Commentary

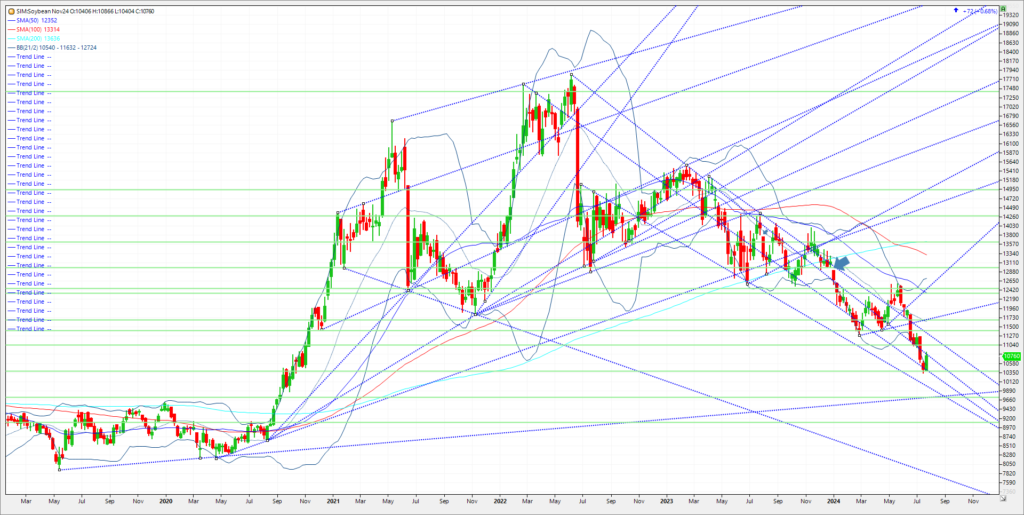

This past weekend’s forecast and early week forecast models show a hotter drier pattern into August. Since August is key yield development time, it’s like one person screaming fire in the theater and the shorts go running for cover. I think we saw some of that market action on Monday because last Fridays close looked very bearish. Funds came in record short this week. Today’s forecast supports this theme but still offers decent rain chances in through mid-next week in the Midwest although a bias toward above normal temperatures and below normal precipitation, especially in northern and western portions of the belt into early August. However, while it warms up above seasonal norms, no heat domes that park themselves over the Midwest for an extended period are forecasted. It’s my opinion that we’ll may see soybean yield models creep lower if this forecast verifies hot and dry for an extended period as we move deeper into August. Will it be enough though for the USDA to alter its balance sheet with significantly lower yield and production? In my view not a by a long shot. For that to happen it needs to stop raining through August to get a significant jump in prices into Labor Day. With outside markets and black swans circling everywhere for potential escalations in global conflicts and the ongoing circus of the Presidential election, everything could be up in the air moving forward. Outside of that grains during US planting season are a supply side driven market with weather 90 percent of our pricing influence. Condition ratings for beans up to this point have been phenomenal at 68 percent good to excellent. Technical levels come in as follows for the remainder of week. Resistance is at 10.78/84. A close over and its 11.03. Over 11.03 and its 11.31. Support is at 10.64. A close below and its 10.38 and 10.34. Under 10.34, its katy bar the door to 9.72.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604