Let’s give Thanks, confidence in System? Change,

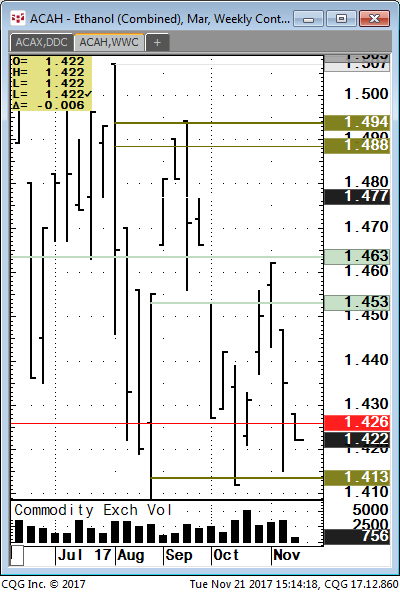

FRB Yellens’ natives getting restless? Yield curve flattens. 2 year i rate closer to tens before yearend, .60-ish

Is this this markets players ready to blow or maybe flip, long bonds like in Summer 2016 at highs? My diary had a $40.5bil player flip long at those 2.08% all time lows in rates (or high prices) in bonds, also historic OLS TYU 133.ish.

Why does this matter? Market prices reflect confidence in the system right?

Lets look macro skeptical at one of biggest non US Income Tax players.

Ubers GCI’s Gated-Community-Imperialists. Above the law? Yes until today maybe. $70 bil mkt cap. Forget their sex in the stairways and host of other (moral values?)but now Uber hid a hacking incident!

Thats against the law and we need as traders to recognize (or get broker whom does) when a macro event occurs, right?

Saudi s arrested news- they pay up on Saudi GCI’s tax evasion and to get out of jail. Saudis now paying bribes for freedom or tax pmt?

We need these kind of galli-ons in Wash DC.

Loss of confidence signals in markets may be starting and you may get the wrong signal at 1st.

Managed expectations is key now in your trading.

Mute the TV & Social media.

Women’s movement is underway and this immediate firing of Charlie Rose is stunning as Mike Bloomberg sacrifice. His documentary type interview will be VERY interesting on his next pick. I bet its a,,, enough.

If you’re looking to trade markets at extremes that hook the sheep like I, for over decade, then give me a call.

