Commentary

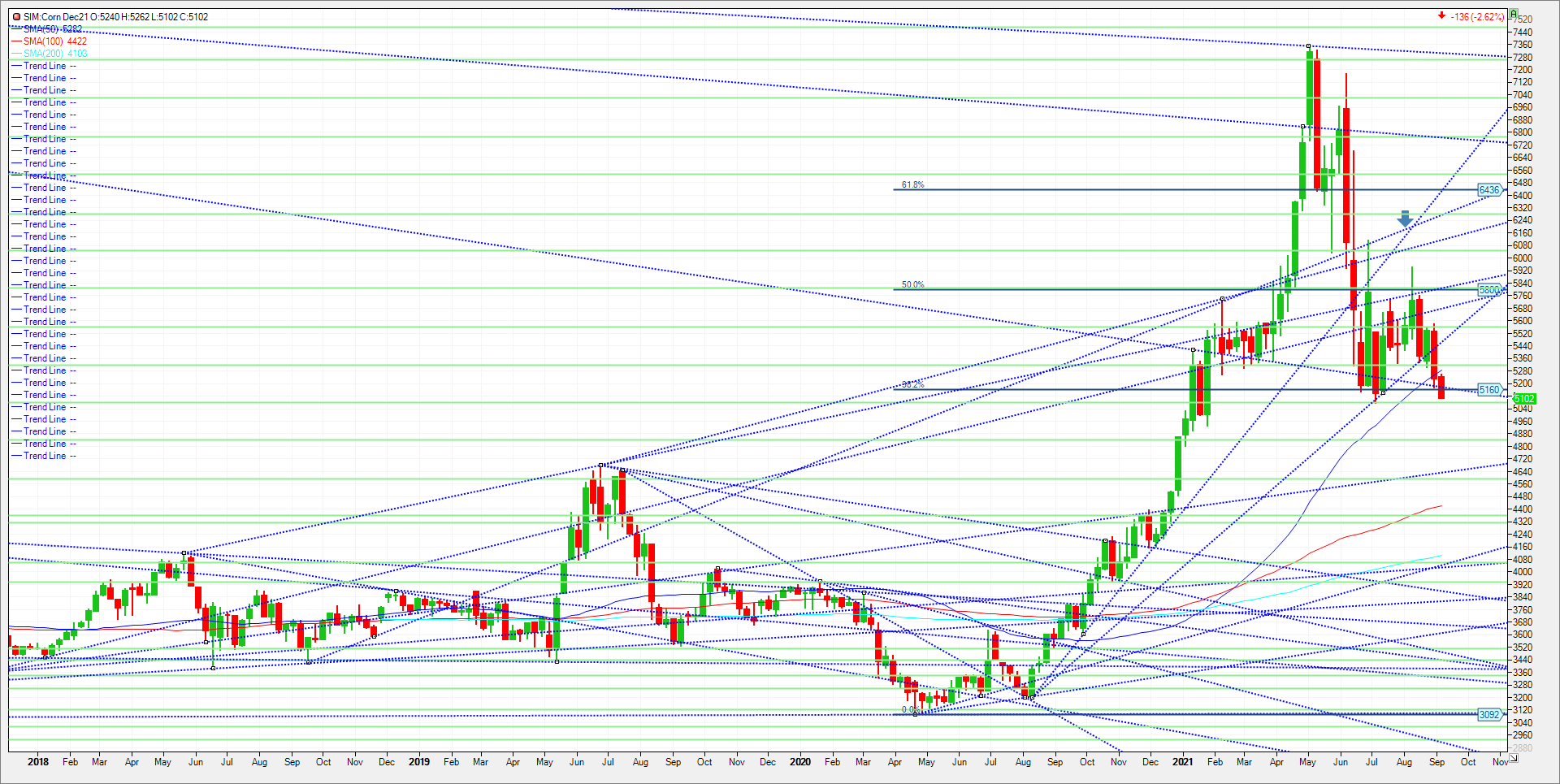

It was another ugly day for market bulls as December corn fell over 10 cents on what seemed to be a liquidation trade in my opinion. This come on top of corn tumbling over 5% last week. We missed the June lows by 3 cents today. Uncertainty over exports could still hang over the market for the near term after Hurricane Ida slammed the Gulf coast and forced the shutdown of several Louisiana grain terminals and key export gateways. USDA’s Sept. 10 Crop Production Report will set the tone for the month ahead, with harvest and yield projections likely to be bumped up from August. Unless USDA unexpectedly cuts its yield and crop estimates, a pickup in exports that signals prices have dropped far enough will be needed to stall seller interest and harvest pressure in my view.

Overall grain export inspection data confirmed that very little grain moved out of New Orleans last week with virtually all of it moving ahead of Hurricane Ida’s August 29th arrival. Just 1.1 million bushels of wheat and 3.7 million bushels of corn were loaded at the Gulf before terminals began to shutter down for the storm. Some terminals expect to get power yet this week to restore operations, but today’s small totals did little to change the bearish sentiment already seen in the commodities in my opinion. All eyes now turn to Fridays WASDE report. This afternoons crop condition report showed corn losing a point in the good to excellent category while beans added one point. The Algos continue to sell the downward momentum signals, with little news to change their purview in my opinion. Friday can change that algo-sentiment, should USDA not surprise with higher yield, production, and potential raise in acres harvested.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3 pm Central Time. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604