500 | $200 | |

| ATM 170P 6.600 | ATM STRADDLE 13.325 | EXPIRES 6/7/24 |

AUGUST’24 LIVE CATTLE

| CURRENT PRICE | PRICE ACTION | PRICE AFTER MOVE | STRIKE | CURRENT PRICE |

| 171.000 | 10% BULL MOVE | 188.100 | 188C | 2.050 |

| 171.000 | 10% BEAR MOVE | 153.900 | 154P | 2.150 |

| 171.000 | 20% BULL MOVE | 205.200 | 204C | 0.550 |

| 171.000 | 20% BEAR MOVE | 136.800 | 138P | 0.550 |

| 171.000 | 30% BULL MOVE | 222.300 | 222C | 0.175 |

| 171.000 | 30% BEAR MOVE | 119.700 | 120P | 0.100 |

FEEDER CATTLE CALLS

| MONTH | STRIKE | PRICE | COST |

| MAR’24 224.400 | 225C | 8.125 | $4,62.50 |

| 230C | 5.975 | $2,987.50 | |

| 235C | 4.300 | $2,150 | |

| ATM 224C 8.625 | ATM STRADDLE 16.850 | EXPIRES 3/28/24 | |

| APR’24 229.525 | 235C | 7.725 | $3,862.50 |

| 240C | 5.950 | $2,975 | |

| 245C | 4.525 | $2,262.50 | |

| ATM 230C 9.875 | ATM STRADDLE 20.225 | EXPIRES 4/25/24 | |

| MAY’24 233.950 | 244C | 7.575 | $3,787.50 |

| 250C | 5.750 | $2,875 | |

| 254C | 4.775 | $2,387.50 | |

| ATM 234C 11.675 | ATM STRADDLE 23.400 | EXPIRES 5/23/24 |

FEEDER CATTLE PUTS

| MONTH | STRIKE | PRICE | COST |

| MAR’24 224.400 | 215P | 4.550 | $2,275 |

| 210P | 3.150 | $1,575 | |

| 205P | 2.175 | $1,087.50 | |

| ATM 224P 8.225 | ATM STRADDLE 16.850 | EXPIRES 3/28/24 | |

| APR’24 229.525 | 220P | 6.100 | $3,050 |

| 210P | 3.300 | $1,650 | |

| 200P | 1.675 | $837.50 | |

| ATM 230P 10.350 | ATM STRADDLE 20.225 | EXPIRES 4/25/24 | |

| MAY’24 233.950 | 220P | 6.025 | $3,012.50 |

| 210P | 3.475 | $1,737.50 | |

| 200P | 1.925 | $962.50 | |

| ATM 234P 11.725 | ATM STRADDLE 23.400 | EXPIRES 5/23/24 |

AUGUST’24 FEEDER CATTLE

| CURRENT PRICE | PRICE ACTION | PRICE AFTER MOVE | STRIKE | CURRENT PRICE |

| 247.625 | 10% BULL MOVE | 272.387 | 272C | 7.050 |

| 247.625 | 10% BEAR MOVE | 222.862 | 224P | 6.525 |

| 247.625 | 20% BULL MOVE | 297.150 | 296C | 3.150 |

| 247.625 | 20% BEAR MOVE | 198.100 | 200P | 2.200 |

| 247.625 | 30% BULL MOVE | 321.912 | 320C | 1.525 |

| 247.625 | 30% BEAR MOVE | 173.337 | 174P | 0.575 |

LEAN HOG CALLS

| MONTH | STRIKE | PRICE | COST |

| FEB’24 71.350 | 75C | 1.225 | $490 |

| 80C | 0.350 | $140 | |

| 85C | 0.125 | $50 | |

| ATM 71C 2.925 | ATM STRADDLE 5.500 | EXPIRES 2/14/24 | |

| APR’24 77.575 | 85C | 1.550 | $620 |

| 90C | 0.700 | $280 | |

| 95C | 0.325 | $130 | |

| ATM 78C 4.125 | ATM STRADDLE 8.675 | EXPIRES 4/12/24 | |

| JUN’24 92.300 | 100C | 2.400 | $960 |

| 110C | 0.700 | $280 | |

| 120C | 0.225 | $90 | |

| ATM 92C 5.675 | ATM STRADDLE 11.050 | EXPIRES 6/14/24 |

LEAN HOG PUTS

| MONTH | STRIKE | PRICE | COST |

| FEB’24 71.350 | 65P | 0.675 | $270 |

| 60P | 0.225 | $90 | |

| 55P | 0.075 | $30 | |

| ATM 71P 2.575 | ATM STRADDLE 5.500 | EXPIRES 2/14/24 | |

| APR’24 77.575 | 70P | 1.600 | $640 |

| 65P | 0.700 | $280 | |

| 60P | 0.325 | $130 | |

| ATM 78P 4.550 | ATM STRADDLE 8.675 | EXPIRES 4/12/24 | |

| JUN’24 92.300 | 84P | 2.375 | $950 |

| 74P | 0.750 | $300 | |

| 64P | 0.225 | $90 | |

| ATM 92P 5.375 | ATM STRADDLE 11.050 | EXPIRES 6/14/24 |

AUGUST’24 LEAN HOGS

| CURRENT PRICE | PRICE ACTION | PRICE AFTER MOVE | STRIKE | CURRENT PRICE |

| 94.300 | 10% BULL MOVE | 103.730 | 102C | 2.950 |

| 94.300 | 10% BEAR MOVE | 84.870 | 86P | 2.925 |

| 94.300 | 20% BULL MOVE | 113.160 | 112C | 1.000 |

| 94.300 | 20% BEAR MOVE | 75.440 | 76P | 1.050 |

| 94.300 | 30% BULL MOVE | 122.590 | 122C | 0.375 |

| 94.300 | 30% BEAR MOVE | 66.010 | 68P | 0.425 |

10 Year Live Cattle Chart Below

10 Year Feeder Cattle Chart Below

I have market commentary and option charts in Pure Hedge – Livestock

and Pure Hedge – Grain at WWW.WALSHTRADING.COM

Call for specific trade recommendations.

1-312-957-8079

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.