Commentary

Markets finished lower across the board with KC leading the way followed by Chicago and then Minneapolis. Values traded lower from both the overnight open and day session open with little if any strength seen at all with algos selling it all the way down. The price action just continues to reinforce the idea that nobody cares right now with basis and spreads weakening. In my opinion, the lack of buying interest is pushing futures lower thus making end-users sit on their hands waiting to buy when the market shows some semblance of turning higher.

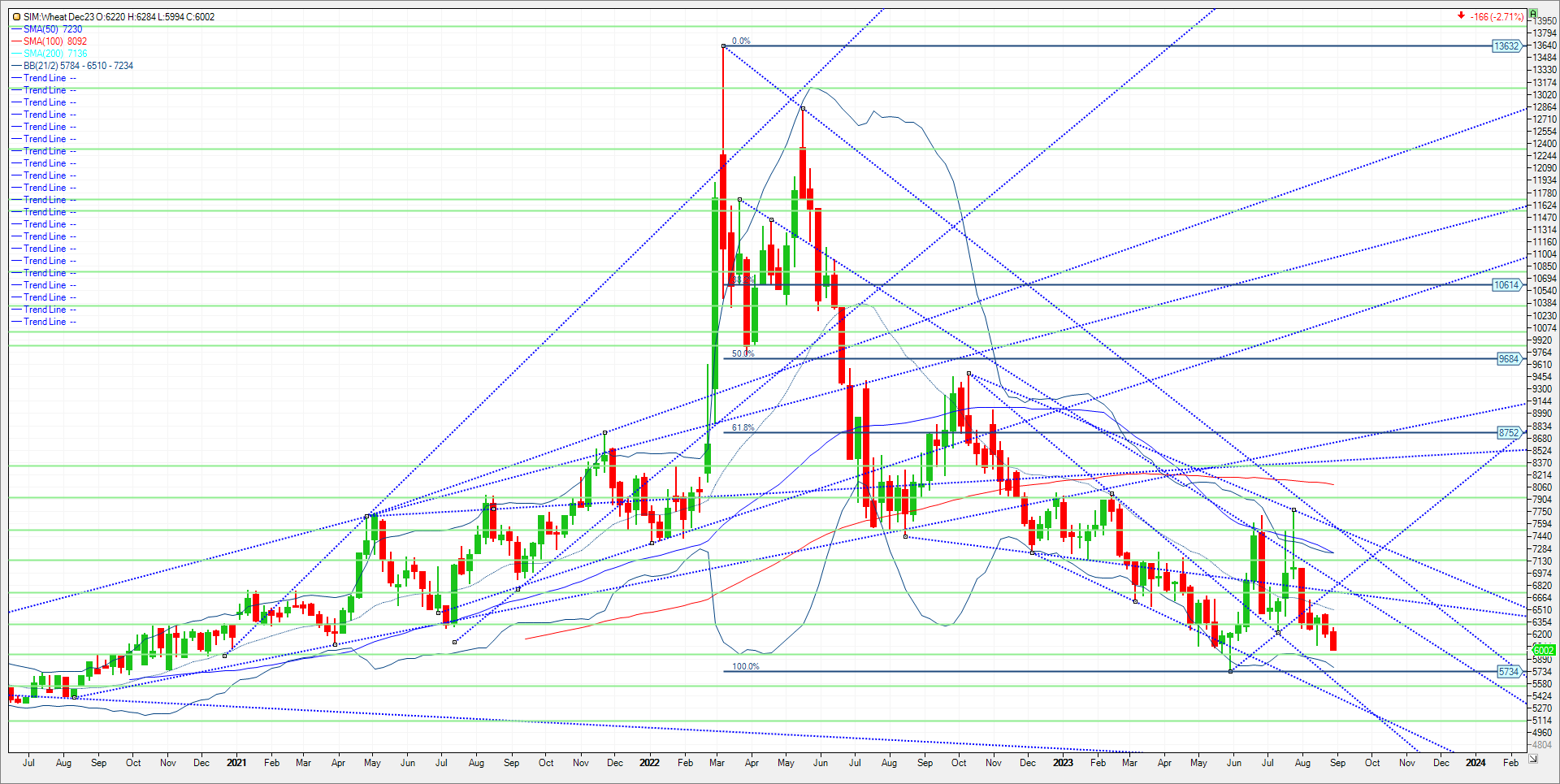

The wheat complex has now broken down technically with new lows being put in for all classes today. December Chicago wheat took out and closed below the 05/31 lows of $6.08 ¼ with the selling gaining steam once this level was taken out. Managed funds may have added another 10K shorts today putting their net Chicago wheat short at 94K contracts in my opinion. Technical levels through next week come in as follows. Support is 592, which represents 25% lower for year. A close below it in my view could push the market to bottom edge of Bollinger band at 578. If those levels don’t hold, look for the market to challenge 554 (trendline) and 552 which is 30% down for year. Resistance is at 632, the 20 percent down threshold and with a close above, last week’s high at 646, and then 651. To turn bullish, market has to close above last week’s high (646) to make a run for 674, 679, and 689, which are three key resistances way up the page. See weekly continuous chart below. No trade recs in this report

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. we discuss supply, demand, weather and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.