Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

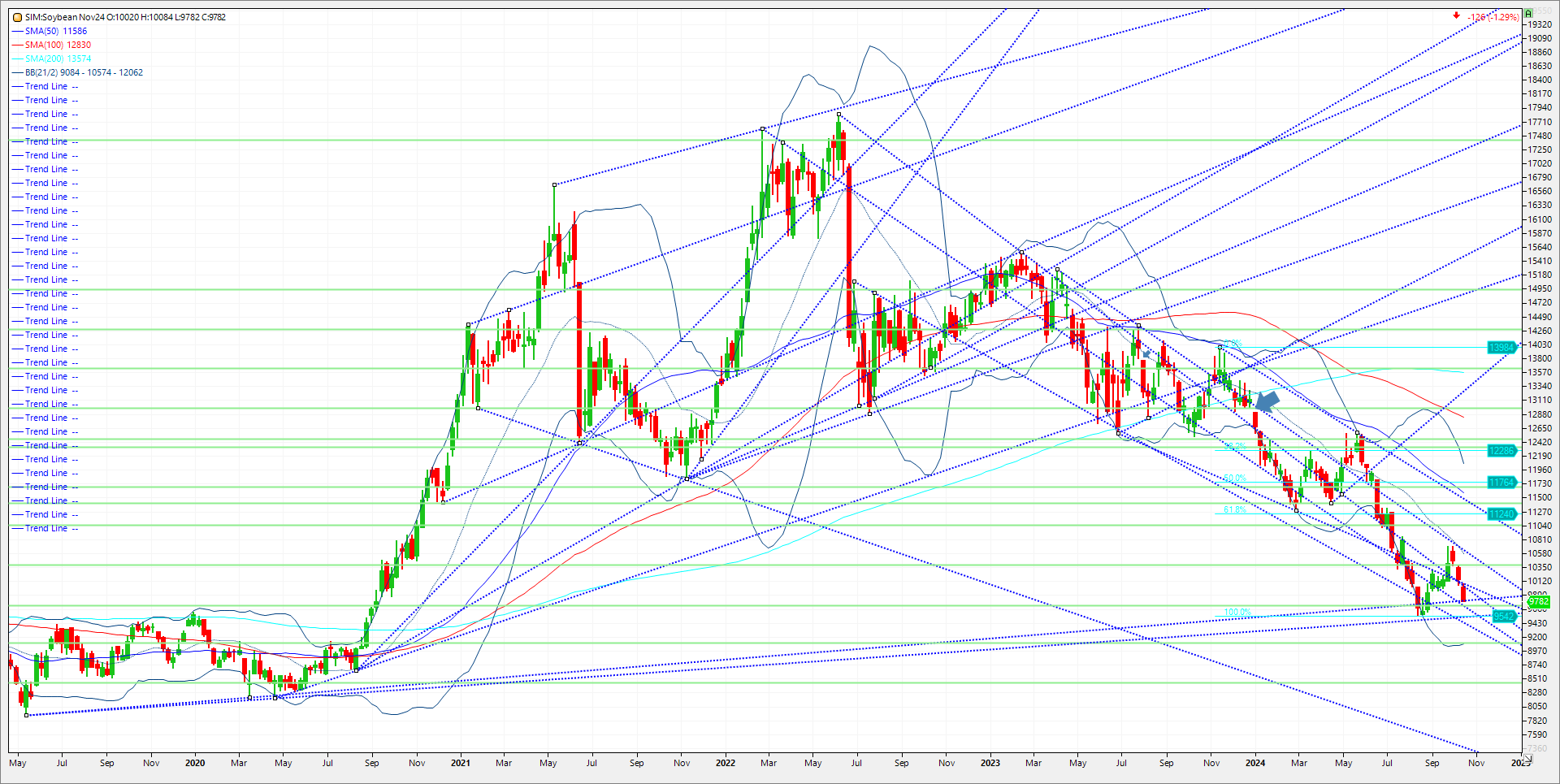

Beans continue to push lower on two fronts. First, forecasts for Brazil below still show impressive rains in Mato Grosso and Northern growing areas near term as models show widespread coverage the next 15 days. So, in my view the weather premium that prompted the sizable trend and index following fund short covering in September on hot/dry weather now shows managed money re-entering short bets on a wetter pattern in my opinion. Second, in the US, soybean harvest now sits at 67% complete, a massive 16% ahead of the previous 5-year average pace, with corn harvest at 47% complete, 8% ahead of the average pace. These were both ahead of market expectations, with the dry weather throughout almost the entire country in the last week helping speed things along. Forecasts remain dry through the remainder of this week as well, meaning we should see another big jump on next Monday’s report. The rapid harvest pace, combined with record yields for many, is in my view continuing to push the limits of storage capacity in the Midwest on the front-end. We are at a key area technically for November beans at 980. We start to move under this level, the markets next target near term is 972, (25%) down for year, and then the next set of trendlines of key support at 949/953. A close under here and its 908/909, bottom edge of Bollinger band and 30% down for year. Resistance is 10.03 to 10.10. A close and its 10.38 and then way up to 10.66.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.