Commentary

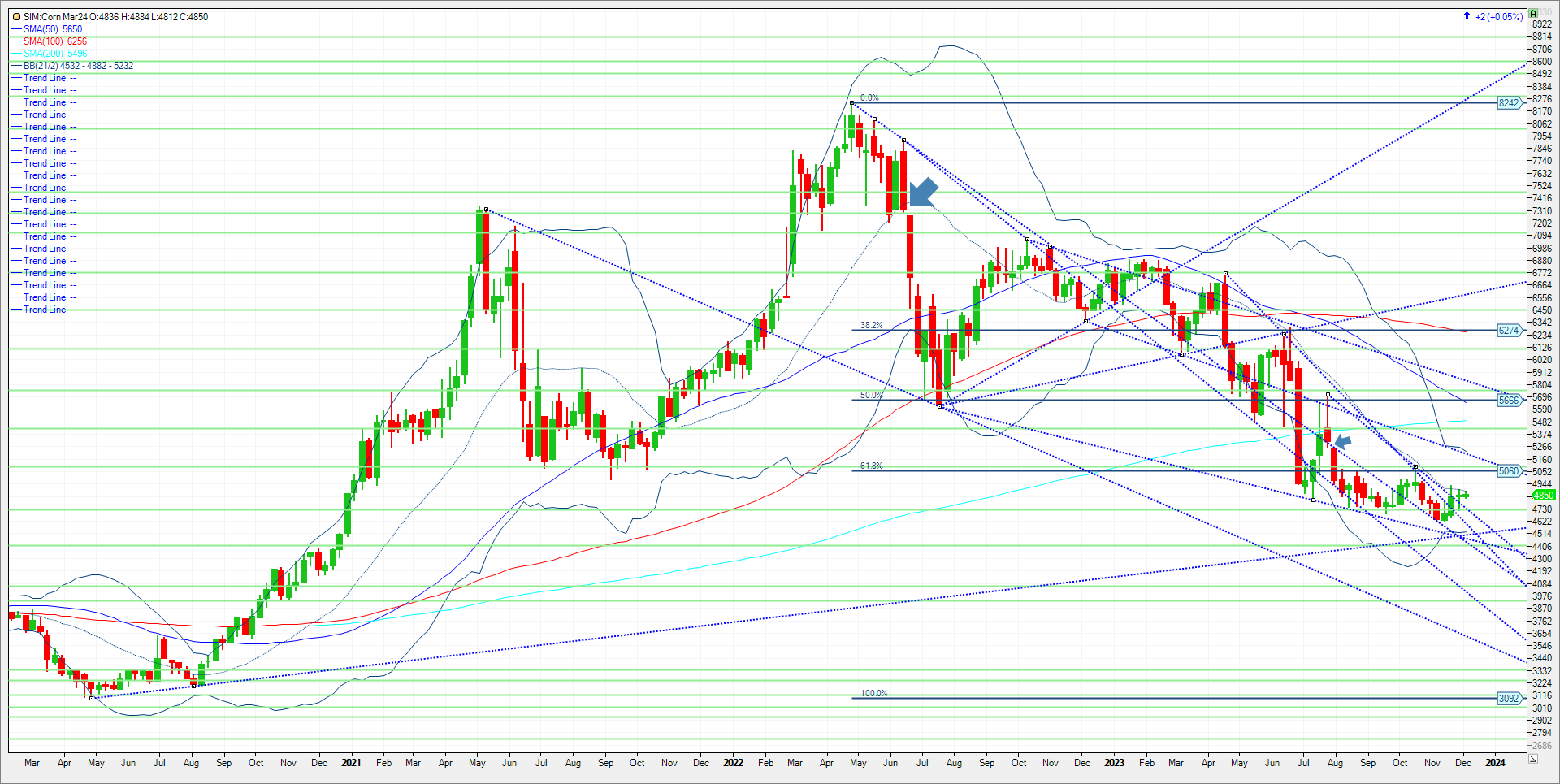

USDA inspected 45.6 million bushels of cornfor export shipment in the week ending November 30, as shown below; its largest weekly total in almost six months. The portion of the above that was inspected specifically for shipment to China during the week included 10.8 million bushels of corn. The corn market had help in my opinion by the fund’s sizable, short positions going into the end of the month. Short covering has been the theme for both corn and wheat the last three sessions. In my view corn slight gain today was aided by the Chinese purchase of US wheat 440,000 metric tons of soft red winter wheat for delivery to China during the 2023/2024 marketing year. The USDA also announced 267,044 metric tons of corn for delivery to Mexico during the 2023/2024 marketing year. Brazil’s corn offers remain the second most competitive in the Western Hemisphere with the US the best offer. The PNW is doing most of the business due to the ongoing low water issues of the Panama Canal. In my opinion the recent export demand still does not turn the balance sheets bullish. However, when combined with stabilizing Black Sea prices may have provided fund managers holding big, short managed positions to short cover ahead of the December 8th crop report and to book profits ahead of year end. Technical levels for March 24 Corn come in as follows for the remainder of the week. Support is 4.74/73. A close under this level and its 4.59. Under 4.59 and the next level of support is down at 4.50 to 4.47. Resistance is 4.89. A close over and its 4.97. A close over 4.97 and its 5.06/07. Over this level and the next levels are 5.19 and the gap at 5.25.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.