Commentary

Profit taking in corn and beans today was seen in my opinion, especially for corn following a new contract low at 3.85. Beans are showing some life here, but I’m not convinced yet that this rally is sustainable. China was very active last week and the week prior for bean purchases for future shipment. One issue is the amounts they are buying are small and don’t really affect the balance sheet in my opinion. That said we have seen two positive closes and a buy the dip mentality here since Pro Farmer released their findings on the size of this year’s bean crop last Friday. Declining rating of 6 to 8 percent in Illinois and Ohio, may have grabbed some headlines on too hot too dry over the past week on Monday’s crop condition report. That said the heat moves out mid-week with better rain chances in the 1-to-5-day forecast move in. Ratings are very subjective, the good to excellent category nationally dropped 1 point as expected to 67% good to excellent.

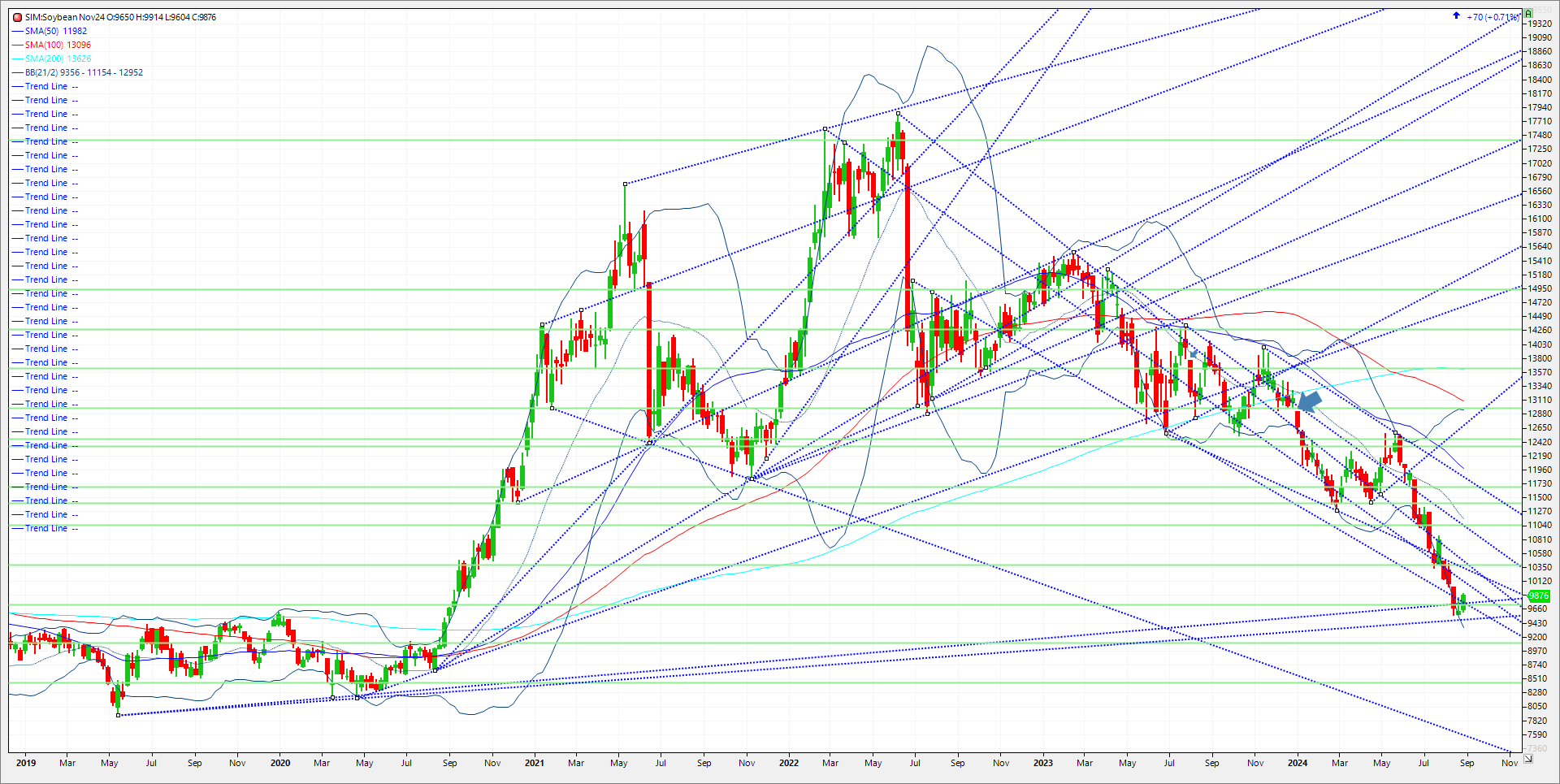

Pro Farmer pegged this year’s soybean crop at 54.9 bushels per acre. Easily a record and over 1.5 bushels per acre over USDA August WASDE. They have bean production at a whopping 4.740 billion bushels amid nearly perfect growing conditions this summer. If verified, such a crop would be 151 million bushels above USDA’s August estimate. That potential if realized would push projected 2024-25 ending stocks above 700 million bushels if demand is held constant, and one can argue that USDA’s export target was inflated when considering the relatively low level of commitments thus far. The USDA currently sits at a 560-million-bushel carry which historically is more than comfortable. Anything can happen here, and we have had consecutive closes above key resistances at 9.76/9.78 this week. Next levels up are 10.12, above that 10.32 and 10.38 A close back under 9.78/76 this week is bearish in my view. I think at some point the market will test the low 9.s as too much supply will overshadow not enough demand. Just my opinion, the key is when? With this in mind consider the following trade.

Trade Idea

Futures-N/A

Options-Buy the March 25 9.00 put. Sell the 8.00/9.00 call spread. Collect 88 cents or $4400 upon entry minus commissions and fees.

Risk/Reward

Futures-N/A

Options-Max risk here is 12 cents or $600 plus trade costs and fees. We are taking a sizable collection of 88 cents and the market trades down to the low 9’s we may be able to keep most of it. Realitevely low margin and risk with options that do not expire until late February 2025.

Please join me every Thursday at 3pm Central for a free grain webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.