Commentary

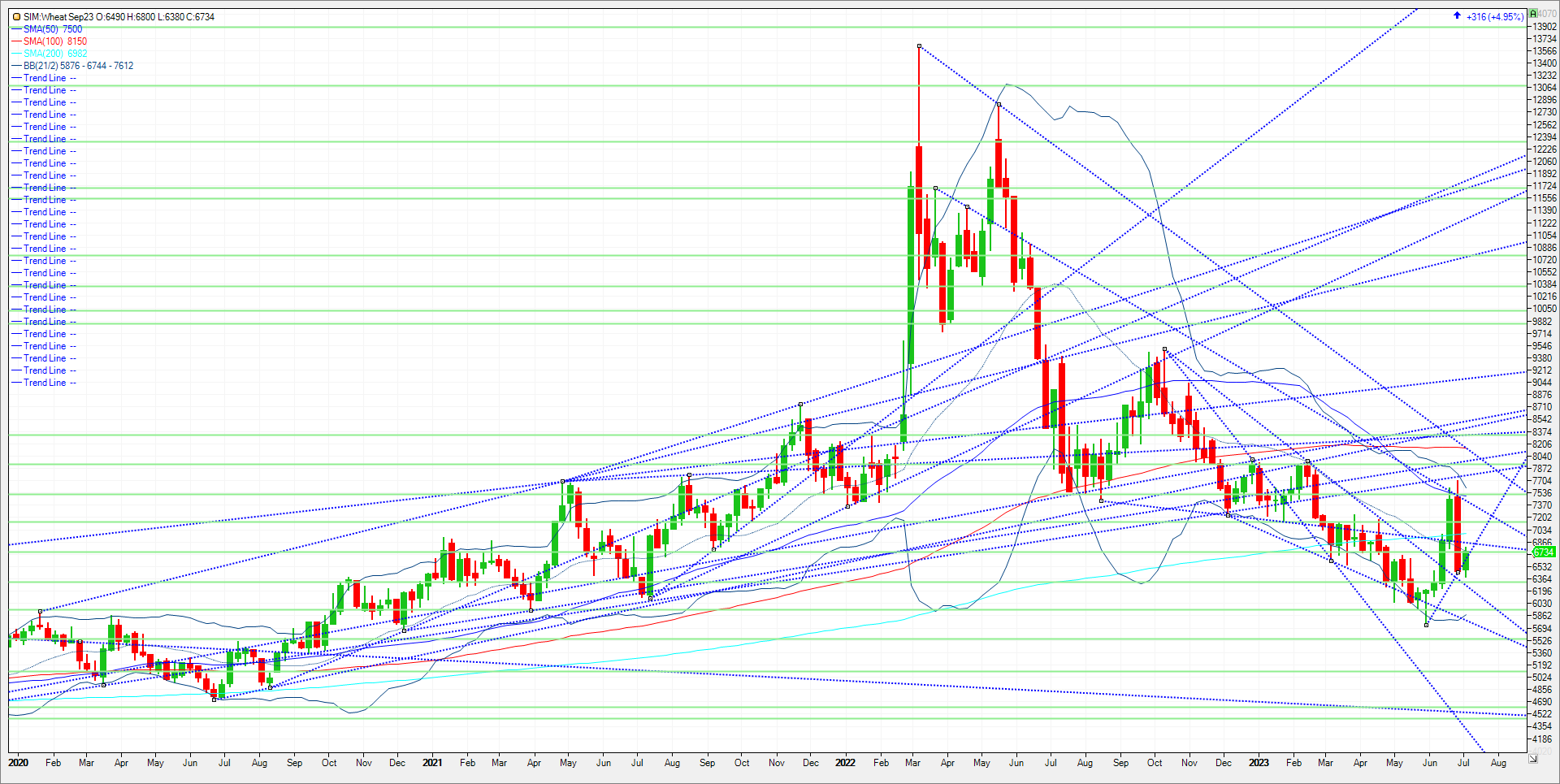

Wheat futures exploded in all classes today with the rally coming on a few fronts. First, crop ratings for Spring wheat declined by 2 points in the good to excellent category as number one producer North Dakota, which represents approximately 51 percent of the Spring wheat crop lost 9 points in the good to excellent category. The weather story of too dry in North Dakota has spread to Canadian provinces as well as European growing areas experiencing sever drought in my opinion. Second, Moscow and Kyiv accused each other of planning to attack the Russian-controlled Zaporizhzhia nuclear power plant in southern Ukraine, though the U.N. nuclear watchdog said it had yet to see indications of mines or explosives at the plant. The risk of a nuclear accident in my view unsettled short positions in the market amid a wave of short covering today. The trade in my opinion had become immune in its reaction to Russian threats to quit a Black Sea initiative allowing Ukrainian exports through the Black Sea. Technical levels for the remainder of the week come in as follows for Chicago wheat. Resistance is first at 6.85. A close over and next resistance is the 200-week moving average at 6.98. A close above these levels and things get interesting and could push the market to the 7.32/7.43 area. Support is first at 662. A close under and its back to the 6.32/6.28 area in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604