Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

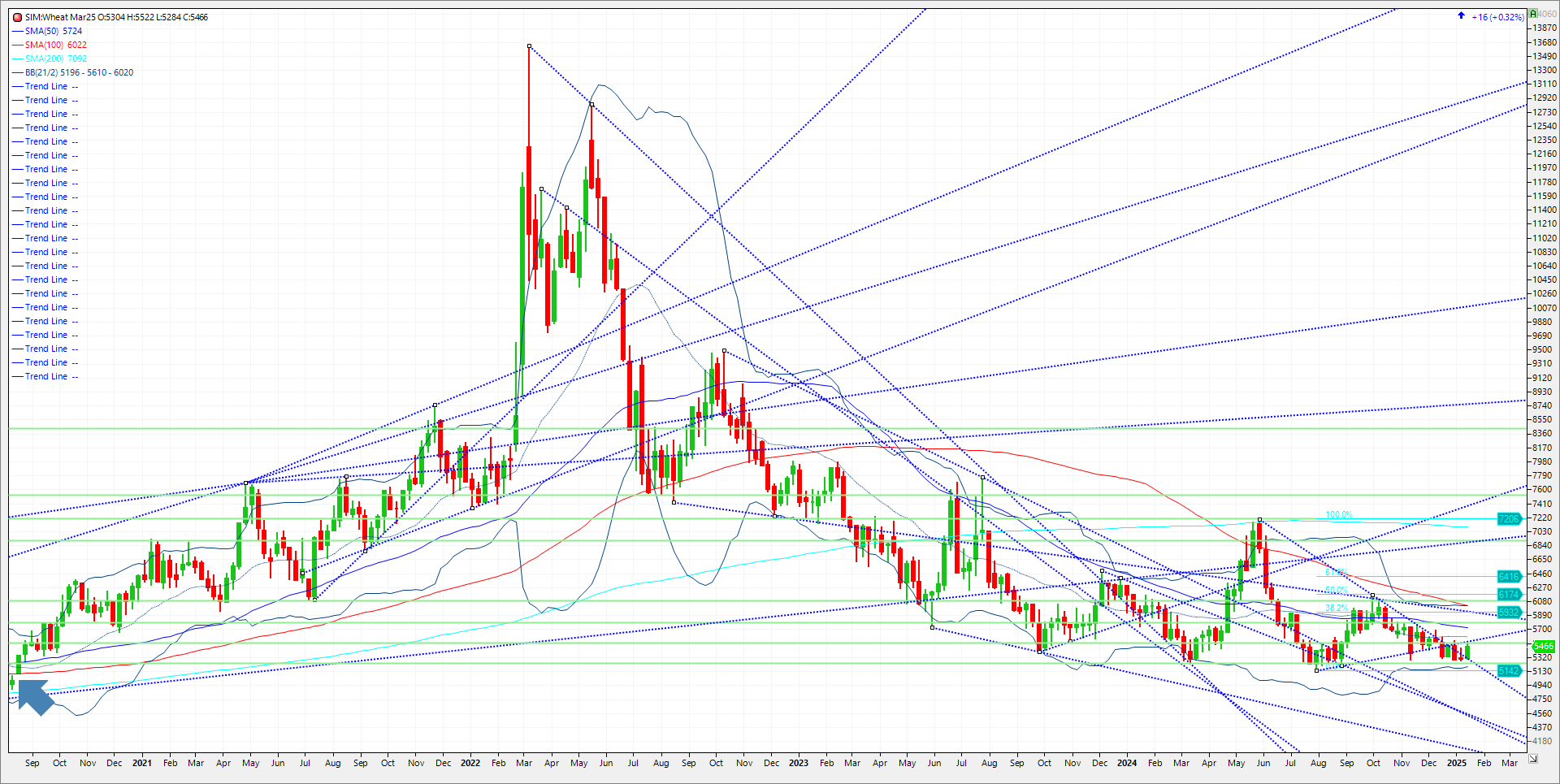

Wheat prices ended the session with lightly mixed results after going through an uneven round of choppy trading on Tuesday. Chicago wheat added 1.75 cents to close at $546.75, March Kansas City futures held steady at $5.61, and March Minneapolis Spring wheat futures dropped 4.25 cents to $589.25. The wheat market looked destined to extend the recent recovery with values rallying strongly the first hour of trade, but the rally was quickly met with selling pressure the balance of the day with corn and soybeans taking a breather post-Wasde report. Simply put, it is my belief that without a continued corn rally, wheat futures could struggle to push higher and sustain rallies. Spec Funds were still buyers today as they whittled down the large Managed Money net short of 75K. World markets remained quiet, and Russian FOB values remained unchanged again. Wheat continues to lack the fundamental story that has recently supported row crops and so will have a more difficult time sustaining flat price strength without a story. The market remains on watch for a threat to the US and Russian wheat crops, but no threat has risen to the level of concern for traders. Aside from some light profit taking by funds we remain rangebound. Funds remain with an aggressive short of 75K in Chicago wheat, short approximately 26K in KC and 24K in Minneapolis. Technical levels for March 25 wheat for the remainder of the week comes in as follows. Support is first at 5.30 and then the 5% down for the year marker at 5.28. Then it is 5.19 and the summer lows at 5.14. Further downside pressure would push the market to the 10 percent down for the year market at 5.00. Resistance is just above todays close at 554, and then up at the 21-week moving average at 561. The market needs to clear 5.61 to make a run for the next key resistance at 573 (50 week moving average) and then 5% higher on year at 582. Best advice here is to trade the charts in this choppy market.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.