Commentary

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

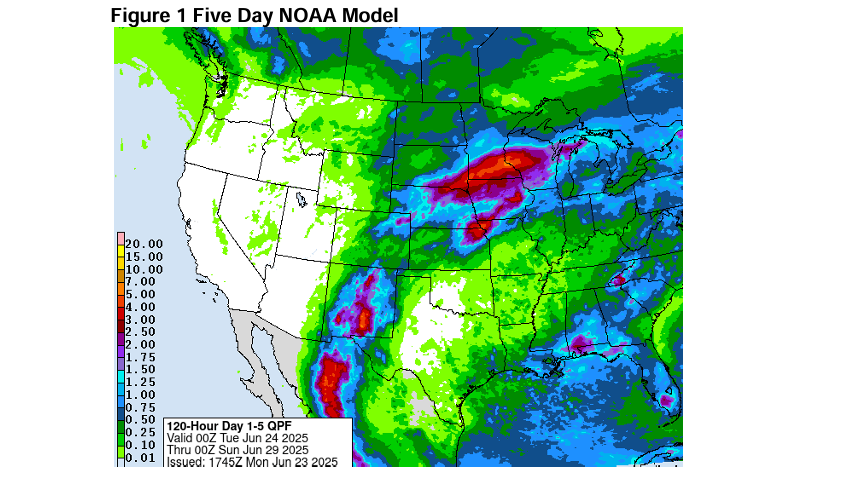

It is my belief that US weather continues to support the production prospects of the Midwest. Per the weather chart below, the heaviest rains in the forecast are predicted to cover the driest area of the corn belt the next 5 days. The Trade is looking at the weather forecast and extrapolating a large corn yield potential in the US. Although the good to excellent condition report released today in corn dropped two points on the week, the forecasts moving forward are warmer and wetter, sort of a greenhouse effect in this early development stage in my view. The drier western Midwest is expected to see follow-up rains from this week, the next 5 days, with lesser amounts in the Upper Plains, Southeast, and ECB. The heavier rain accumulations will likely drive down the soil moisture deficits in those areas in my view. Technically, todays close under 435 is not good and is bearish technically in my opinion. However, I wouldn’t be a seller here for a potential move to 4.12 (10%) down for the year, and 4.00 (round number Psychological) yet. We have a key planting intentions number next Monday on June 30th. The short positions have the profit as managed money is short over 200K contracts in my opinion and therefore the risk. The common thinking is that harvested acres comes in 3.7 million acres more than last year which was similar to the March planting intentions number. But what if the USDA throws a curve ball as they often do on these reports? Shorts have the profit and therefore the risk. The bulls need a major flip flop in weather to hotter and drier and while forecasts near term aren’t predicting that for now, it can change in a NY minute. Month and quarter end could be reasons to see short covering as well. The supposed easing of tensions in the Middle East isn’t helping the bulls either today. Although that issue unfortunately could be far from over.

Trade Ideas-N/A

Risk/Reward-N/A

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.