If we tally up the managed money net short positions in all seven exportable grain contracts as of last week, the total amount of contracts shorts totaled approximately 597,800. This was up from 514,000 the week prior and 440 K two weeks ago. Despite planting delays in much of the Midwest for corn and spring wheat, funds continue to ” Dare the market” regarding a China trade deal or late plantings that could negatively influence future yield. Last year, was a cold and wet April for much of the Midwest where some of the same planting concerns were voiced. However May turned warm and dry and planting progress came in at lightning speed once producers got in the fields. Early June saw the trade war begin and prices plummeted amid no weather premium. This year we have the USDA raising ending stocks, sour on future exports and decrease usage. Big crops are coming out of South America where soybean harvest is over 90 percent competed in Brazil and almost two thirds complete in Argentina. Those hoping for a trade deal black swan to enter into the market may as well wait til Christmas for all we know. If it happens at all it will likely be when the market least expects it. Sort of like the announcement of tariffs on Chinese goods last June or just recently this past Sunday night when the Secretary of State abruptly declared that Iranian oil waivers would be withdrawn. You just never know who is going to say what and when in this headline driven age. The approximately 597,800 was the number of managed money shorts as of last Tuesday, so in my view given the continued downward price movement in corn and beans, the total net short is well over 600 K as of this writing.

Trade the Charts and let the technical action guide your entries and exits. While further planting delays maybe a reason for shorts to cover, who’s to say they won’t sell if corn or wheat rally 15 to 20 cents from here in May. I would imagine those still holding on to last years crop might be willing. Its been profitable for funds as they have employed this strategy since Mid- December.

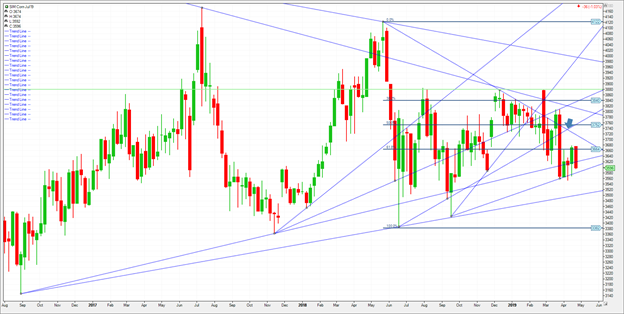

For Corn (-327 K shorts) July 19 is now top step. July major support is 358. A close under and its 350. A close under 350 and its 338. Resistance is 361.6. A close over and its 371.6 which is a downward trend line this week designated by the blue arrow. A close over that line and its 375 then 381.

For Soybeans (-92K shorts), July is top step. They got clobbered today losing 15 cents settling at 875. A fifty percent retracement from the September bean low at 812 and 2019 high at 935 sits at 873.4. Support under this level is at 870. Under 870 its 859. Under 859 and its katy bar the door in my view possibly down to 812. Resistance is up at 888/889.4. Over that it 909. Over 909 and we can climb to 935.

KC wheat (-54 K shorts) has held key support at 418 basis July 19 futures the last two sessions. A close under 418 and its 409. Under 4.09 and its 3.96. Resistance is 426, and then 436.6. A close over 436.6 and its 447.

Please join me each Thursday at 3 pm Central for a free grain and livestock webinar. We discuss supply, demand, weather and the charts, trading ideas for both speculative and hedge game plans. Please call me at 888 391 7894 or email me at slusk@walshtrading.com