Commentary

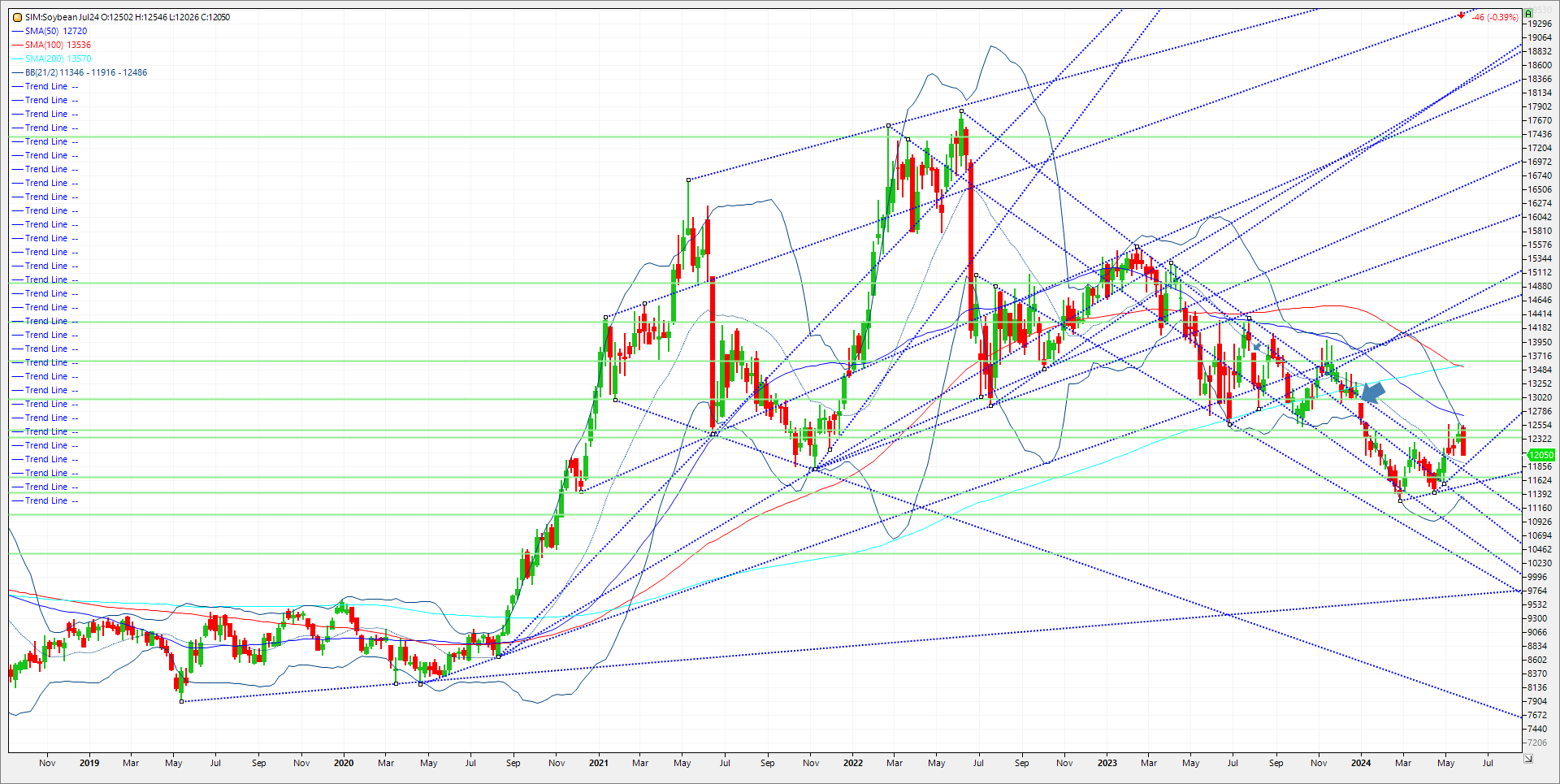

Rough week for the soy complexes this week led by meal as it reversed lower. News that China exporting large quantities of soymeal probably didn’t help. Prior to this week, the strength in soymeal prices had been a surprise to some, as the assumption of a strong crush pace would result in burdensome supplies. That wasn’t the case as the low April crush number from NOPA indicated a steep decline in crush rates, mainly due to maintenance downtime which helped tighten stocks. US prices remain elevated and of note managed funds have pushed out to an aggressive long of approximately 100K contracts. However given the action in prices, its likely the current net long is around 80K. Weather for planting soybeans remains non-threatening with drought-stricken areas all but being eliminated with all the Spring rains. New crop soybeans have another issue. China’s current interest in new crop US origin soybeans is zero so far. That is a record low. I don’t think it will remain this way into Fall, but it appears the Chinese crusher is betting on a good crop in the US that could push prices significantly lower this Fall. Soybeans need a US weather issue this Fall to avoid having ending stocks above a burdensome 400 million bushels. No planning delays of anything serious plus more than adequate soil moisture profiles heading into Summer coupled with nonexistent new crop demand lean bearish in my view going forward. Weekly support for July soybeans through next week is at 1192/1190. A close under and its 1178. A close under 1178 and its 1156. Resistance is first at 12.34 and then 12.47. A close over and its 12.72 the 50-week moving average.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central . We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604