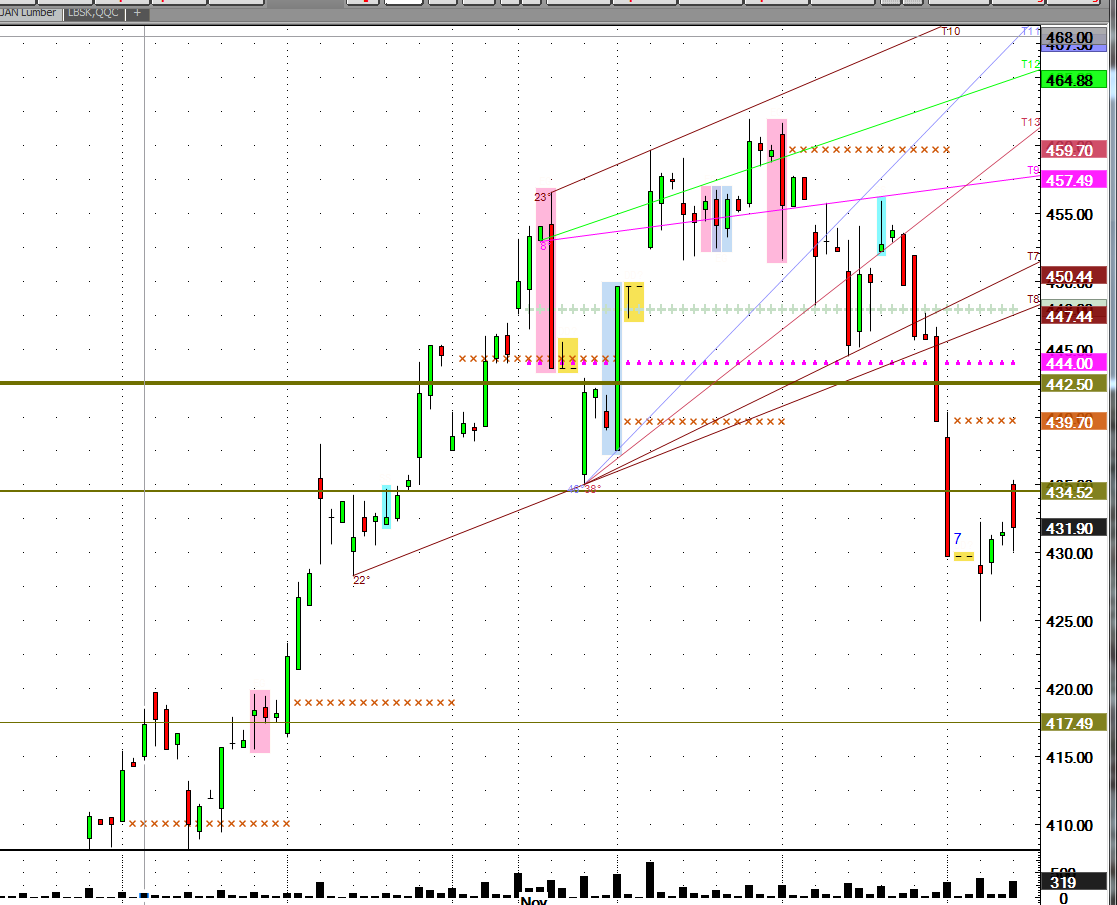

Lumber- Is this insurance front runner historic bull market over? Who follows lumber? 442.

Is live cattle like hogs weeks back, a bottom? 59.26.

Pattern in tow. Jan Feeder’s yest low was pattern 149.50, new low stop always all mkts is a must. Make the bet at a line, .50c stop-ish, trader profile, then enjoy the day. OCO’s work if you want.

Bonds- hundreds of billions in R&D (opioids) profits hidden. 1 US death per 15min.s

up from last months 22min, Staggering. BIO tanked 12%, but can not cover.

