Commentary

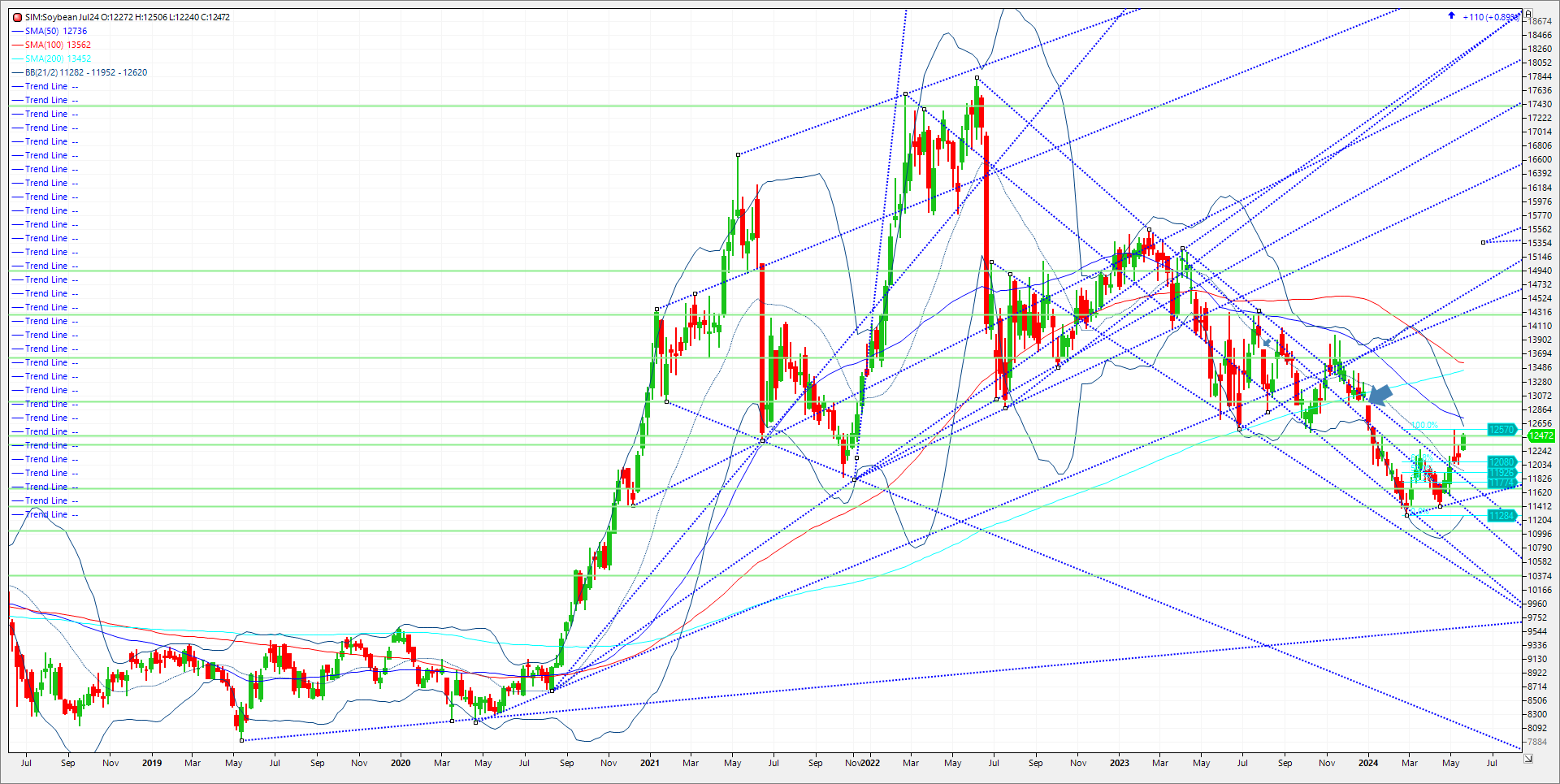

China demand has resurfaced in the last few days as the trade reported Chinese purchases of “at least” two cargoes of U.S. soybeans in recent days, totaling around 130k Tonnes, for July shipment. Flood losses in Rio Grande Del Sol in Southern Brazil are still being assessed, which is offering additional support in my opinion. Slow to launch newly built soybean crushers added bullishness to soymeal today as western feed markets ran low on protein and caused meal values to rally with soybeans and support crush margins. US cash crush margins improved 10 cents per bushel this week. Brazil’s producer is a tight holder of soybeans too. Private estimates show they are holding over 40% of their crop, which could be a record for this time of season. Extended rallies in old crop beans could be short-lived due to the large holdings not yet moved. Which brings us to technical levels to follow for the most actively traded July beans below. For the remainder of the week. Support is at 12.34 and then the weekly low at 1224. A close under 1224, the market could reverse and trend back to 11.95 and 11.88. Resistance is 12.47 and then the recent highs at 12.56. A close above here and the market could trade to 1273, (50 week moving average). A close over this level and the market could trade to the gap from the start of the year at 1291-1297. Watch to see if the 100-week moving average closes well below the 200-week moving average. It could be a clue of a reversal of trend and lower prices should it occur in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604