A continued slide in corn for the third straight day has given thoughts to funds flipping from a net long to net short position. Recent rains in the Midwest have curtailed any further buying of beans despite a bullish report Wednesday. Rallies for now are selling opportunities as soy lacks a near term bullish driver as weather isn’t threatening for now. corn being liquidated hasn’t helped soybeans or meal any. I think we may be at or near a bottom in Kc and Minneapolis wheat for now as the selling as subsided and I watch for profit taking to commence soon. Its getting cheap in Kc under 4.00 and near 5.00 in Minneapolis. On top of all that we have a major slide in equities that has Central banks globally scrambling to print more dollars. Should this type of environment continue where trade wars and currency devaluations headline more risk off sentiment, I could see funds converge into some grain and livestock sectors deemed undervalued as a buy vs inflation. In my view it why you have investors pouring into Gold, Silver, Bond and Note futures.Again just my opinion here but I think funds and money managers might start diversifying into other sectors here. December 19 is the lead month in KC futures on the roll here. (Chart below). This could be a double bottom at 381. An aggressive trade would be to buy the DEC 420 call for 11 cents. One could finance by selling the Dec 400/380 put spread for 9 cents. Max risk on this option strategy is 20 cents. Or simply buy futures here with a stop under 380 risking approximately 20 cents.

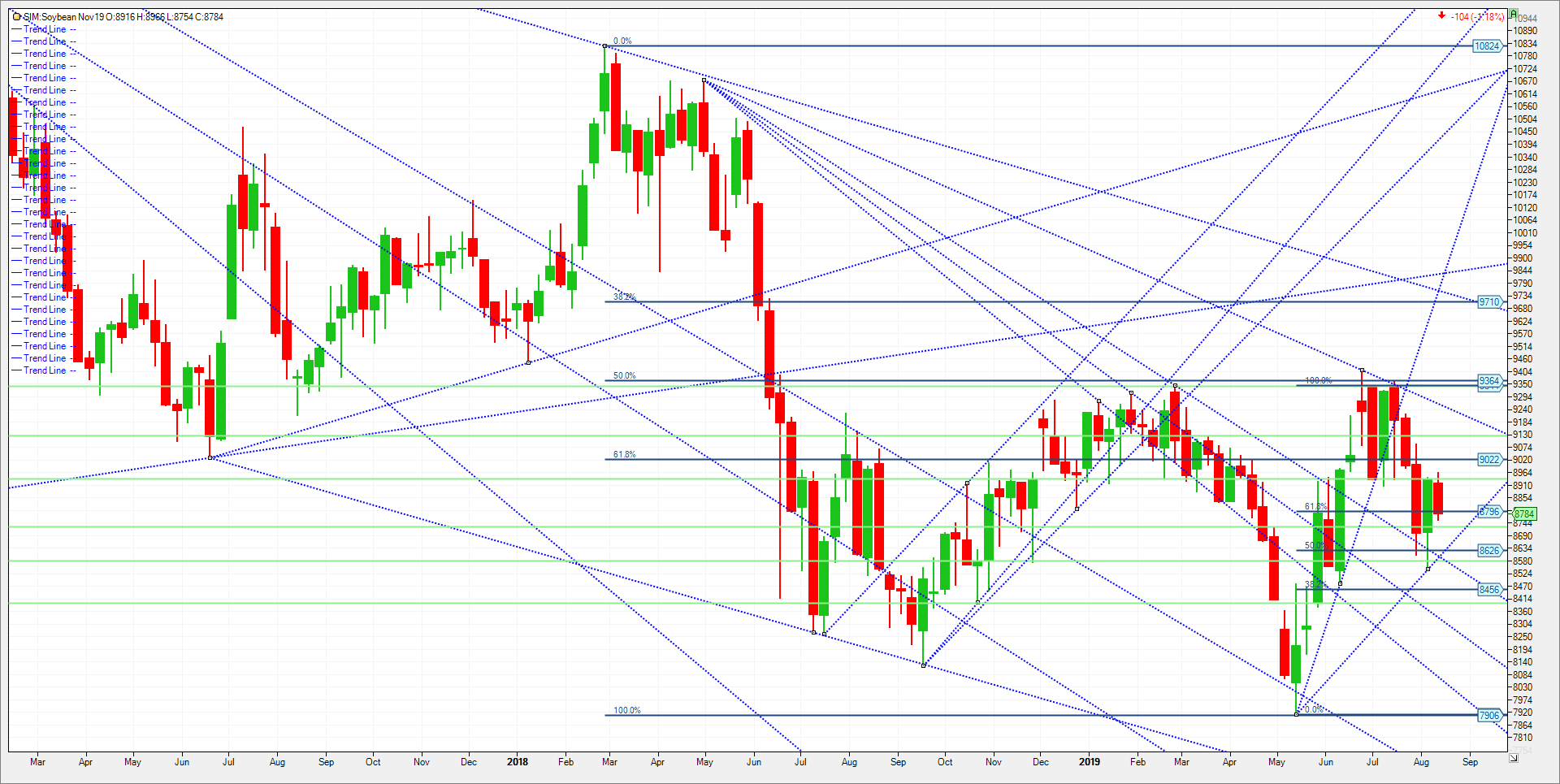

Beans are another sector that could see some interest here if support levels hold. Major support Nov beans at 8.60 and should this level hold on any break, I would look to be a buyer. We may not get that chance. Remember the USDA had very low acres at 76 million including 4.35 million prevent plant. Yield at 48.5 BPA could be a little optimistic for a very late planted crop. In my view let the charts tell you what to do but we if see a move over 894, we could see an eventual rally to 921, the 200 day moving average. I would low ball a 7 cent bid on the 900/950 November 19 call spread for starters here basis. It settled at 10 cents today, and I think we should be looking to buy a further break should major support hold.

Please join me every Thursday at 3 pm Central time for a free grain and livestock webinar. We discuss supply, demand, weather and the charts. A recording link will be sent to your email upon signup. Sign Up Now