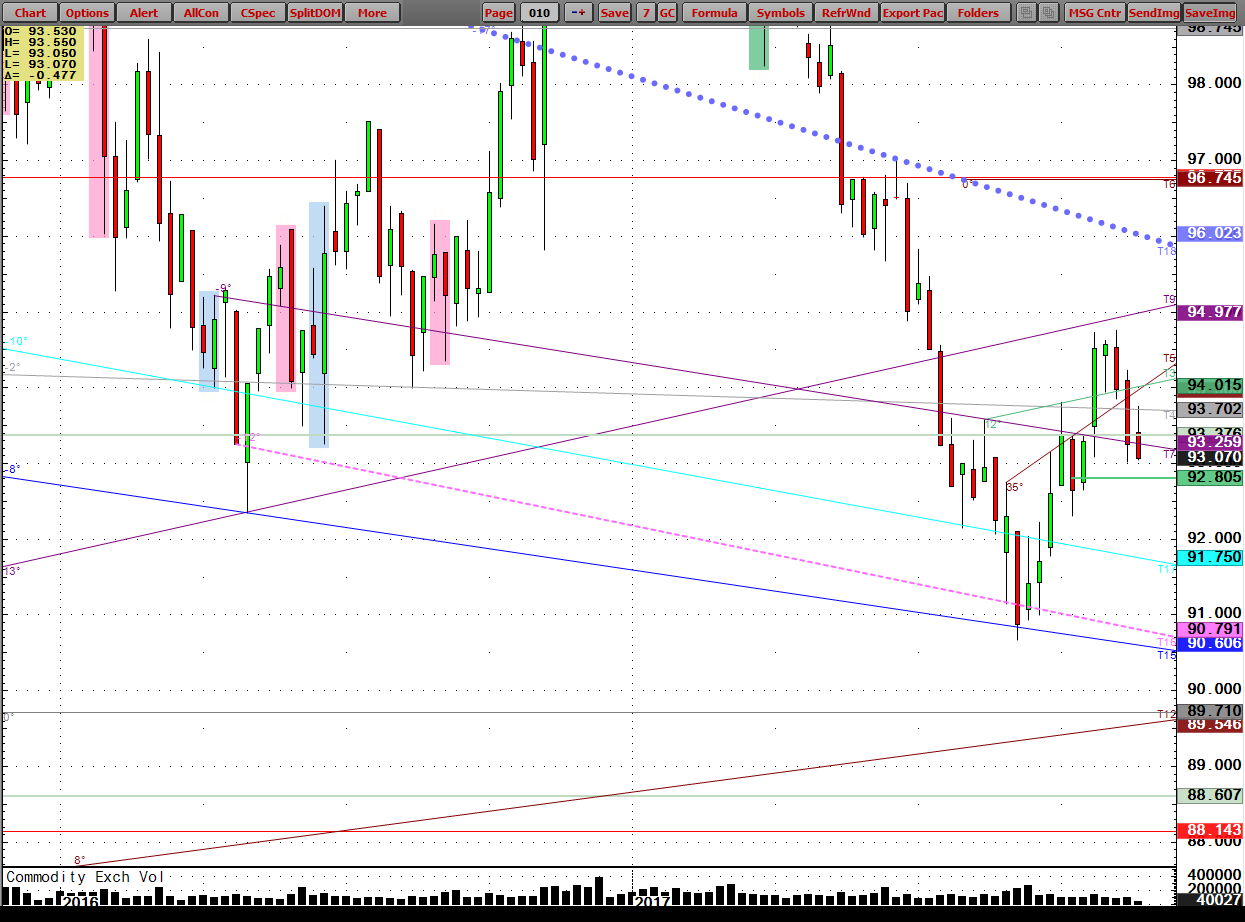

If looking to sell bonds get a good level and strategy. We can vertical up into extreme sell’s #.

