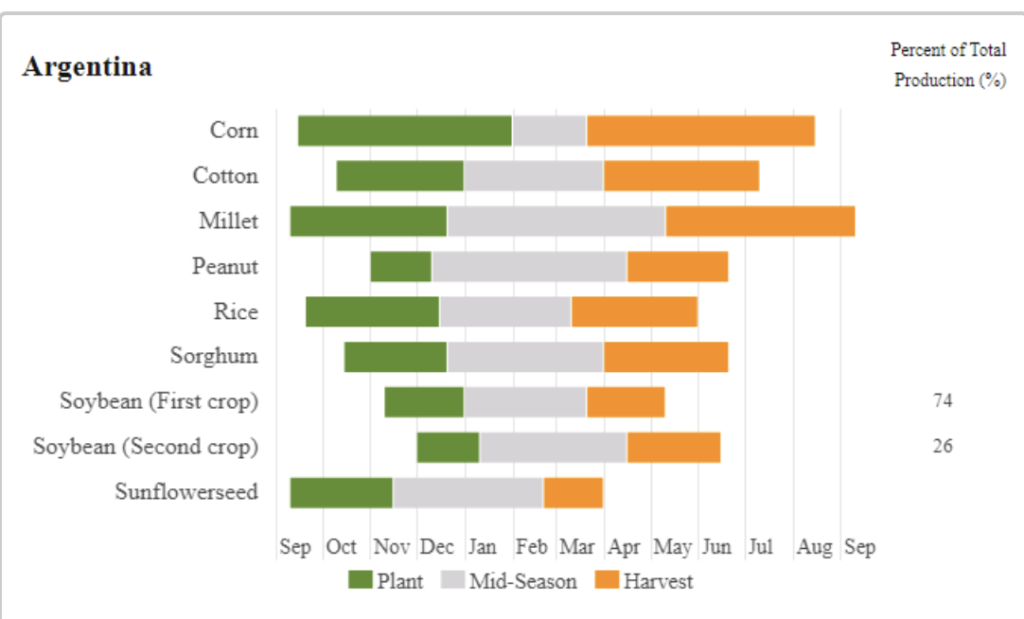

March soybean meal gapped lower Thursday, January 23, on news that Argentina lowered export taxes starting Monday, January 27, and continuing through June. With two crops per year, Argentina’s soybean harvest period can begin as early as late February and extend into June.

Above: Daily March 2025 Soybean chart, courtesy of CQG

Above: Daily March 2025 Soybean Meal chart, courtesy of CQG

Chart courtesy of United States Department of Agriculture (USDA) Foreign Agricultural Service

