Commentary

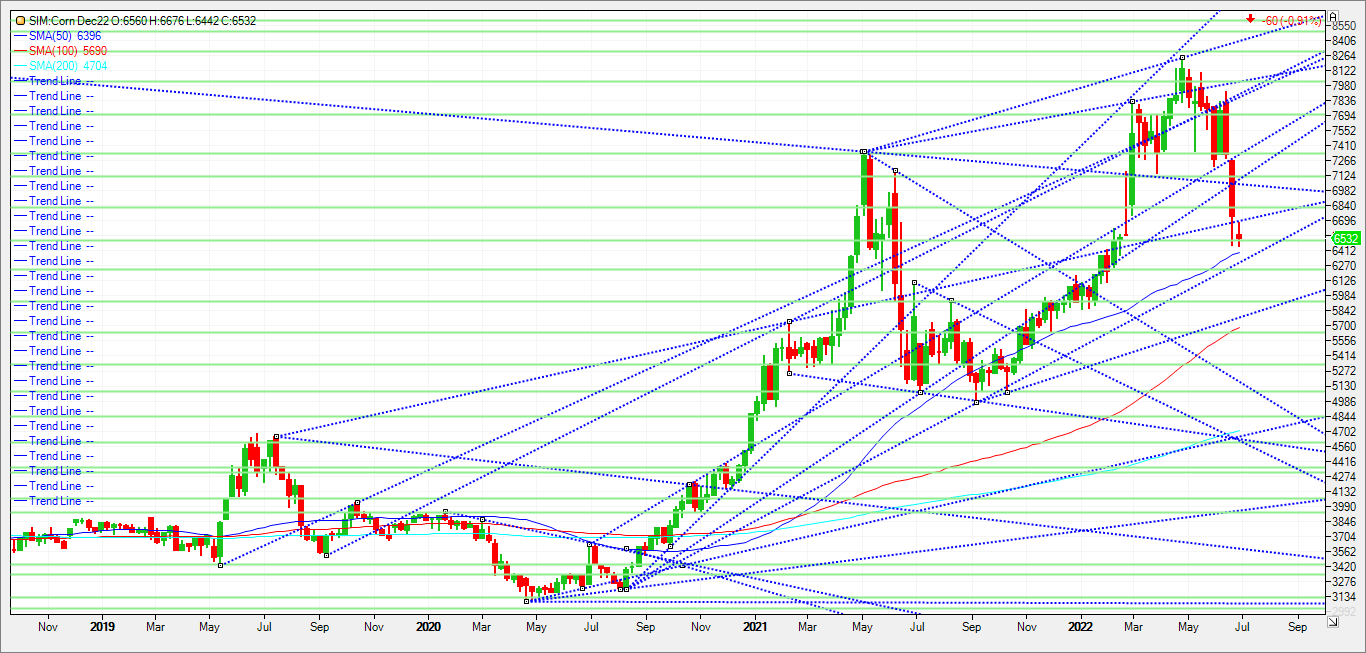

July 2022 corn gained, and deferred contracts slipped amid bull spreading and narrow-range trading ahead of USDA’s Acreage and Quarterly Grain Stocks reports tomorrow. The window for a significant weather market scare developing for the corn crop is narrowing a bit, with extended weather forecasts now reaching out into early July and showing no serious threats in my view. The near-term Midwest weather outlook appears to be unthreatening, though dryness could become a concern. No excessive heat is expected in the heart of the Midwest for the next couple of weeks, but many areas will need rain, according to crop and weather scouts. The National Weather Service shows “most forecast models are offering some timely rain, but its distribution may not be ideally suited leaving some areas drier biased while others get a little boost in moisture.” In my view it is never the same everywhere regarding weather and its impact on future yields. That said these forecasts can change in a New York Minute. So, I’m looking the charts for direction post report tomorrow. For tomorrow’s USDA acreage update, USDA is expected to raise its forecast for U.S. corn plantings by about 370,000 acres, to 89.86 million, per a Reuters survey of analysts. A weekly December 2022 chart attached below attached below. Technical levels into next week come in as follows. First support in my view is the 50-day moving average at 6.39. A close under and it trendline support at 6.33. A close under that level and its 6.22. A close under that level and we could see December corn trade to unchanged on the year at 5.93. Resistance next week comes in at 6.71. A close above and its 6.82. a move above this level could push corn to 7.04 and then up at 7.12. My technical opinion here.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar tomorrow at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604