Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

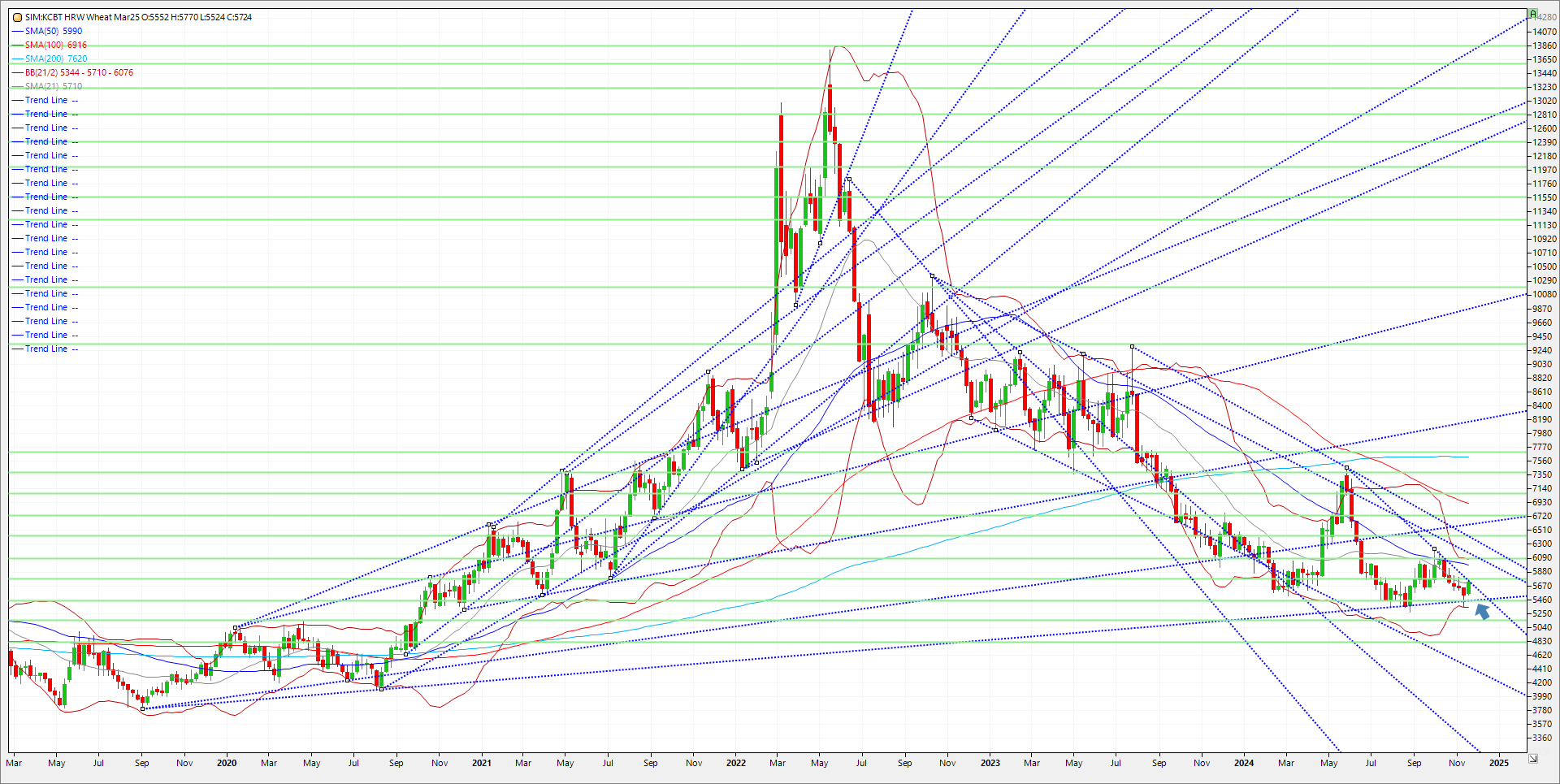

All wheat classes extended their gains for a fourth consecutive session due to further geo-political risk premium being added in my opinion. Ukraine fired missiles into Russia for a second straight day today. This time it reportedly fired British Storm Shadow cruise missiles into Russia, after firing U.S. ATACMS missiles into Russia yesterday. This followed news out of Russia the day prior that Putin has lowered the threshold for nuclear warfare was in response to Ukraine acquiring missiles created short covering in my view from the managed shorts. Overall fund covering in my estimation has largely fueled the four-day rally as this potential new escalation takes another turn as this conflict has surpassed 1000 days. Clearly the market and of course the Algos will continue to watch headlines again for future direction. Rallies over the past year off of previous military escalations have been sold as there was no response or corresponding rally from Black Sea cash prices. However, this latest escalation could change the veracity of retaliations in my opinion and perhaps just prod the funds from a net short of 40K in Chicago and approximately 20K in KC wheat to cover and go near net neutral. The only advice is to trade the levels on the charts. Anything is possible. Technical levels for the higher protein KC wheat comes in as follows for the remainder of the week, March Kc wheat is most the most actively traded contract. Major support is at 5.44/5.46. Outside of some daily and weekly swing numbers, not much of note until those levels of meaningful support. Should we close under, don’t hold any longs in my view, because prices would fall all the way to 5.14, which represents 20% down for the year. Resistance is just above todays close at the trendline at 5.76/5.78. A close higher and its major resistance at the 50-week moving average at 5.99. A close above here and its 6.07/6.10. Trade the Charts!

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.