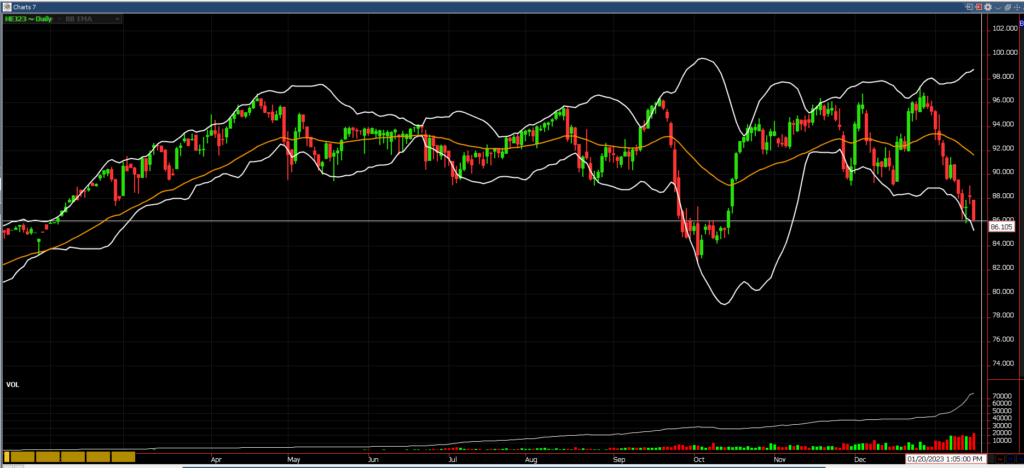

Hog markets were very volatile today with the April contract seeing immediate pressure in the morning as the contract sold off nearly $2 dollars. Mid-session the market rallied back up to only a 55-cent loss only to sharply sell off and settle at 86.20, down 1.925 on the day. The CME hog index today continued to slide as Tuesday’s preliminary figure came in at 34 cents lower at $73.84, 34 cents lower from Mondays. There continues to be a backlog of hogs on the farms on top of extended packer cutbacks through the holiday season is the major culprit which is keeping these prices under pressure in my opinion. Last week’s kill topped the comparable year-ago figure by about 13% and that trend continued early this week, with the Monday-Wednesday total at 1.398 million head coming in 76,000 (5.7%) over year-ago.

From a technical analysis view, with today’s drop carrying prices through previously tentative support at last Thursday’s low of $77.575 the bears are still in control in my opinion. Initial resistance at that level is backed by today’s high at $78.50, then by yesterday’s high of $79.90 and the psychological $80.00 level. A breakout above those levels would have bulls targeting the December low at $81.525. Today’s low placed initial support at $77.125.

April Hogs

**Call me for a free consultation for a marketing plan regarding your livestock needs.**

Peter McGinn

Account Executive

Walsh Trading, Inc.

Direct: 312-985-0931

Toll Free: 800-556-9411

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research