Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Our next presentation will be January 9th, 2025, at 3pm Central. Sign Up Now

Commentary

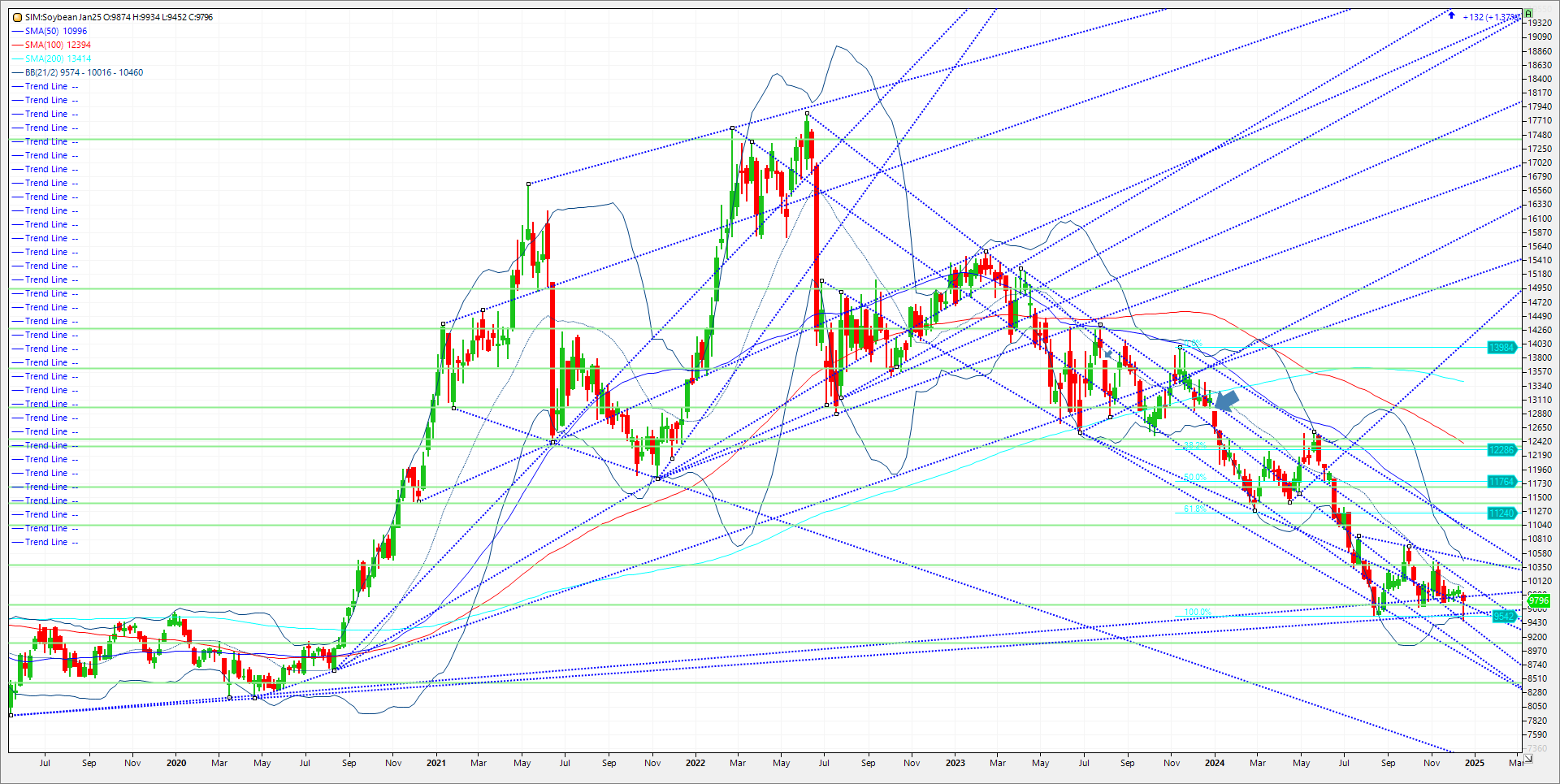

Soybeans were pressured on three straight days of producer selling to begin the week but recovered on Thursday/Friday amid profit taking as the theme in my opinion. The late week rebound was encouraging, particularly when viewed in light of strong daily and weekly export news. But the ability of soybeans and products to sustain rallies is open to serious question. Does the late week rally get rewarded with selling? Earlier in the week pressure from the looming Brazilian harvest likely exacerbated the soybean market’s reaction to the Fed’s more hawkish tone and the resulting U.S. dollar surge and equity market breakdown. The enormous Brazilian crop will soon become a reality, as will the potential of President Trump’s trade policies. In my view strong production headlines continue to come out of Brazil with private estimates now feeling pretty confident about a 170 MMT+ soybean crop. Argentina has more weather risk as it is earlier in the growing season and forecasts are appearing to show some dryness over the next 15 days. It is too early to draw too much concern on crop size, but the Argentina forecast may begin getting more attention if the dryness persists. Todays close just below 9.80 March beans is nestled just below a key trendline. (see chart). Consecutive closes over 9.80 push the market to 10.02 which is the 21-week moving average. Above that its 10.08, the next key trendline resistance. We close above these levels, don’t be short, the bean market could run to 10.47/49. Support is 971. A close under and its 9.54 and then 9.41. A close under 9.41 and its katy bar the door to 9.02. Keep in mind we are in holiday markets mode until the first full week of January. No trade recs as of right now as the stalemate of the US debt ceiling and potential government shutdown look as there is no deal as of this post.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.