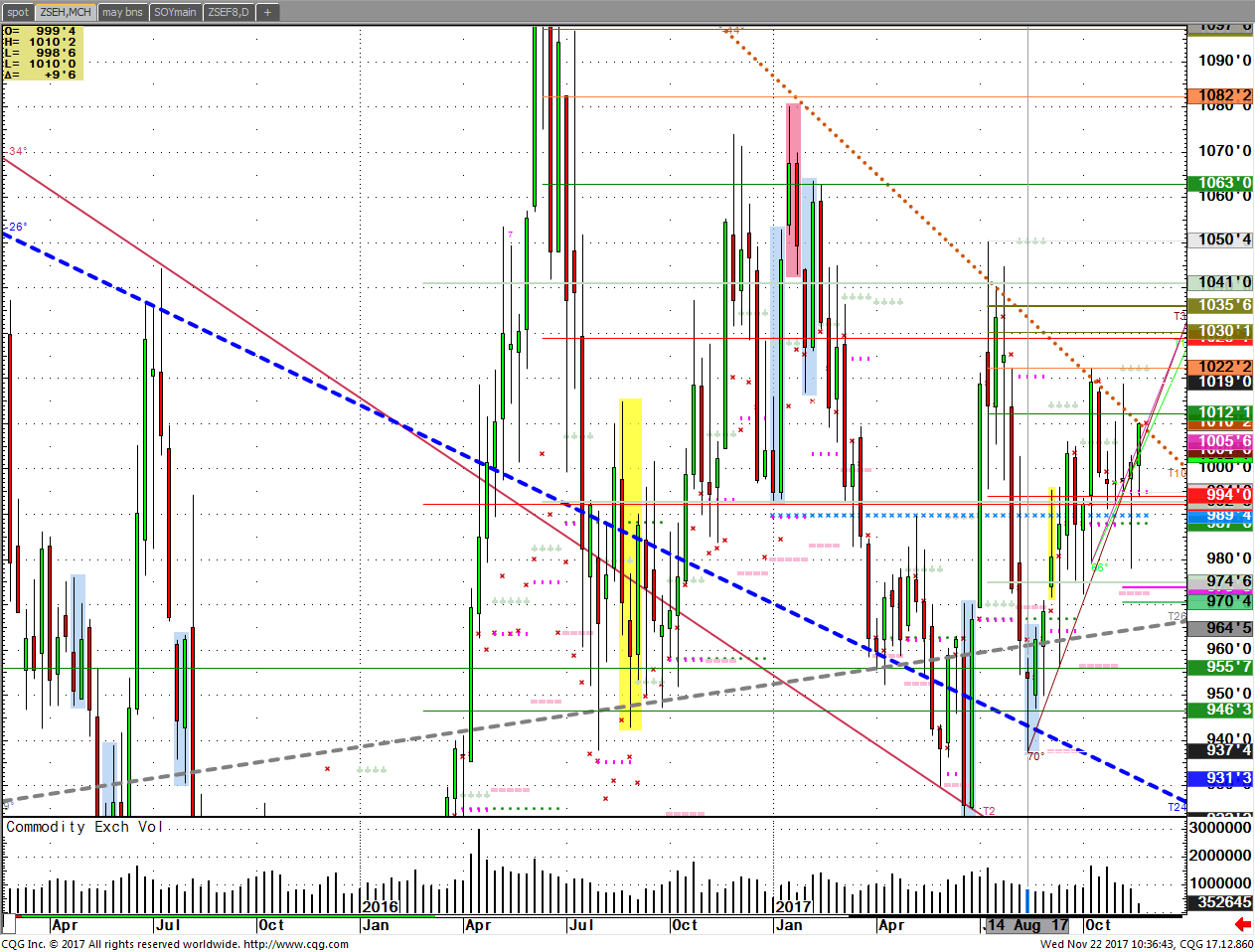

Grains-long term friendly. Whats real story in soymeal strength? Bean oil LT could be sleeper. OSZ hit held good TL’s this weeks low. Big boy pro-trading outfit momentum product, that charts extremely well based off events. Need an All time high story? Buy Inflation Now, my opinion, all of it.

YEN HITS SELL OLIVE 1ST TIME OUT. NOW IT IS KATIE BAR THE DOOR, SHORTS COVER NOTICE LOW OF BAR AFTER CLOSE OVER. THATS A GOOD CHART POINT FOR CLIENTS.

