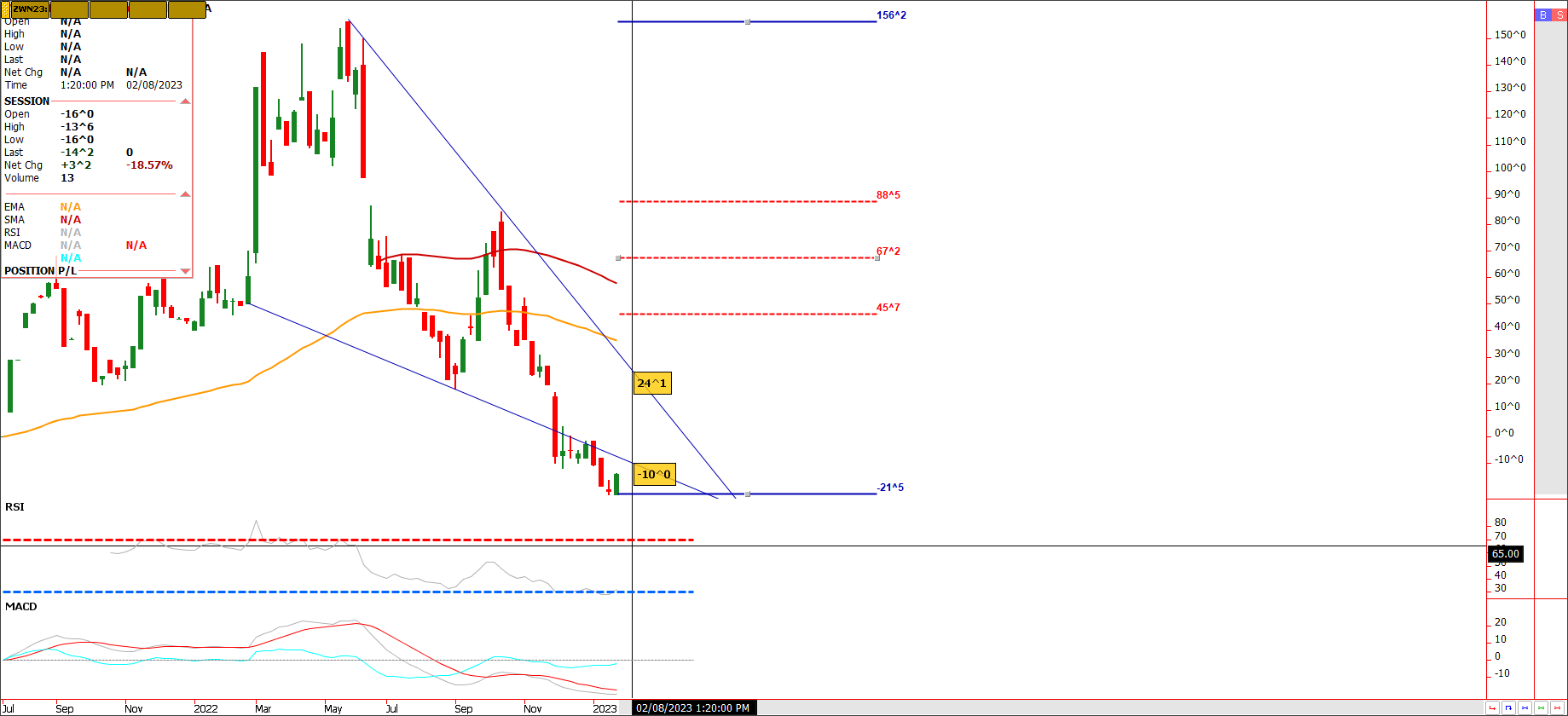

A couple plays to consider in wheat. Trend and Index following funds are short 65K contracts. Attached is a chart for the July23/July 24 Chicago wheat futures spread. Last Spring, the spread traded to 1.56 over, July 23 over following the Russian invasion of Ukraine. Currently, the July 23/July24 spread sits at 15 to 20 cents under. Can it work lower? Absolutely it can so caution is warranted. But it has dropped $1.80 or 9K a spread since the Spring of 2022. A sizable drop in my view. One may buy the spread, but open Interest and volume is low currently, so it’s hard to know where to put a stop loss. I have an option idea too that defines what the risk is here also and in my view is a little conservative. I suspect that the July futures spread, ZWN23:N24[SP]will gain in interest and volume when the March futures contract rolls off the Board in a few weeks. Until then, a stop loss of approximately 15 cents or $750.00 from entry is suggested. Rumors abound have Russia sending 200K troops late winter/early Spring into Ukraine. Rumors also have Russia placing anti-aircraft missiles on top of key government buildings in Moscow. Couple that with the Ukraine asking and now getting approvals for M1 tanks from the US and now Germany sending tanks to fortify Ukrainian defenses. It has also been rumored that the Netherlands has agreed to send F16s to the Ukrainian Air Defense. In my view the potential exists for a wider war against Russia that pulls in NATO members. Should that occur, you can kiss that pathway to get Ukrainian grain via the Black Sea, goodbye in my opinion. This morning’s news stated that a Turkish ship was hit with a missile in the port near Kherson. However, we saw not much of a market reaction. It seems that some markets are becoming less sensitive to headlines coming out of Ukraine. In my opinion the trade is almost desensitized by the daily flow of news that doesn’t provide clarity to their impact on certain commodities. With funds short 65K contracts, I’m eager to see how the stubborn the shorts defend their positions ahead of a possible intensification of the war in Eastern Europe.

Option idea below along with the aforementioned futures spread. Two strategies to consider here. Call me with questions.

Trade Ideas

Futures-Buy the July 23/July 24 Chicago wheat futures spread at -15 cents under.

Options: Sell the July Chicago 2023 wheat 9.00/8.00 put spread for 80 cents OB.

Risk/Reward

Futures-If filled on the futures spread at -15 cents, I would place a stop at -30 cents July 23 under. The risk therefore is 15 cents or $750.00 plus commissions and fees.

Options- This option strategy collects 4K upon entry, minus commissions and fees. Max risk is 1K plus trade costs and fees. I would be out of the put spread if the most actively traded contract, in this case March futures contract, settles under 7.13.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604