Commentary

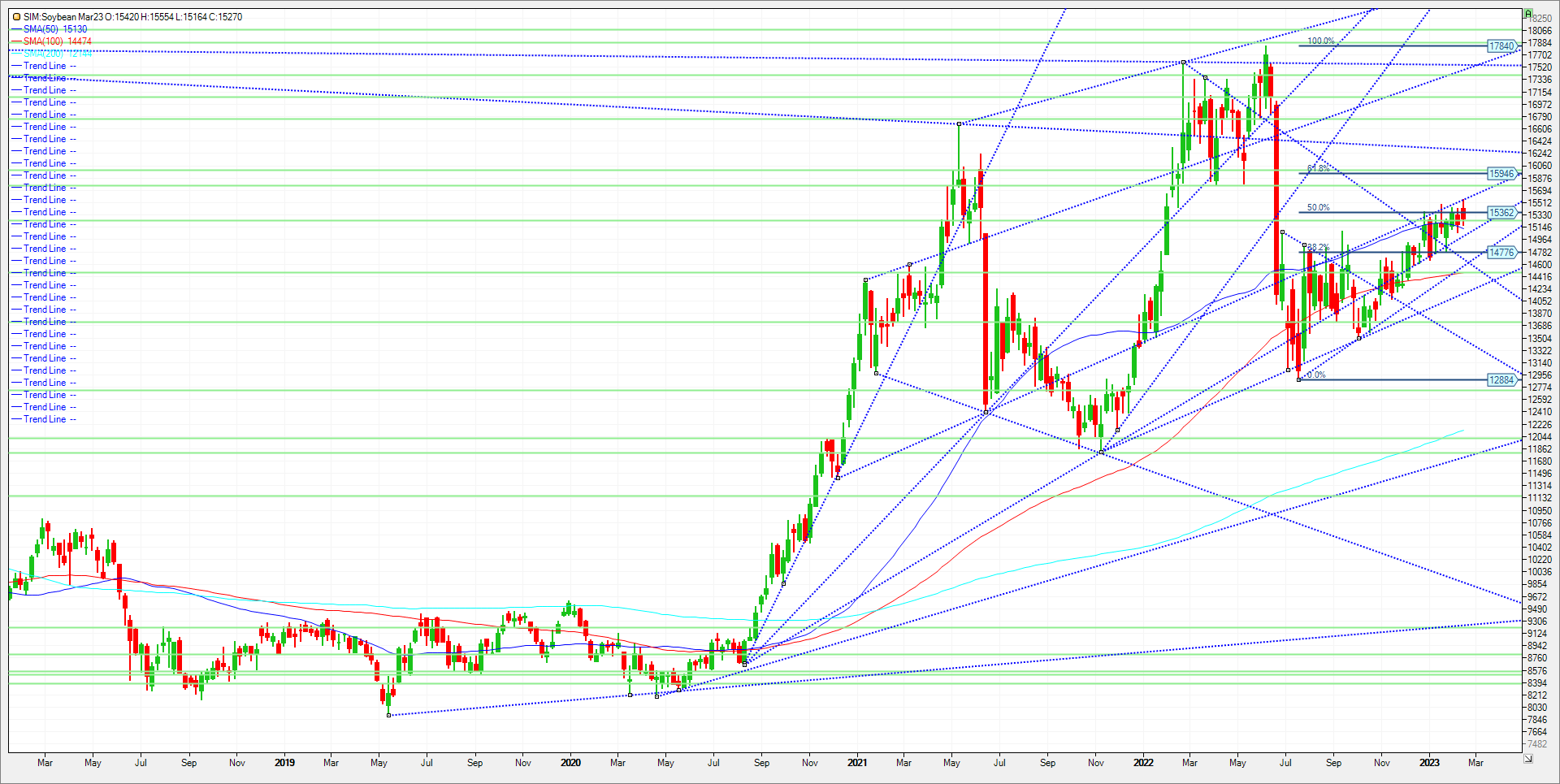

Soybeans gapped higher overnight with a run back towards last Monday’s move highs; it was mostly downhill after that last week, but all the same bullish concerns remain with the Ag Forum looming later this week. Rain chances for drought ridden areas of Argentina are forecasted to be limited into month end while heat returns. Amid dry conditions in the Southern growing areas, crop scouts now have cited frost damage to immature crops in Southern Argentina. For those keeping score, the Argentinean farmer has already lost sizable production due to drought and heat, so let’s add an early frost to the mix. Good to excellent conditions for beans there came in at just 9 percent g/e per the Rosario Grain Exchange last week. (Not good). The common thinking is that Brazil’s production will more than offset any shortfall in Argentina. However, demand into China remains strong for US soybeans with today’s export inspection once again meeting expectations. USDA this morning reported U.S. soybean export inspections of 1.578 MMT for week ended Feb. 16, (58.0 million bu.). Inspections are up 12 percent vs expectations or 231 million bushels for the 22/23 marketing year. The two-day USDA AG forum will take place Feb 23rd and 24th. Traders see soybean planted area of 88.6 million acres with a range of 87 to 89.5 million. Ending stocks are projected near 297 million bushels with a range of guesstimates from 217 to 430 million bushels. Unless we see bearish Ag Forum numbers, or Chinese bean cancellations, with demand for US origin falling, I look for the funds to press the upside here, as weather events in the World’s largest bean crusher continue to stymie production with production estimates lowered further.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604