Commentary

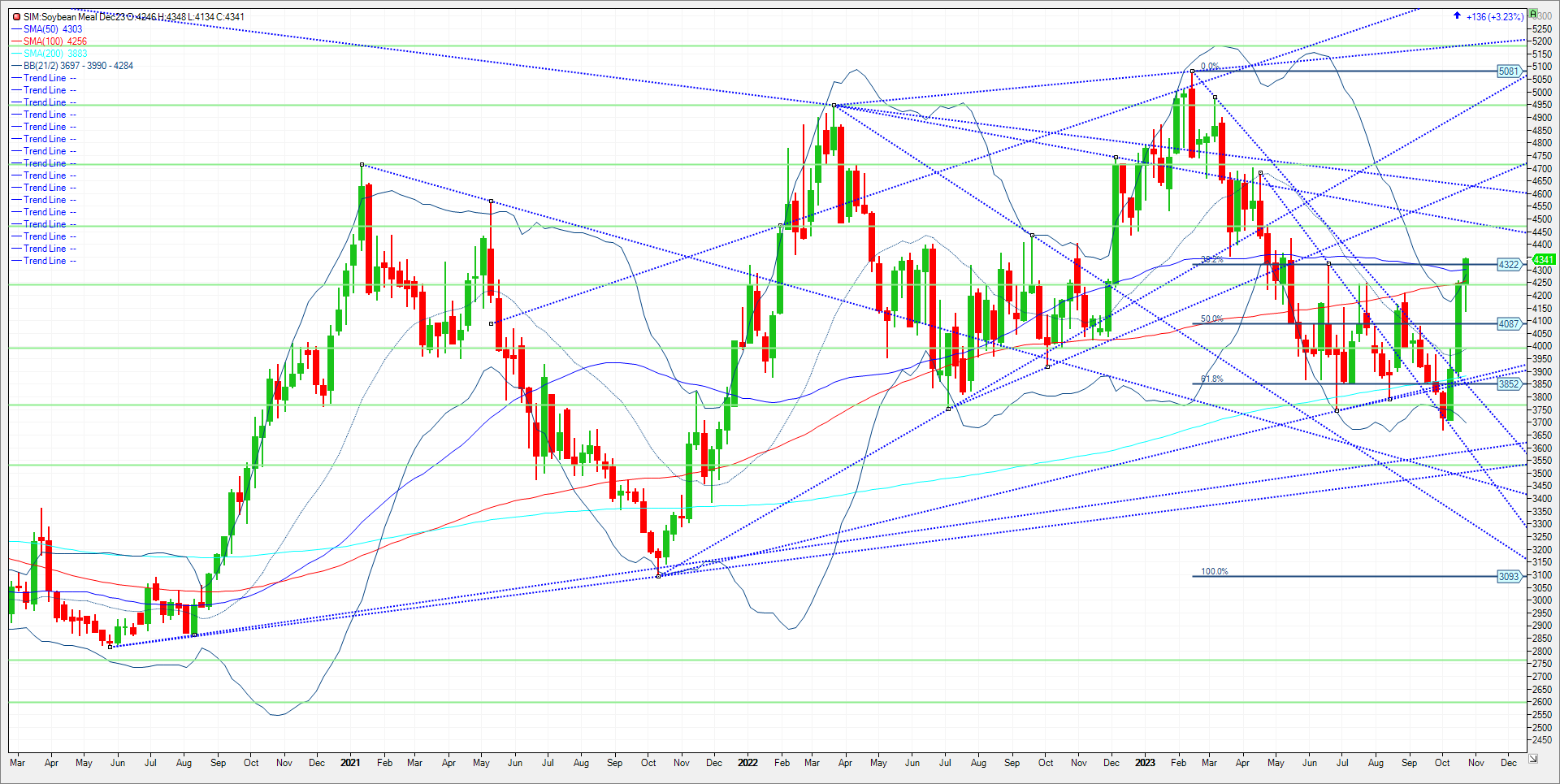

Soymeal and soybeans rallied on two fronts today. First, Argentina is running low on soybeans to crush while exportable supply of soybeans in Brazil are nearing sold out per Hightower. Argentina is extending its “soy dollar” program to bring hard currency into its weak economy. Still cash is starting to firm with the expectation that buyers will step in after recent price breaks to support the market. As harvest advances at 76 percent complete in the US, the markets eyes turn to demand and weather in South America. However, it is meal now leading the sector in my view, leading beans higher with a breakout occurring on the weekly continuous soymeal chart in my opinion. (See Below)

Second, Chinese importers this morning signed framework agreements to buy billions of dollars of agricultural goods (including corn, soybeans, wheat, and sorghum) from the United States, per the U.S. Soybean Export Council; they’re non-binding letters of intent, as they always are, as China can cancel sales for future shipment at any moment. while somewhat supportive today, pay attention to what China does, not what they say or sign.

As of the last CFTC report as of 10/20, funds went negative beans but not by much. Managed funds short soybeans by 2k. They are long soymeal and Soy oil to the tune of 50K for meal and 20K for oil. Trade idea below in beans looking for a push higher into the November WASDE.

Trade Ideas

Futures-N/A

Options-Buy the December 23 soybean 1290 call. Sell the August soybean 1460 call at parity or even money. ZSQ24C1460:Z23C1290[DG]

Risk/Reward

Futures-N/A

Options-There is unlimited risk here as one is short a call option with a late July 2024 expiration versus the long option that expires the day after Thanksgiving. We are buying a call option approximately 34 cents in the money, (Dec 1290C) vs selling an August option (ZSQ24 1460C) approximately $1.30 out of money. We are looking for January beans to take out last week’s highs in the low 1330’s with the possibility of a challenge to the 1355/56 area and potentially 1372 area and then exit. However, a futures close below 1293 (basis January) and I would exit the spread.

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

slusk@walshtrading.com

www.walshtrading.com

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604