Commentary

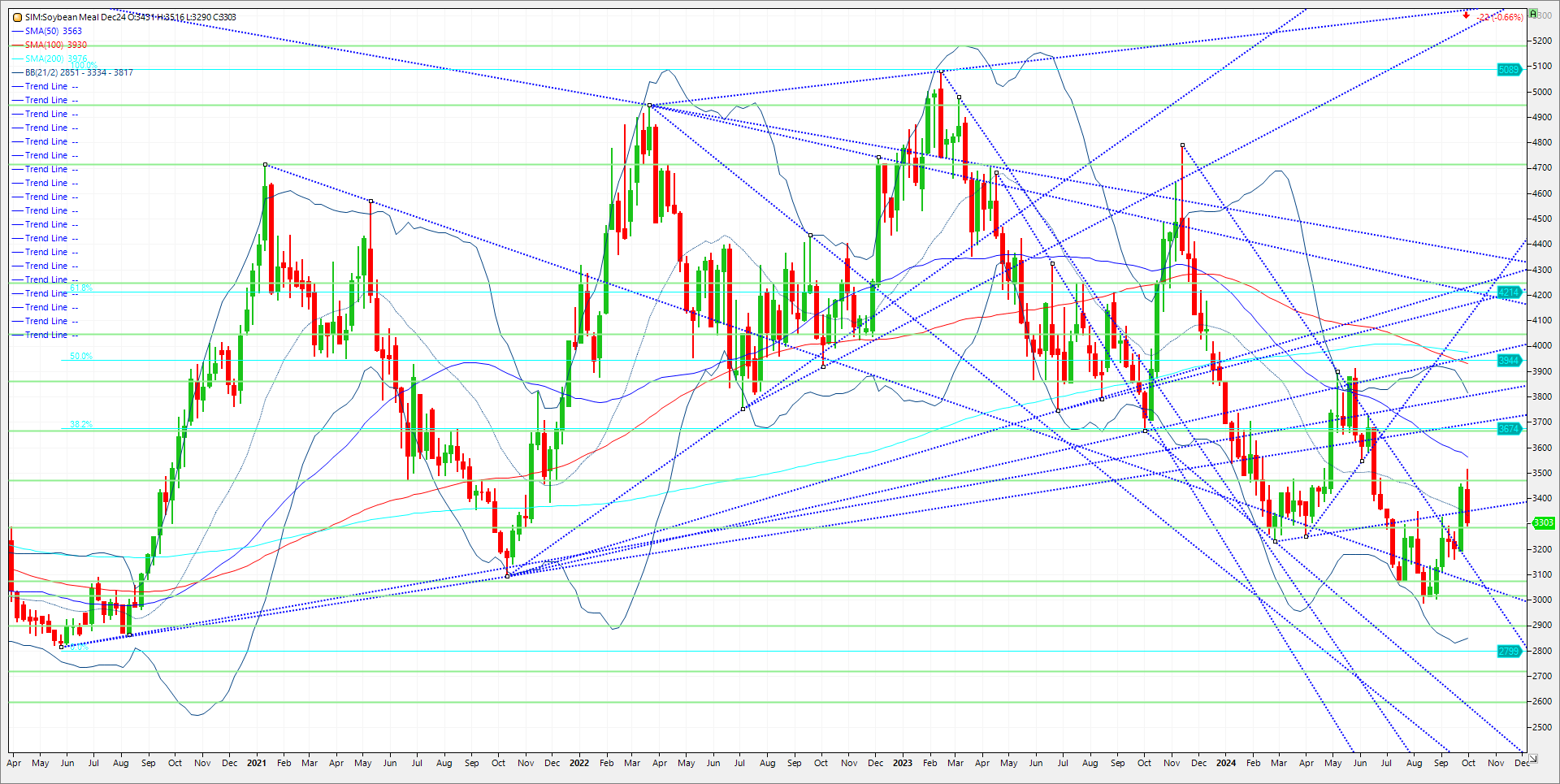

As of this past Tuesday managed funds per CFTC were net long over 100K contracts. Last time we saw funds push this aggressive of a long was late Spring (June 24) and prices plummeted from almost 390 to 3.00. See chart below. This week saw December Soymeal, the most actively traded contract, tick above 350.0 for a NY minute before retreating hard below key support this week at 334.5. Further liquidation seems possible technically and I wonder if it is a matter of time if prices revisit their early August lows sooner rather than later as recent longs get caught on the break.

There were some surprises in my view that entered into the Bean and Meal market aside from a wetter outlook in Brazil in October. First, ADM announced today that a soy processing facility in Des Moines is expected to be idle from mid-October to November for maintenance which could create a buildup of supplies near term. The plant accounts for 12% of Iowa’s crush volume. The US East Coast and Gulf Coast longshoreman strike was suspended today after a tentative agreement was reached, but the effect on soy exports has been minimal. Last and most importantly, per Hightower is that the EU proposed delaying the implementation of their deforestation regulations until 2026. In my view the announcement surprised the market and meal prices fell sharply. Per Hightower again, the EU rules, commonly called EUDR, would have banned the import of bean and bean products from deforested areas and limited the amount of meal the EU could import from Brazil, which would have the most challenging time complying with the new regulations. It is my belief that new rules would be a massive change for global soymeal trade flows, and the EU is expected to ratify the delay. The two most bullish drivers of the recent rally, dryness in Brazil and potentially altered global soy trade flows due to the EU deforestation rules, could be fading into the background should the October rains verify in South America.

Trade Ideas

Futures-N/A

Options-Work to buy the March 25 meal 3.00 put and sell the March 25 380 call at even money

Risk/Reward

Futures-N/A

Options-Unlimited risk here as one is naked short a call. Look to exit if March meal trades down between 310 and 3.00. Get out on a close above the weekly high at 352.

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.