Weather events, export quotas, and an increase in export taxes out of Russia that may extend past June have created more uncertainty in the wheat complex than I can remember. Yesterdays crop report from USDA had all wheat ending stocks at 836 million bushels, unchanged from last month. The breakdown per class had KC wheat ending stocks at 362, up from 334 in January. Minneapolis came in lower at 258 from 279 last month. World numbers came in at 304.22 million metric tons vs 313.19 million. China demand was revised higher by 5 million metric tons. They account for 51 percent of the World’s stockpile but remember they are not an exporter, so in my view, who really knows? In my view the world numbers were seen as bullish vs expectations, but in my opinion as corn collapsed yesterday, wheat followed in tow. While temperatures drop well below freezing deep into Texas this weekend into next week, weather forecasters are mixed as to the condition of the winter wheat crop as it relates to winter kill. Similarly in Russia an impressive snow event is potentially expected later this week and into the weekend in western and northern Ukraine to the Moscow area of Russia’s Central Region. Snow accumulations of 10 to 24 inches could provide a protective blanket with extreme cold to follow. Snow cover is also expected to improve in the snow-free areas of Russia’s Southern region before a forecasted bitter cold comes along next week. While world supplies are ample above 300 million metric tons, it is my belief that government intervention remains an uncertainty and supportive to the wheat market in the near term. In short, dips remain a buying opportunity in the grain sector over all until more certainty is known regarding domestic and global production.

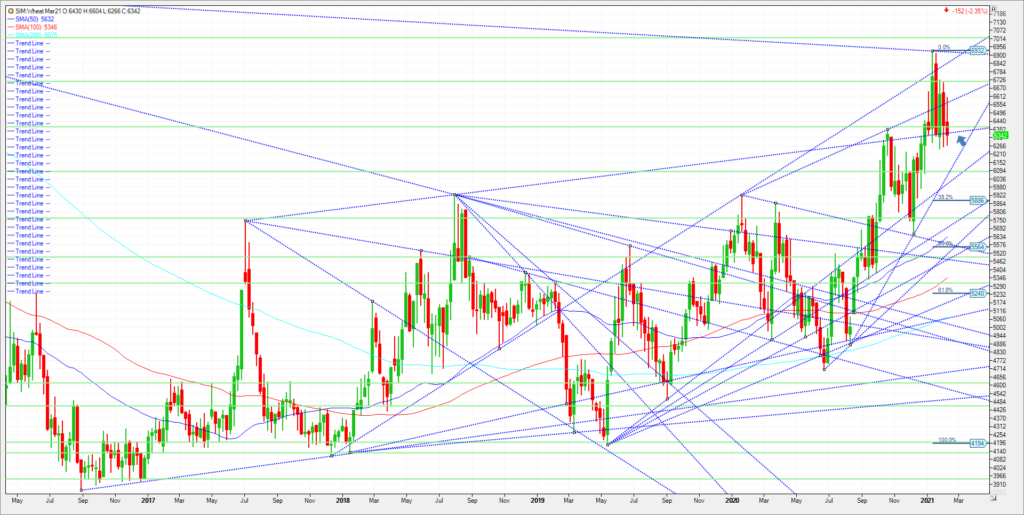

Technical’ s through next week come in as follows through next Friday for Chicago wheat. Today the March contract settled at 635.4 a half point below the trendline at 636. A close below here and the next support is down to 610.6 and then 602.4. A close under 602..4 could push the market to 588.4. We closed 2020 at 640, so in my view a close over is needed here to push the market to the next resistance at 658.2. A close over this area and the next resistances in my view are 686.2 and then 692.2.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. Sign up is free and a recording link will be sent upon signup. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.