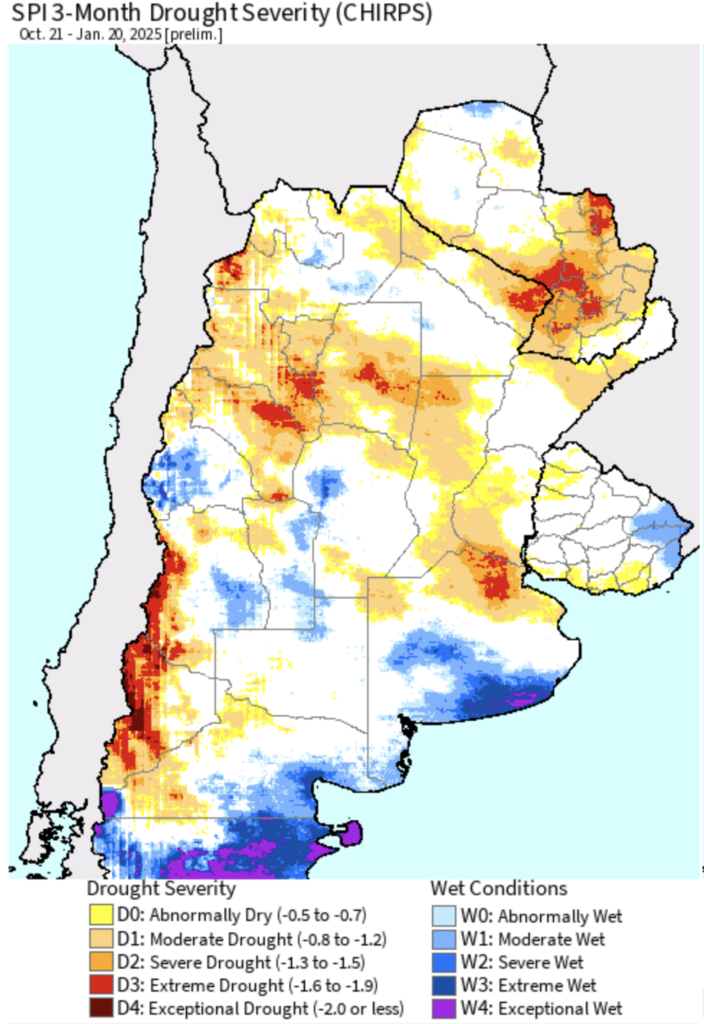

The export tax on soybeans was cut to 26% from 33%. Tax on soybean products dropped to 24.5 % from 31%. A lifeline to farmers experiencing an ongoing drought, the reductions are expected to encourage them to sell. Chinese buyers may be absent during their celebration of the Lunar New Year.

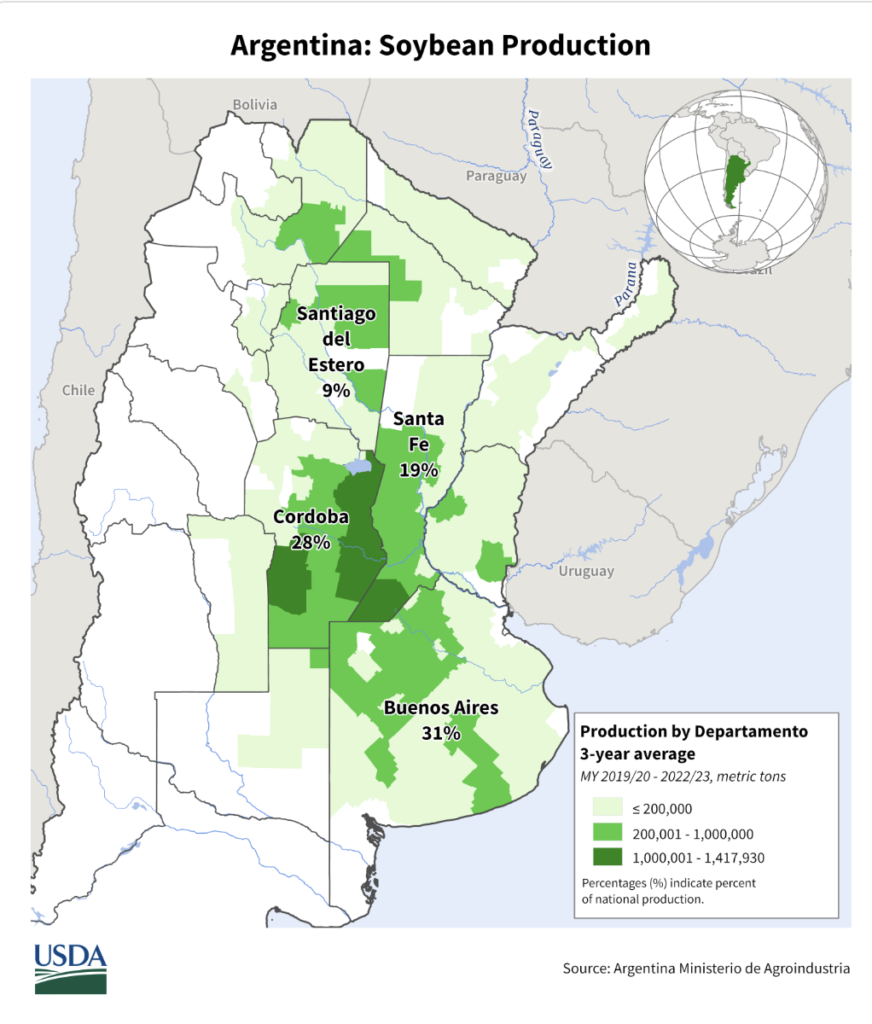

Argentina’s soybean production for the marketing year 2024/25 is forecast at 52.0 million metric tons, up 2 percent from last month and 8 percent from last year, according to a global market analysis published in December by the United States Department of Agriculture (USDA) Foreign Agricultural Service. The report goes on to state that soybean yield is forecast at 3.01 tons per hectare, which is up 2 percent from last year’s yield. The Buenos Aires Grain Exchange is less optimistic and lowered their production estimate one million tons to 49.6 metric tons. Argentina is the world’s third largest producer of soybeans, accounting for 12 percent of global production.

