Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

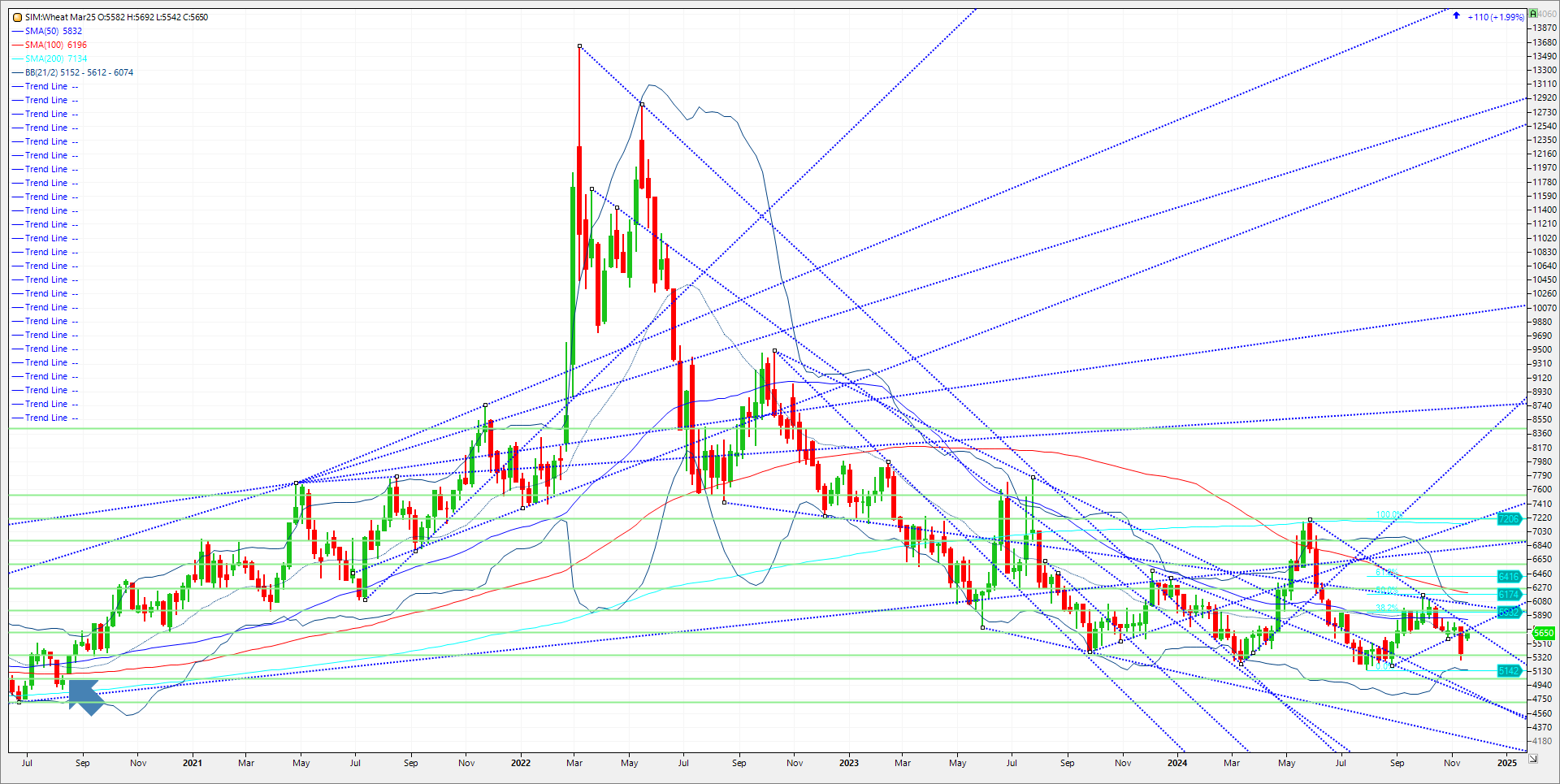

Wheat prices are leading to the upside today after the Biden administration announced Ukraine can use long range missiles against Russia. Russia responded to the decision by launching a massive drone attack overnight targeting Ukraine’s power infrastructure. Ukraine’s government suggests they have lost 18% of their agriculture growing area due to the war. As with previous Russian headlines, they need in my opinion to be fed daily with another repurposed or new headline, to keep the bullish momentum flowing. That said, this is an escalation. Bearish sentiment returned in my opinion after market as winter Wheat rated good / excellent (G/EX) as of November 17 was up 5% at 49% and poor / very poor was down 3% at 15%. Current good to excellent is down 1% versus the 10-year average and Poor / Very Poor is unchanged versus the 10-year average. Of the 18 reported states 10 reported better, 7 worse, and 1 unchanged G/EX ratings. Keep in mind, March is now the most actively traded contract. I have no opinion here as while we are early in the growing season, conditions are vastly improved. That goes by the wayside in my view If the war severely escalates in the next two months, as funds currently short, may liquidate amid the uncertainty. Support and resistance for March 25 wheat this week comes in as follows. Support is the 21-week MA at 5.61. Consecutive closes under and the market could fall out of bed again until the weekly pivot number at 545. A close under here and its 5.35. Resistance is at 5.69 and then 5.77. Major resistance is 5,83. a close over and its 597 to 6.04.

Trade Idea

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.