Commentary

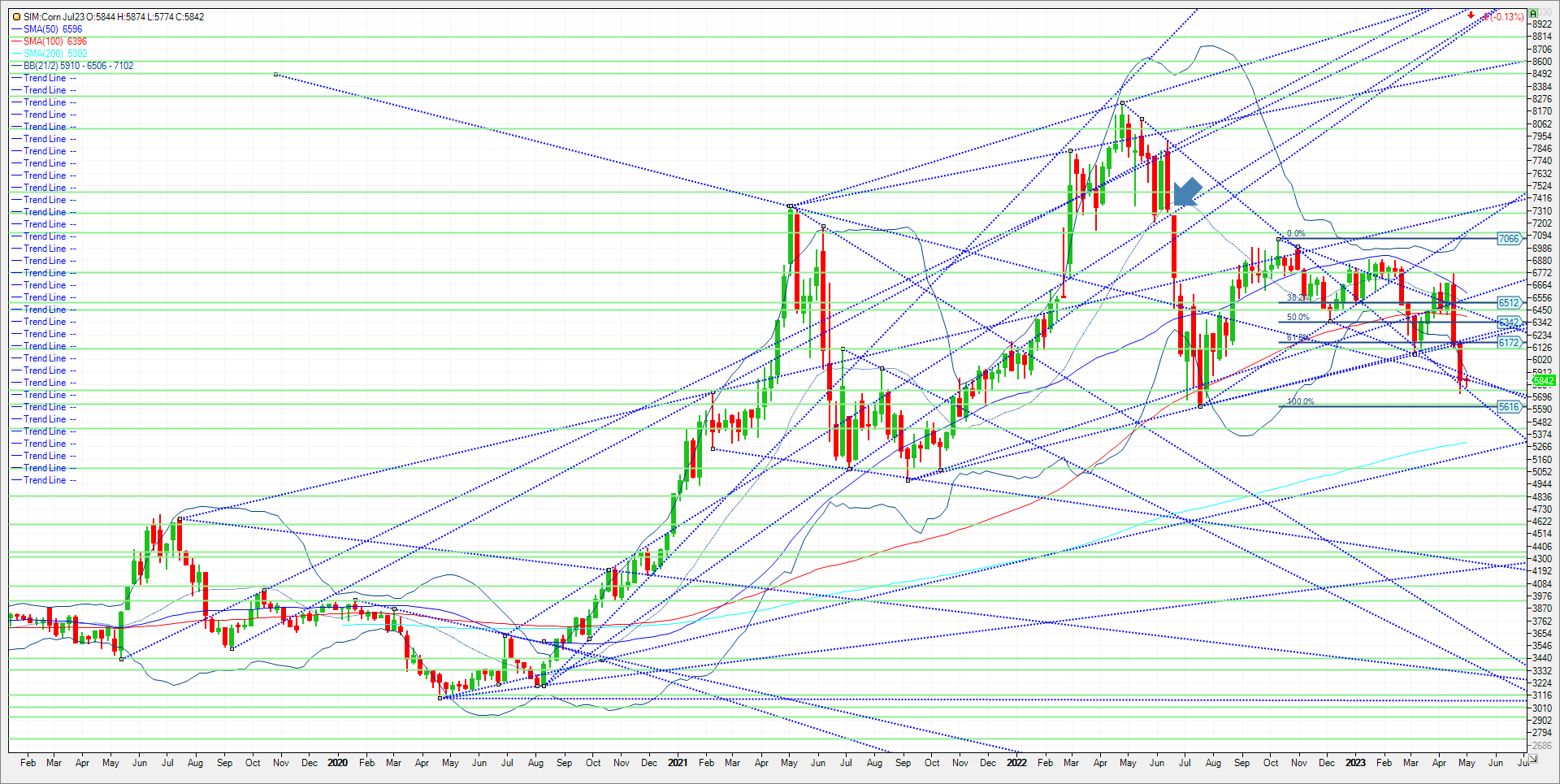

Export inspections for corn came in at a marketing year high of 59.8 million bushelsfor export inspection in the week ending April 27. The recent trend for inspections shows a good week, followed by a poor week, and then repeating again. China took in just 8.0 million bushels of corn on inspection. The total marketing year to date corn export inspections to 941 million bushels, down exactly 500 million or 35% from the previous year’s pace and down 165 million bushels from the seasonal pace needed to hit USDA’s target. Managed money accounts moved to a net short position of 15,297 futures and options contracts in the corn market as of April 25, according to the CFTC. Funds trimmed their net long position in soybean futures and options to 87,208 contracts, a decline of over 45K contracts for the week, while they extended their net short in SRW wheat to 113,012 contracts. Demand or lack thereof for corn, wheat, and beans has been a key theme in my view as to why funds are liquidating. We arent seeing increases in open interest, so the managed money crowd is heading for the mattresses in old crop contracts. That being said, one can still make the argument that we are still in a uptrend. Calendar spreads could be offering some clues here as there are still strong inversions in the spreads. For old crop corn and bean contracts, look at May/July Corn and May/July Soybeans for direction near term. Should these inversions increase, (rally), look for the July contract to follow May higher, acting as tail of the Dog. Technical levels for July corn for this week come in as follows. Support is at 5.76/5,77. A close under here and next support is at 5.61. A Close under 5.61 and its 5.44 which is 20% down for the year. If 5.44 can’t hold, look for the market to test 5.30, which is the 200-day moving average. Resistance is up at 5.88. A close over and its 6.07. Back over 6.07, and the market could test 6.11 and 6.17. A close over 6.17, and its katy bar the door to 6.41/6.45.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.​

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.​

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTIâ€) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax