Commentary

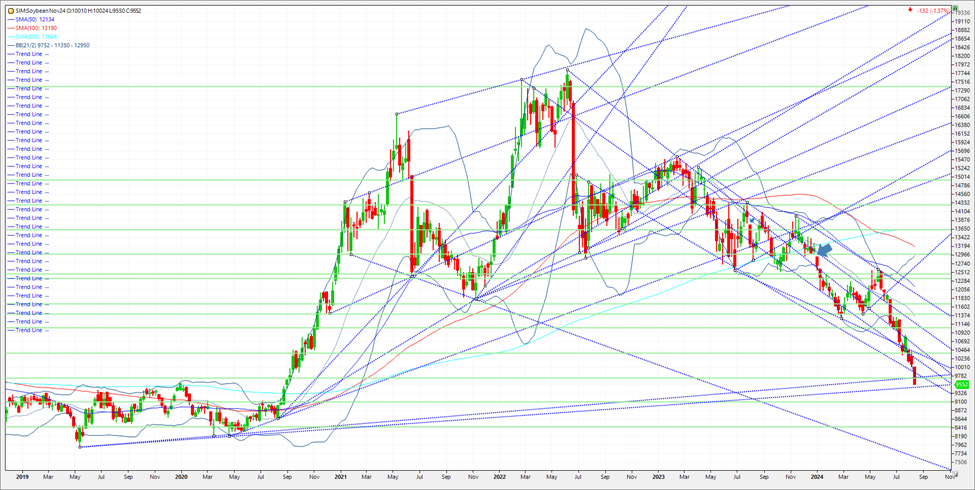

USDA’s estimate of 2024 U.S. soybean production at 4.589 billion bu. smashed the pre report average by 120 million bushels on Monday which in my opinion exerted fresh downward pressure on prices. And weather forecasts suggest as of now that there’s little reason to think late-summer conditions will diminish the estimated total. What is perhaps more discouraging is the lack of new crop demand. Exporters sold 49.4 million bushels of new-crop soybeans in the week ending August 8, according to this week’s USDA weekly export sales report. That brings new-crop export sales commitments to 216 million bushels. USDA has new-crop soybean exports set at 1.850 billion bushels. Based on a 10-year seasonal, we should have 707 million on the books by the first week of the new marketing year to maintain the seasonal pace needed to hit USDA’s target for the new marketing year. We need in my view to see a strong sustained export pace soon or We could see USDA paring back their export estimates in future WASDE reports that could push ending stocks above 600 million bushels. With each new low we have seen profit taking and some bottom picking, but make no mistake, funds have sold on rallies and this market could see an 8 handle on it before long. The market is in dire need of a story to get funds to cover. Whether it’s a geo-political escalation in the Middle East or Eastern Europe, or a black swan weather event like an extreme early frost or derecho, a bullish bias is needed. Rains continue to arrive in the Midwest, while demand is lacking and as long as this persists, prices move from the upper left to the lower right in my opinion. Technical levels for next week for November beans come in as follows. Support is 9.48. A close under and it’s the 30% down for the year target at 9.09. Under that level its 9.00. Resistance is 9.75 then 9.83. A close mover 9.83 is needed to turn up. Should that happen look for 10.20 and then 10.38 to challenge. Trade idea below with weekly continuous chart.

Trade Idea

Futures-N/A

Options-Buy the January soybean 9.00 put and sell the July 25 soybean 12.00 call. Offer the spread at a 2-cent collection or ($100) minus trade costs and fees. ZSN25C1200:F25P900[1-1]

Risk/Reward

Futures-N/A

Options-there is unlimited risk here as one is short a July 25 call. This trade is geared for soybean producers as protection for falling prices.

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.