Commentary

December Lean Hogs made a new low, trading down to 65.70 then reversing course and surging higher. It ended up making the high at 67.225 and settlement was nearby at 67.025. The new low was a successful test of the 21 DMA at 66.05 for it held and price was also able to settle at trendline resistance at 67.025. Price now has to stay above the down sloping trendline which now comes in at 67.975. If it can do so, we may see a retest of resistance at 67.80 and then 68.75. Resistance then comes in at 69.80. Support is at 66.55, the rising 21 DMA and then 64.80.

The Pork Cutout Index decreased and is at 98.20 as of 10/22/2020.

The Lean Hog Index down ticked and is at 78.60 as of 10/21/2020.

Estimated Slaughter for Friday is 486,000 which is below last week’s 487,000 and above last year’s slaughter at 480,000. Saturday slaughter is expected to be 244,000, which is below last week’s 264,000 and last year’s 253,000. The weekly total is expected to be 2,679,000, which is below last week’s 2,688,000 and last year’s 2,690,000.

January Feeder Cattle consolidated within the Thursday trading range, making the high at 126.65 and the low at 125.30. Settlement was at 125.55. We have an inside candlestick formation and a narrow trading range that potentially could lead to a breakout above the high or a breakdown below the low. Settlement was below support at 125.90. A failure from settlement could see price test support at 122.775. Support then comes in at 120.50. Trading above the high could see price revisit resistance at 127.575 and then 128.875.

The Feeder Cattle Index fell and is at 134.01 as of 10/22/2020.

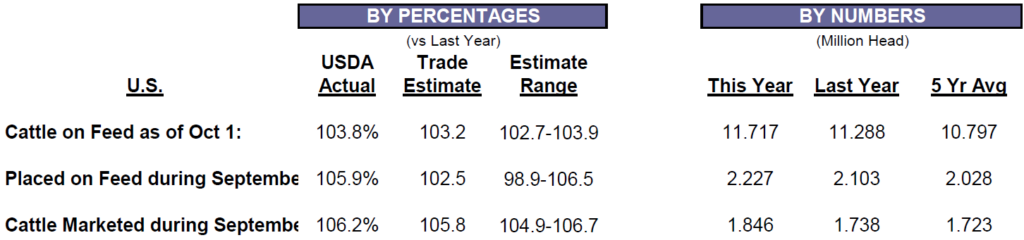

December Live Cattle also consolidated within Thursday’s trading range. The high was 104.50 and the low 103.275. Settlement was at 103.575. This the third time in the past 4 days that price broke below the 200 DMA now at 103.76 and the second time it settled below it. This must hold or it is bye bye in my opinion. Repeated pounding at this support could lead to a breakdown and possible stops getting hit and accelerating the selling. There is support at 103.00, 101.625 and then 100.275. Making the settlement below the 200 DMA more ominous is the 100 DMA is providing strong resistance up at 105.24. Relief should come if price can start trading above it and settling above it. Resistance is at 104.20 – 104.85, the 100 DMA, 106.025, 107.30 and then 108.65. Putting even more pressure on cattle is the Cattle on Feed Report. It came in bearish off of average estimates. The good thing about these reports is each report’s effects have been fleeting as of late. We’ll see…

Boxed beef cutouts were mixed with choice cutouts down 1.37 to 207.49 and select up 0.32 to 191.40. The choice/ select spread narrowed to 16.09 and the load count was 148.

Friday’s estimated slaughter is 103,000, which is below last week’s 116,000, and last year’s 109,000. Saturday slaughter is expected to be 60,000 which is lower than last week’s 62,000 and above last year’s 59,000. The weekly total is expected to be 643,000 which is below last week’s 654,000 and above last year’s 640,000.

The USDA report LM_Ct131 states: Thus far on Friday negotiated cash trading in the Southern Plains has been at a standstill. In Nebraska and the Western Cornbelt, negotiated cash trading has been mostly inactive on light demand. Not enough purchases in any region for a full market trend. The last reported live market in the Southern Plains was on Tuesday at 106.00. In Nebraska, the last reported market was on Wednesday with live purchases from 104.00-105.00 and dressed purchases from 162.00-165.00. In the Western Cornbelt, the last reported market was on Wednesday with live purchases from 103.00- 105.00 and dressed purchases from 163.00-165.00.

Trade Suggestion(s)

Hogs – Buy the June 100 call and sell the June 110/100 put spread for negative 860.

Risk/Reward

Max risk is $560.00 per contract plus commissions and fees.

Futures N/A

Options N/A

For those interested I hold a weekly grain (with Sean Lusk) and livestock webinar on Thursdays (except holiday weeks) and our next webinar will be on Thursday, October 29, 2020 at 3:00 pm. It is free for anyone who wants to sign up and the link for sign up is below. If you cannot attend live a recording will be sent to your email upon completion of the webinar.

**Call me for a free consultation for a marketing plan regarding your livestock needs.**

Ben DiCostanzo

Senior Market Strategist

Walsh Trading, Inc.

Direct: 312.957.4163

888.391.7894

Fax: 312.256.0109

www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (WTI) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.