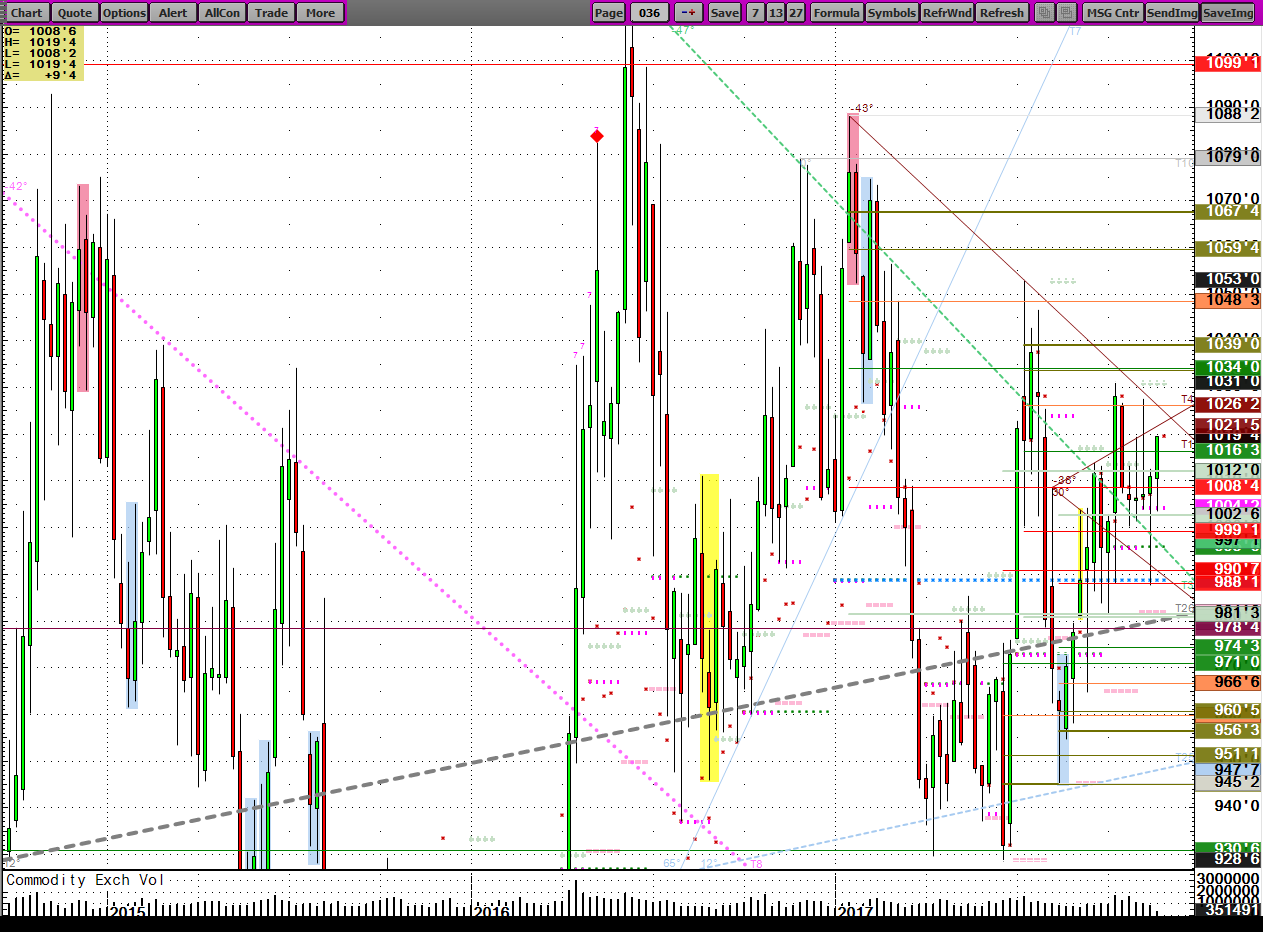

Upper left is Dec Live Cattle, low of day is one tick off low on gap higher after buy level OLB hit 2 days earlier. $1500 rally from buy level in 2 days. That’s my product to clients.

FOCUS ONLY ON LAST TWO BARS OF DATA AND SEE IF THEY HIT ANYTHING OF VALUE. I THINK THEY DO. POWDER BLUE HERE BY LOW,

OILSHARE CHARTS VERY WELL AND OFFERS VERY LARGE MOMENTUM PLAYS IF THIS IS YOUR RISK PROFILE. 500 POINTS PER ONE LOT IS $15,000, $30 PER .01 HERE.

oilshare spread- warning this moves trading desk fast but if you catch by a bottom returns can be $30 * 300 displayed here for demonstration of patterns, events are important, powder blues

Brent- over $64 very decent OLS hit and filled. Down $1.70 while WTI up $1.00 fast. Get it? Play the extreme long shots.

I dont cover but love that high tick print. 64.64, half of BOZ OLB, eight week run.

SPUs- EPs- look guys some of the innerd’s of this index have gone up (3 I saw this am) 1,200% to indices up 3,000%.

That’s from either 2009 crash low or Later!

Bit coin weekly price change is more than all of the soybean harvest!

How does that make a producer feel.

Chart perspective can be seen on Walsh.

Happy Thanksgiving Speculation,