Commentary

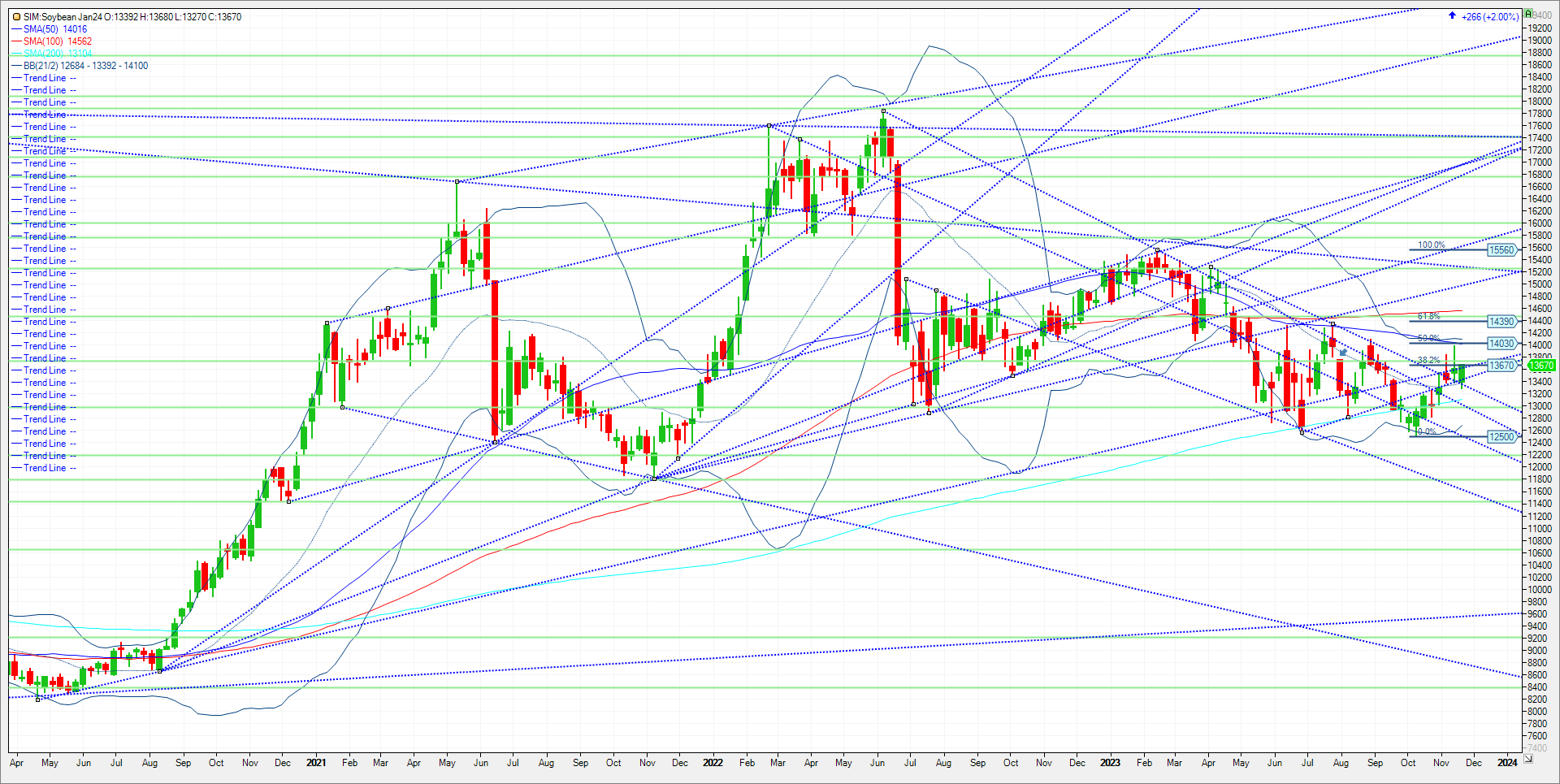

Portions of central Brazil received light precipitation over the weekend, while southern areas received heavy rains. Not much change occurred for center west, center south or interior northeastern Brazil over the coming ten days, as isolated showers and thunderstorms have the potential to pop up across key summer crop areas. However, in my view funds weren’t impressed with the forecasts moving forward or the totals and coverage over the weekend. Given that the market broke 13 cents on last night’s open then proceeded to settle over key resistance today at 1365 basis January. Beans ended up closing over the previous day high finishing 27 cents higher on day and 40 cents from the morning low, may have scared some recent shorts to cover as this might be seen as a key reversal higher in my opinion. On the demand side of the balance sheet, soybean export inspections totaled 59.1 million bushels for the week ending 11/16. 36.9 million bushels are headed for China with Germany taking another 4.5 million bushels. For the 2023/24 marketing year, the U.S. has inspected 585 million bushels of soybeans beating the seasonal pace needed of 518 mil bushels to meet the USDA estimate. China imported 4.81 MMT (176.7 mil bushels) of soybeans from Brazil in October according to Brazil’s General Administration of Customs. China’s imports are typically dominated by freshly harvested U.S. supplies during this time of year. That said US sales for future shipment have ticked up as well, which tells me that China’s appetite for beans remains insatiable. The market direction is being fueled by weather in S.A. as harvest nears completion here at home. Technically if we hold 13.65 on consecutive closes puts 14.03 to 14.10 in the crosshairs in my view as a upside target for January beans. A close over those levels and its 1448 next. Support is here at 13.65, with a close under 13.45. A close under 1335 and its katy bear the door to 12.96.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar on Thursday November 30th at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.