Commentary

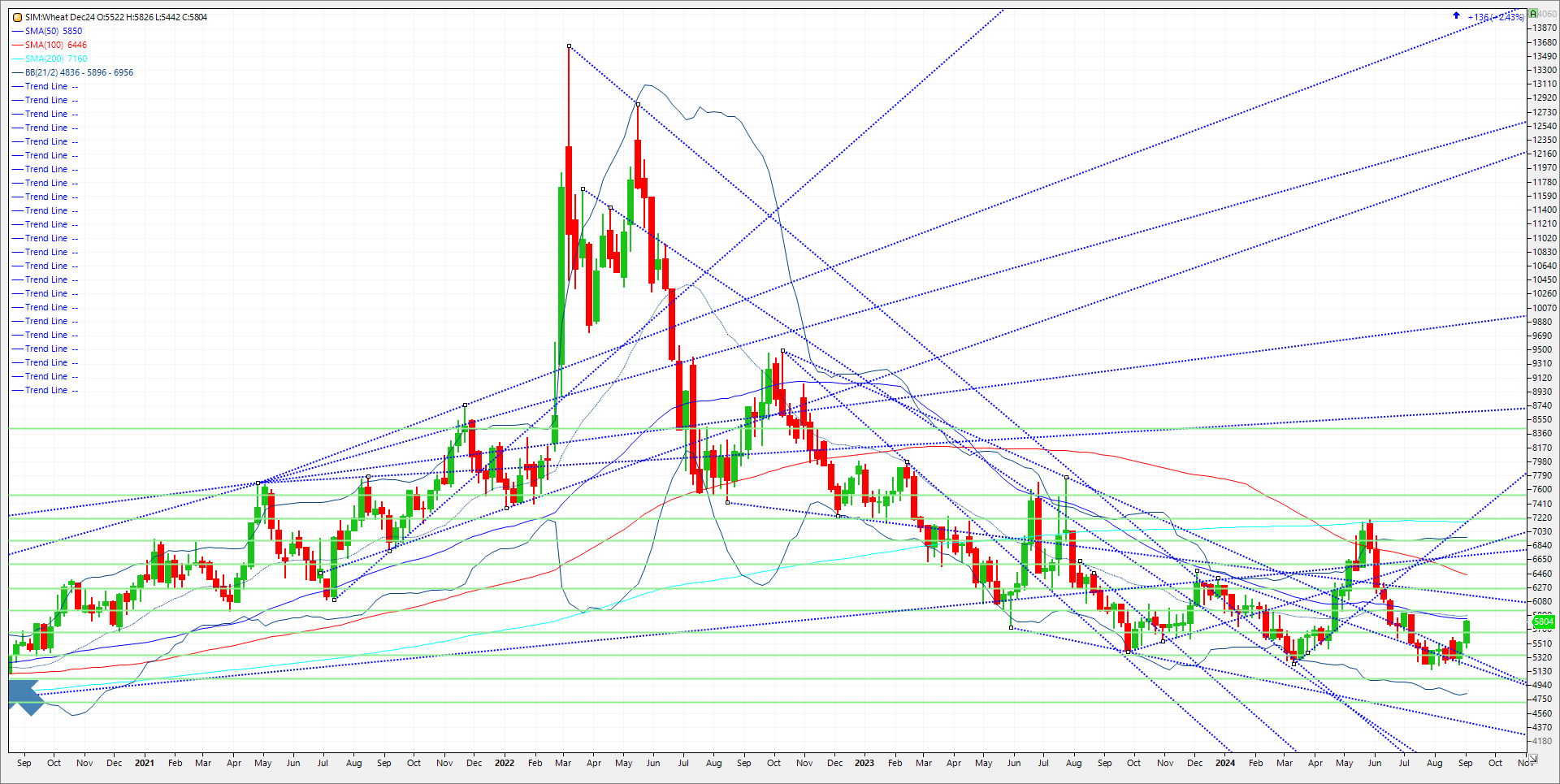

The short covering is all the rage in the grain markets lately, with wheat leading the way while breaking out of the range that has contained it since July. Fundamentally, there isn’t a reason in my opinion that has abruptly entered into the market as Russian values hold steady and there are large tenders upcoming. Drought in portions of the U.S. Southern Plains and in the Black Sea Region raise concerns for next year’s winter wheat crop, but in my view, it may be difficult to sustain a rally at this point based on Black Sea dryness when the cash market in that region remains quite weak as exporters seek customers. That being said, KC wheat has now closed higher for 7 consecutive sessions with Chicago and Minneapolis now higher for 6 consecutive sessions. It appears that markets are now shifting focus to the demand side of the equation as harvest in the US and Black Sea look to wrap up. US has a decent number of sales on into early 2025 and while Russian values remain steady. If cash markets turn bid and move higher in Russia and Eastern Europe, then the path of least resistance is higher in my opinion. Grain prices have been battered since Memorial Day weekend and crop sizes and production smaller in major growers (EU, Argentina, Russia) this past year in regard to wheat. There are questions moving forward and with corn and beans going bid for now, short covering is featured. As always trade the charts. Major resistance for Chicago wheat is at the 50-week moving average at 585 and then 5.89 the 21-week MA. A close above this area and 5.90 and the market moves to trendline resistance at 6.15 and then 6.28. A close under 5.66 in my opinion could ignite more downward pressure and could push the market to 5.35 basis December futures.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.