Commentary

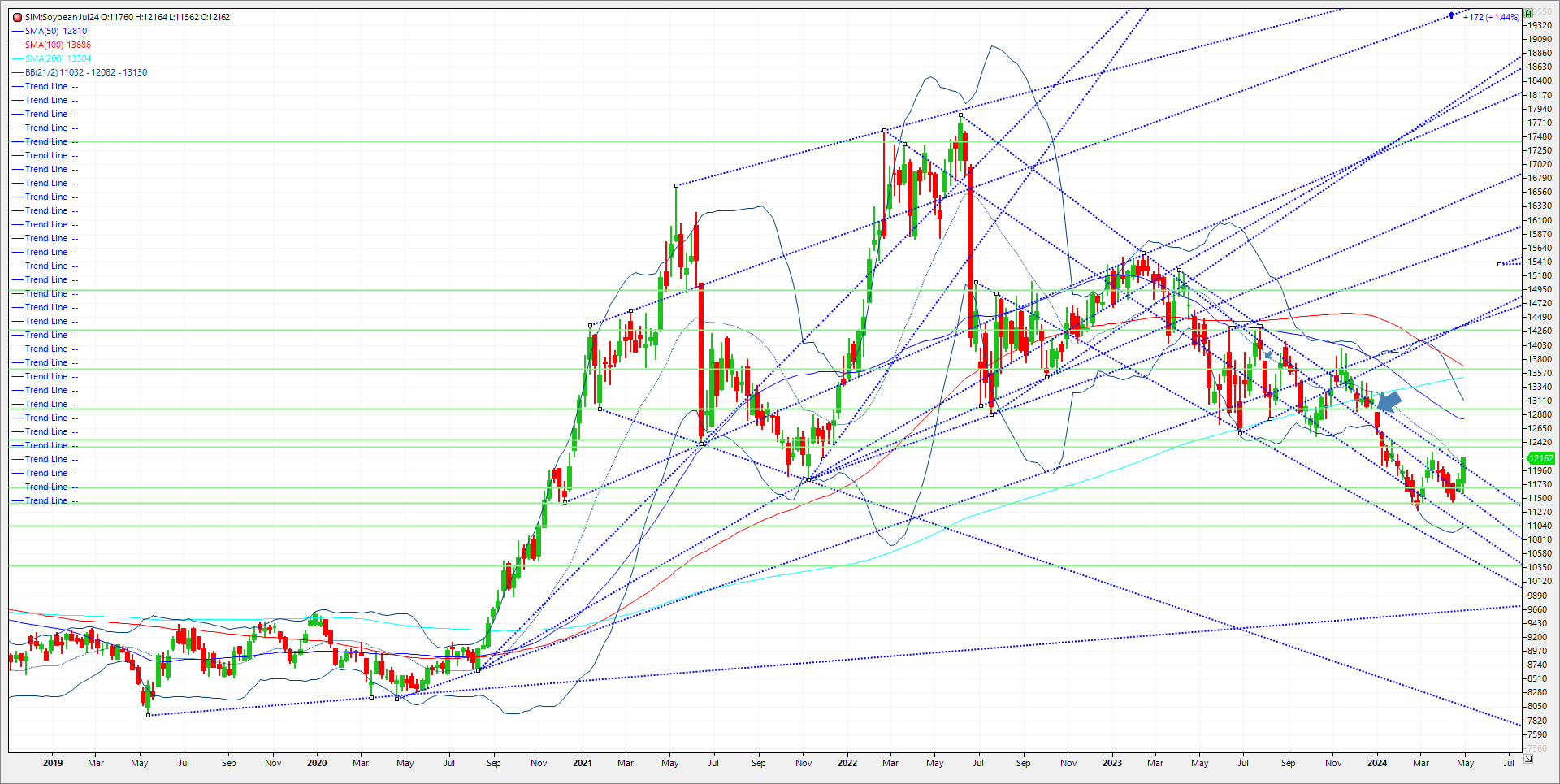

Torrential rainfall in Brazil’s far southern state of Rio Grande do Sul state caused flooding and disruptions to the final stages of soybean and corn harvests. Grain traders the last few trading sessions point to excessive wet weather that is suggesting that with roughly a quarter of the crop remaining in the field, it could be subject to harvest and quality loss. Crop scouts suggest that we might be talking about roughly 125 million bushels of soybeans at risk of loss potentially, but that number could be revised significantly in either direction at this point. Meal and Soybeans matched each other penny for a penny today while the bean oil market traded negatively. With the funds short over 150K contracts, news that could subtract 5 to 7 million metric tons off of total production was a reason to short cover. The trade in my view received inflationary reactions following this week’s Fed meeting, and unemployment report. Now throw in a weather scare from the World’s largest bean grower, short covering was an easy choice heading into an uncertain weekend in my opinion. Technical levels for July 24 beans come in as follow next week. Support is first at 12.07 and then 11.97. A close under and its 11.68. If 1168 doesn’t hold its 1149. Resistance is at 1226 (March high) and then 1234. A close over both levels could push the market to 1247. A close over here and its 1280, the 50-week moving average.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.