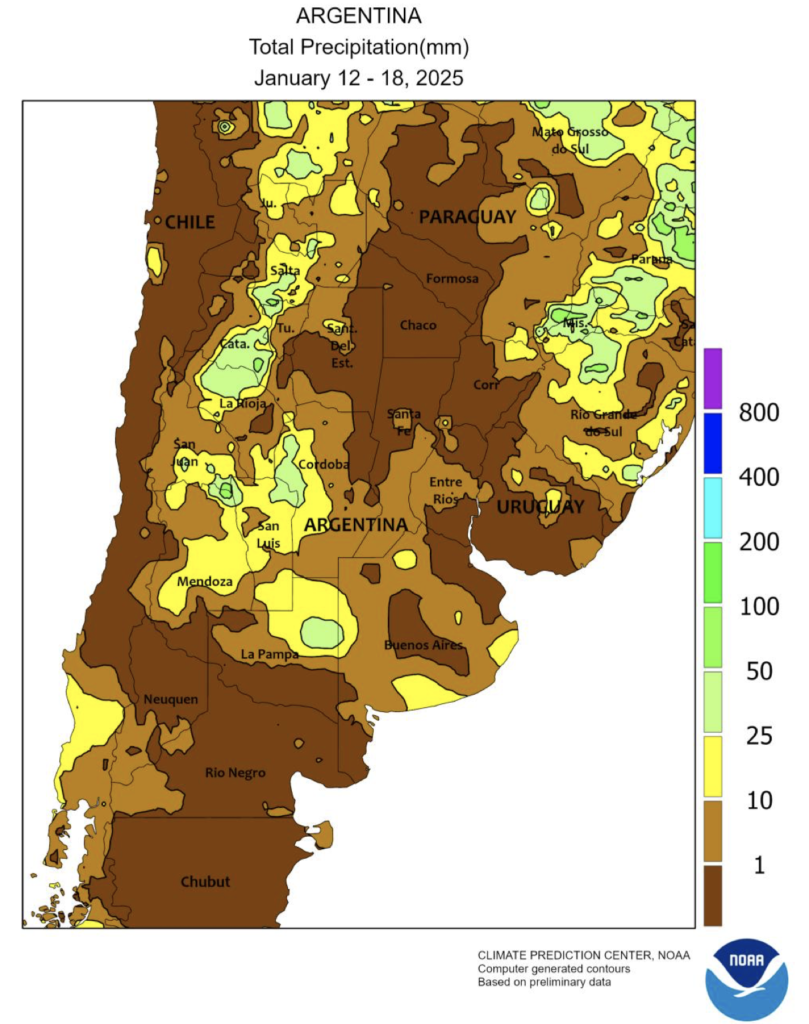

According to the USDA Weekly Weather and Crop Bulletin, persistent heat and dry weather this month in Argentina is untimely for many summer crops, including soybeans.

In a report released by the Buenos Aires Grain Exchange on January 25, additional rainfall through the growing season is important to maintain its current estimates for total soybean production. As of January 25, 92% of soybeans were rated in normal and excellent condition compared to the report released on Jan. 18, rating 98% of soybeans in normal and excellent condition. Forecasts show rain is expected in some areas next week.

Above: Chart courtesy of United States Department of Agriculture (USDA) Foreign Agricultural Service

Above: January 22, 2025 Weekly Weather and Crop Bulletin, U.S. DEPARTMENT OF AGRICULTURE National Agricultural Statistics Service and World Agricultural Outlook Board and U.S. DEPARTMENT OF COMMERCE National Oceanic and Atmospheric Administration National Weather Service

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878-2391 8248

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.