Commentary

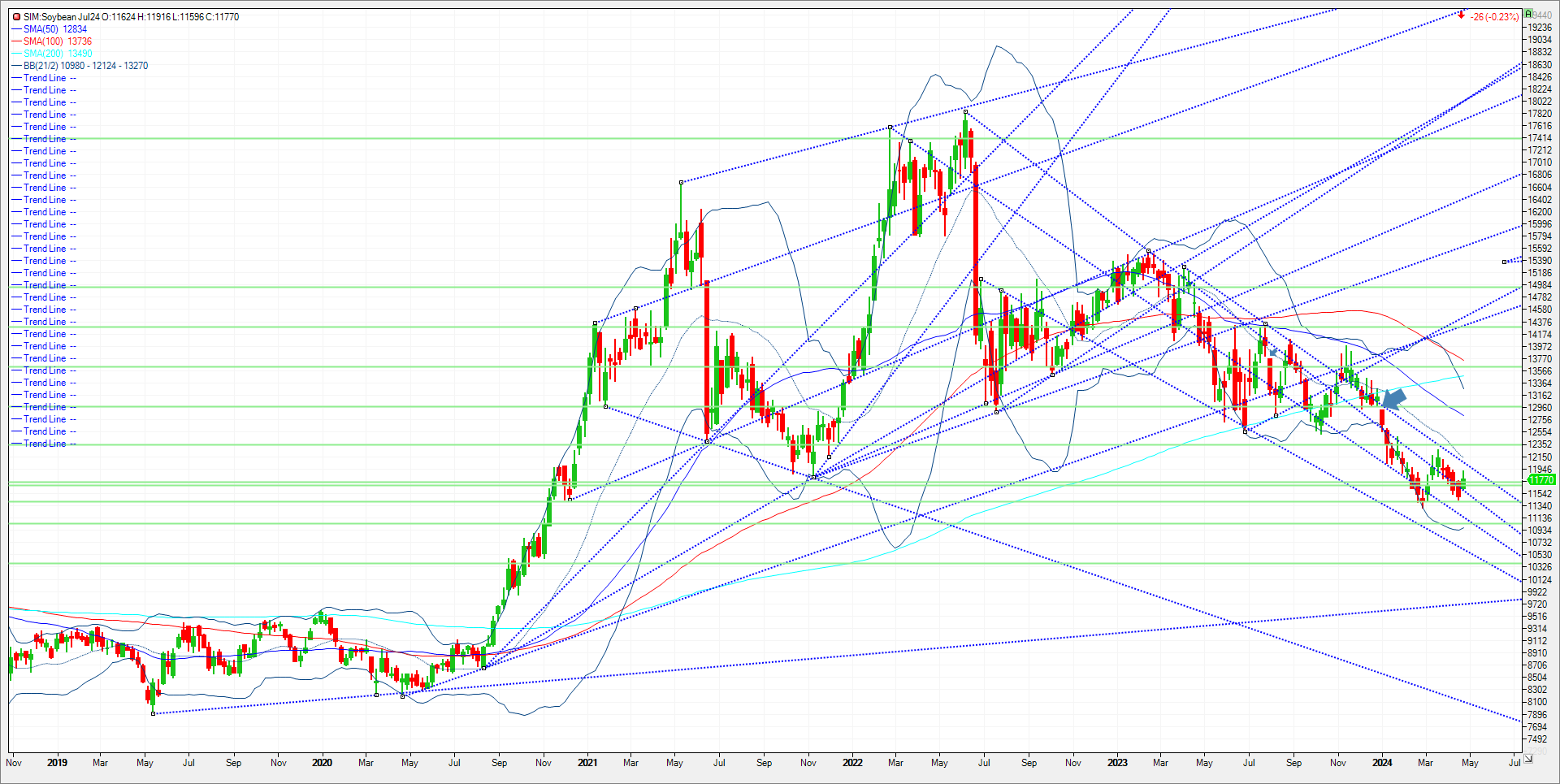

The soybean complex continues to struggle, as it is simply priced well above the world cash market right now in my opinion. It doesn’t have a story to trade otherwise for old crop beans. This comes as the Brazilian harvest mostly complete and the Argentine harvest gaining momentum. Argentina’s Buenos Aires exchange reports that the soybean harvest has advanced to 26% complete vs 36% on average. Condition ratings held steady at 30% despite the same report implying a cut to the crop size is incoming due to early underperforming harvested yields. May 24/July24 hit a new low today amid May option expiration today, which added pressure and stifled any rally in my view. Old crop/New Crop spreads are under pressure as weak domestic demand is featured amid plentiful supplies coming out of South America. Funds are short 149K bean contracts as managed money short covered over 16K contracts since the last reporting period. Trade idea into month end and the May WASDE. Support for July beans is first at 11.68, and then at 1154. A close under and its 1140. Under 1140 and the market could retest the February lows at 11.28, then make a run for trendline support at 11.10. Resistance is 11.91 (this week’s high) and then 12.04. A close over here and the next level is the 21-week moving average at 12.12. A close over here and the market could run to 12.34, which represents five percent down for the year.

Trade Ideas

Futures-N/A

Options-Buy the June 24 soybean 1170 put and sell the Sep Soybean 13.00 call for even money plus trade costs and fees.

| ZSU24C1300:M24P1170[1-1] |

Risk/Reward

Futures-N/A

Options-unlimited risk here. This option settled at a 2.4 cent debit today, so we need the market to trade 4 to 5 cents higher in my opinion next week to get filled at our entry price. That said one can place a stop loss at 12 cents which if filled at parity would risk approximately $600 plus trade costs and fees. The goal of the trade is to see if the underlying July soybean futures will retest their recent lows at 1240 or the continuous low at 1128. I would suggest exiting there. To potentially tighten up the risk, if July futures closes above 1191 after one has entered into the trade, simply get out. June options settle on 5/24. That give the trade 4 weeks to perform.

Please join me for a free weekly grain webinar every Thursday at 3pm. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604