Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

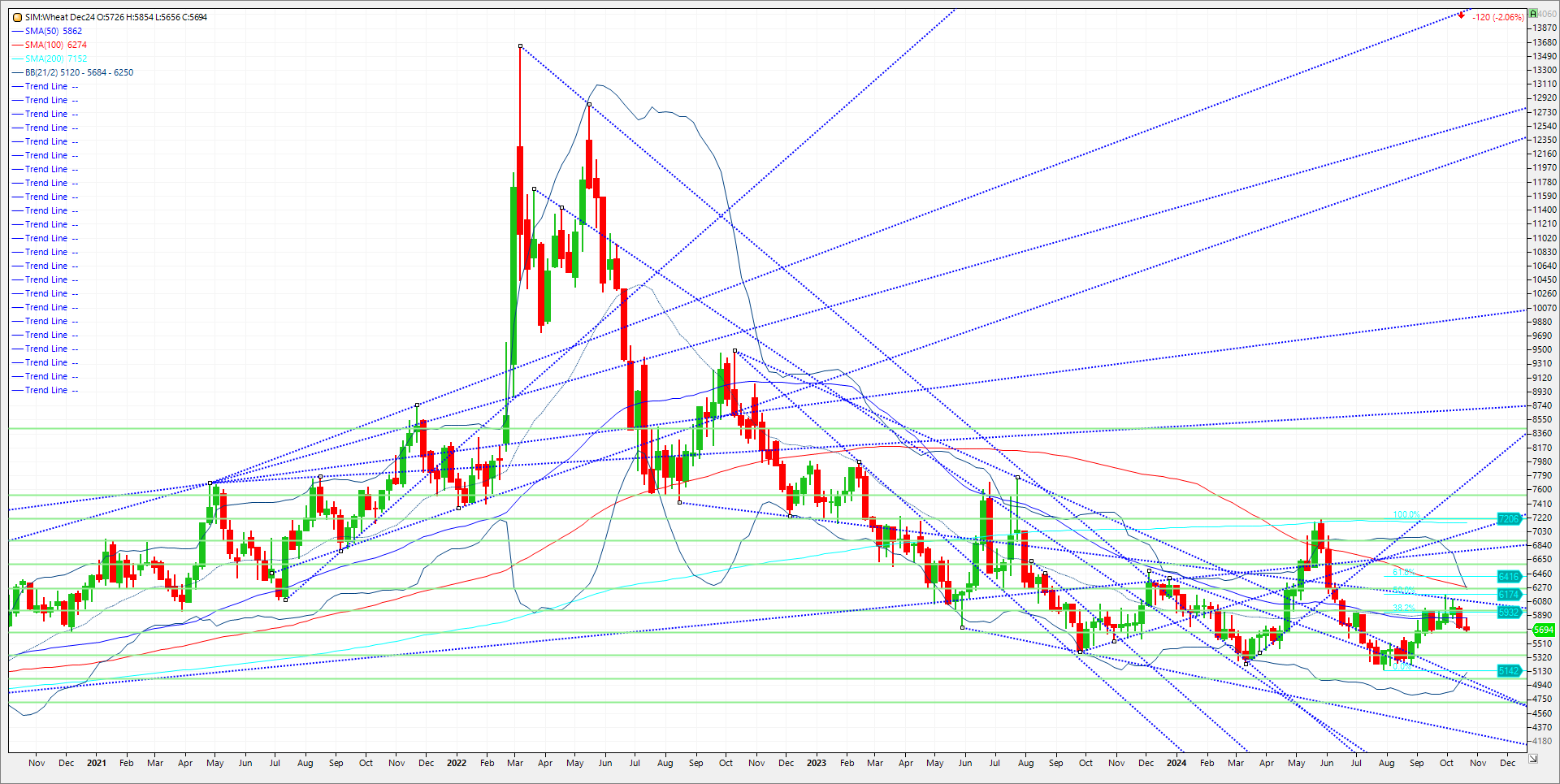

The global wheat situation remains price supportive in my opinion, with concerns about dryness over the Southern Plains amplifying talk of reduced Russian and Aussie production. But futures struggled today posting double digit losses across the wheat complex amid all three wheat classes slipping to their 30-day lows this session as rumors circulated that Egypt is struggling to pay for the wheat it bought from Russia in the super-tender announce weeks ago. Russian FOB values dropped $5/mt today. That would be equal to a 14 cent per bushel drop on the Chicago Board. The 10-day weather models continue to hold onto the rains for the Southern Plains. These rains need to show in my view as the most recent Drought Monitor showed 79% of the U.S. was covered by abnormal dryness/drought. USDA estimated 58% of the U.S. winter wheat crop was experiencing drought conditions, nine points above year-ago at this time. Based on this data, USDA initial winter wheat crop condition ratings on Monday could be below average heading into dormancy. Remember though it’s extremely early for a winter wheat weather crop scare. That said, I have no clue if the Egyptian news has merit. I do know they are the World’s number one wheat buyer and can’t recall the Egyptians not paying their bill. What is more concerning to me is that the North Koreans on a very small scale have joined the fight with the Russians versus Ukraine. That is an escalation albeit a minor one. However, like crude oil in the Middle East, until there is major supply disruption, we may remain range bound. Longer term though given that China, the EU, and the US are injecting more stimulus and lowering rates, the reinflation trade is back in my view, it may not be to the extent or severe as 2022, but food and energy will be supported on dips into 2025 in my opinion. Trade idea below.

Trade Ideas

Futures-N/a

Options-Four-legged spread suggested here as this strategy is two bullish plays combined. Hear me out. Buy the January Chicago wheat 6.00 call. Sell the July 720 call against the long on an option diagonal. At the same time sell the July Chicago wheat 8.00/7.00 put spread. Collect 87 cents upon entry, minus trade costs and fees.

| ZWN25P800:700: C720:F25C600[1-1+1-1] |

Risk/Reward

Futures-N/A

Options-One is collecting 87 cents or $4350 upon entry minus trade costs and fees. Risk on a GTC sell stop at 95 cents. This risks 8 cents or $800, plus trade cost and fees. Work to buy back at 30 cents for a collection of 57 cents minus trade costs and fees.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.