Commentary:

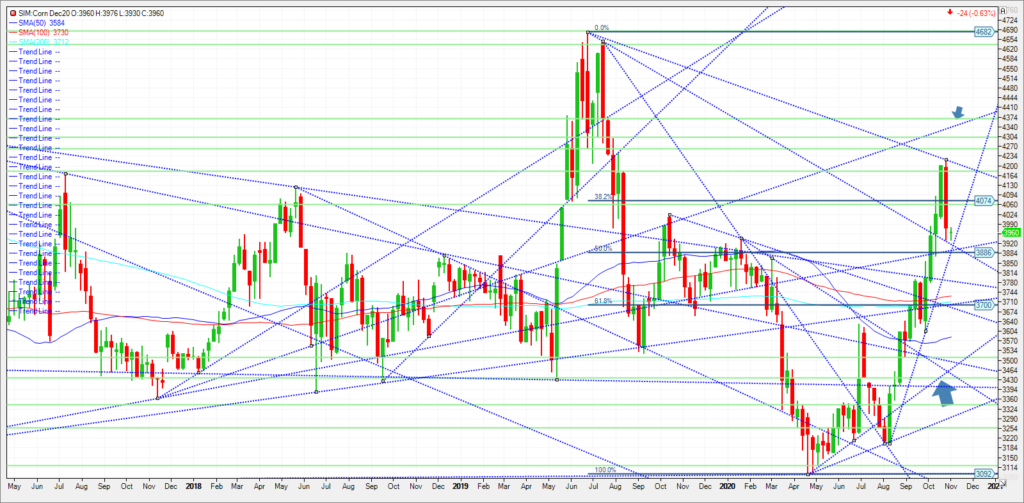

Per the last positioning report from the CFTC as of Tuesday October 27th, the report showed managed funds long 745K contracts. That is if you combine the soy complex (beans, meal, bean oil), Corn, and Chicago and KC Wheat. Since 10/27/20, we have seen beans fall over 40 cents, corn over 25 and wheat almost 45 cents from high to last night’s low. Given last week was month end, and in front of tomorrow’s Presidential election, those who were long had the profit and in my view the risk, therefore in my opinion some profit taking amid liquidation occurred ahead of these events. The largest long was Corn at 258K in the grain complex. Demand has been very good and was again evidenced by private exporters reporting just this morning to the USDA. Another flash sales announcement of 204,000 metric tons of corn for delivery to unknown destinations during the 2020/2021 marketing year was announced. Unknown is spelled C-H-I-N-A. Corn futures in China are at 9.80 a bushel. Export prices for Brazilian corn are at $6.04 and Argentina are at 4.96. Rumors abound that Brazil maybe out of Corn and could come to the US to fill needs. Also of note is that we have another crop report next Tuesday. Will the USDA adjust ending stocks lower amid higher Chinese demand? Could it pull ending stocks below 2 billion bushels? Todays close at 397.4 is above key support at the 388/3.90 level. Key resistance is up at 4.06/4.07. A close above here is needed in my view to push the market to 421.4 and then 4.26. A close under 3.88 could push the market to 378.4 and then 3.70. Given harvest progress at over 82 percent harvested for corn, and the upcoming weather window showing warm dry days into this weekend, this corn crop could be over 90 percent harvested by November 9th, ahead of schedule. Its hard to know the ramifications the election will have at this point on top of what the USDA purview of future demand will be next Tuesday.

Trade Recs:N/A

Risk/Reward-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. Sign up is free and a recording link will be sent upon signup. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.