Please join me every Thursday at 3pm Central for a free grain webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

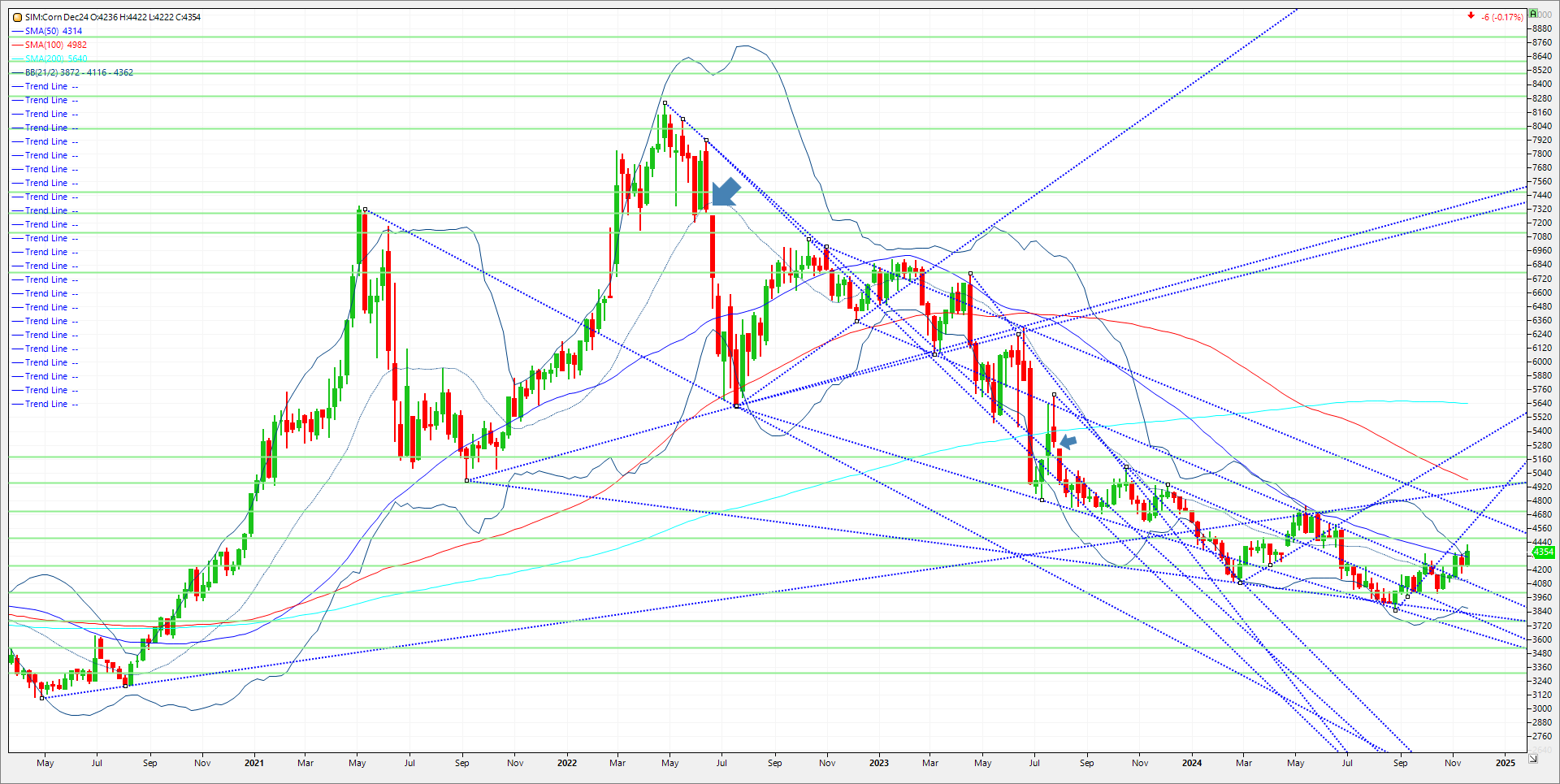

Although recent data suggests the fall surge in export demand peaked, usage for ethanol production remains robust. Conversely, with the corn harvest essentially complete, the market is feeling much less hedge pressure. That said the corn market was stuck in quicksand this week. March corn traded in a 9-cent range and finished the week essentially flat. We didn’t see much in the way of flash sale announcements for sales for future shipment into Mexico or, “unknown” which you could argue is bearish, but the flip side of that argument is that sales to date this marketing year are 20% higher than the USDA balance sheet, so perhaps with prices somewhat elevated, a pause was in order. The huge harvest may remain a handicap for bulls, while lack of farmer selling may limit any break in the market. The wild card here is Eastern Europe. Should that issue escalate, all bets are off on where this market could go. Technical levels for March Corn come in as follows. Support is first at 436 and then 431. A close under 431 and its 424/22. A close under this level is 4.11. Resistance is 448. A close over and its 460 then 471.

Two trade suggestions. First one designed for those who have sold their grain and want to take a long position in the market. Second trade is for those who have unpriced bushels.

Bullish Trade-Bushels Sold

Options-For a 6 cent ($300) collection or credit minus trade costs and fees, buy the January 4.00 corn call while selling the Dec 25 540/490 put spread. One is essentially getting long corn at 4.00 basis March futures provided March corn settles above 4.00 when January options expire on 12/27. If purchased I would look to exit either the long call position or if exercised the futures position at 460 to 4.70 which are longer term resistance levels on the weekly continuous chart. The gameplan then would then look to buy back the short Dec 25 put spread cheaper than where we sold it.

Risk-The risk on a 6-cent collection per todays close is approximately 44 cents plus trade costs and fees. This trade should be only considered for producers of corn.

Bearish Trade-For unpriced bushels

Options–Buy the May 25 corn 470 puts for 30 cents. Sell the Dec 2025 corn 4.00/4.60 call spread at 30 cents. Enter into this three-way option spread for even money. ZCZ25C400:460: K25P470 (1-1-1)

Risk– This is an old and new crop hedge. The maximum risk here is 60 cents plus trade costs and fees. Risk on the May puts is 30 cents plus trade costs. Risk on the December call is 30 cents. We are entering in at even money. The value of the 470 put basis May25 futures is what will determine this trade. If May 25 corn drops and retests the August lows near 414, I would advise exiting the option premium between 65 to 70 cents collection. One then can decide to cover the dec 25 call spread or use it as partial hedge vs next year’s production. However consecutive closes over near-term highs at 461 and I am out with an approximate10-cent loss and will re-evaluate.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.