Commentary

Funds continue to abandon their net short in wheat across the Board and are nearing parity in the managed category for all three classes. Like corn and beans, it appears funds want out ahead of some uncertainties even though US production of corn and beans are record large. Demand is tepid at best, but the market continues to rally in wheat as shorts liquidate amid geo-political fears in the Middle East and Russia/Ukraine while drought persists in the Black Sea. In my view adding to the bullishness, Russian drones attacked a Ukraine grain storage port infrastructure last night. Russia also says its winter grain crops are in “worse than usual” condition due to dryness. Sovecon says the wheat planting pace is slowing down and is expected to drop to 11-year lows due to dryness with not much relief in sight near term.

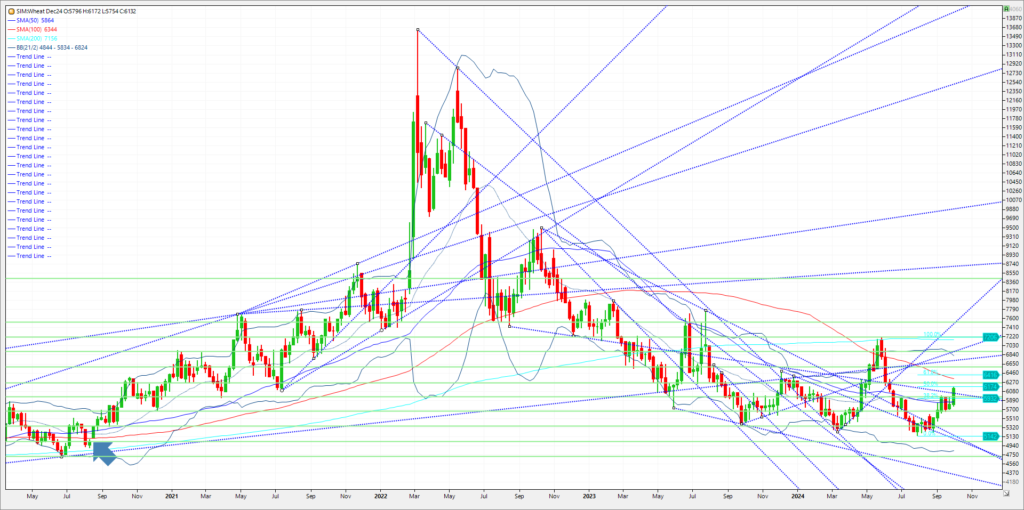

While this sizable sale has been in the works for weeks, Egypt’s GASC agreed to a direct wheat purchase this morning for a whopping 3.12 MMT, including 510k tonnes each from November through April from Black Sea origins. This same joint venture with a major supplier already resulted in 430k tonnes bought for October shipment. The Russian grain exporters union said that 2024/25 first quarter (July-Aug-Sept) export volumes were “excessive” at around 17 MMT, and they are looking for quotas to limit shipments going forward. Meanwhile, private consultancy SovEcon cut their 2024/25 wheat export estimate from 48.1 to 47.6 MMT, with grain exports overall down from 56.5 to 55.4 MMT. They pegged current wheat stocks at 24.8 MMT, down 14% from last year; stocks were at 22.5 MMT a month ago, but that was 20% above last season. The next targets for Chicago wheat are unchanged on year at 628, and then 634, the week moving average. We close above these levels, and the rally could extend to the 680 area. A close below the 50-week moving average is needed this week near 586, and should it occur look for the 566 area to be revisited.

Trade Ideas

Futures-N/A

Options-N/A

Risk Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.