Commentary

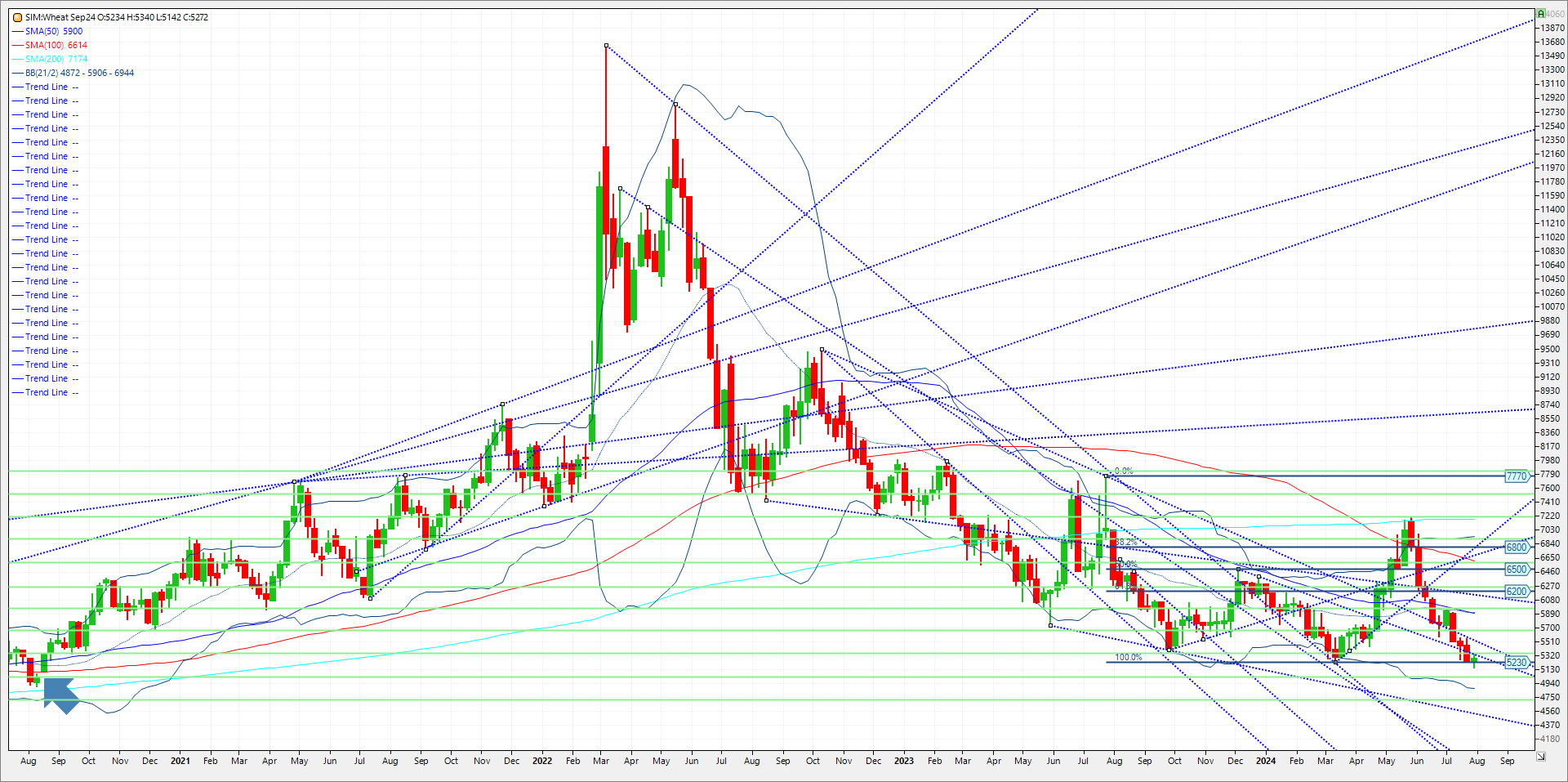

Short covering to end the month today was the feature in wheat. But it was a second straight month of losses for all three wheat complexes led by Chicago wheat. Sep Chicago wheat posted a 78-cent trading range and lost just over 46 cents. New contract lows were made in the final week of trade and now near $5 looks like the next target in my opinion with 5.04, the 20% down for the target. KC wheat saw a 65-cent trading range with losses of 37.25 cents and just like Chicago made new contract lows. September Minneapolis had a 61.50 cent trading range posting losses of 31.50 cents and new contract lows. Outside of bottom picking and profit taking, funds defend their positions. This market has been in free fall since Memorial Dqy weekend. European and Russian shortages this past crop season may show up at some point to drive the market higher, but lack of demand domestically coupled with weaker corn and bean prices are doing wheat no favors. Chicago soft red winter wheat is the cheapest in the World and maybe supportive to futures on further breaks. However, until we see something else develop, we could remain range bound until prices start to rise in the Black Sea. However Russian values continue to sit between $210-$220/tonne and until we see this change, it feels like we again are just stuck range bound, in my opinion China announced it will expand its Wheat Reserve in 2024, which is indirectly a claim the country has the supplies to do it and the demand that does not push for imports. Pay attention to what they do and never what they say. Some bullish news today aside from month end profit taking was that the Ukraine grain traders union, UGA cut their 2024 total grain and oilseed production estimate by 2.8 million tonnes due to extreme summer heat, to 71.8 MMT; that would include 23.4 MMT of corn and 19.8 MMT of wheat.

Technical levels: first support is down at the 2020 gap at 5.08 and then 5.04, which represents 20|% down for year. From there next support is at 487. bottom of Bollinger bans and then 25% down for year at 473. We need to close above trendline resistance at 549 to turn this higher. If that happens look at 5.66 and then the 50-week moving average at 5.90 as upside targets.

Trade Ideas

Futures-N/A

Options-N/A

Risk/reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.