Commentary

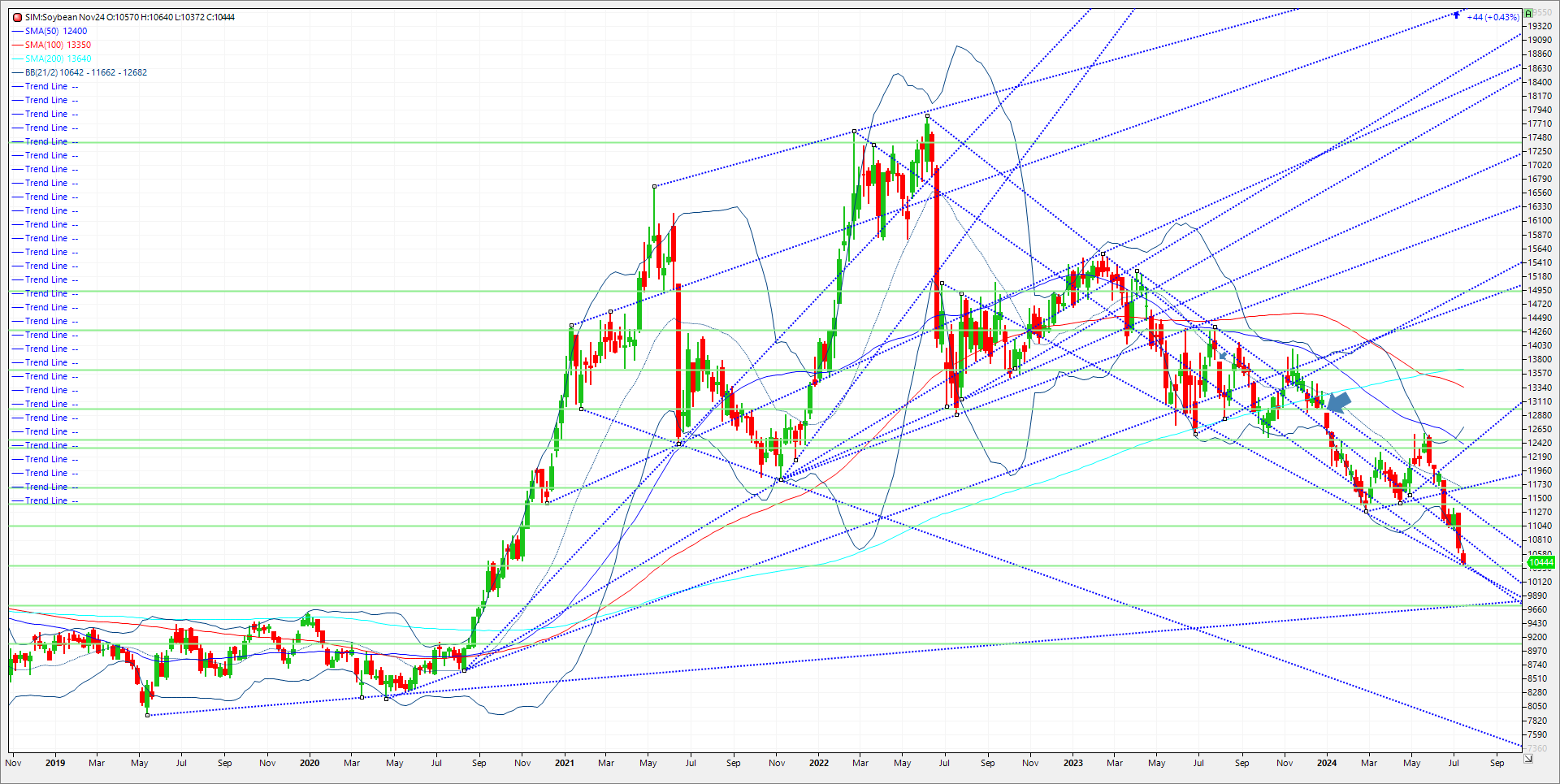

In my opinion, beans have more room to the downside near term. Since July 5th, the market has broken 93 cents on good weather and weak outside markets like corn and wheat. Funds are now record short close to 200K short. One of our downside targets got hit at 10.38, making a low of 1037.2. That level represents 20% down for the year. Next week we have a major trendline at 10.33. Should that not hold its Katy bar the door to 25% lower on year to 9.72 and trendline support at 9.69. Upside targets include the 50 % retracement from the July 5th high at 1131 to today’s low at 10.37. that level is at 10.78. We need a close over that level to challenge 11.03 (15 % lower on year and then major resistance at 11.31 (July 5th high). The bean market doesn’t turn bullish until we close over that level in my opinion. The grain market as a whole has been beaten down since Memorial Day weekend on two fronts. First weather has been near perfect, plenty of rain and no heat domes over the Midwest. Chinese buyers have already purchased more than 7 million metric tons of new-crop Brazilian soybeans for delivery early next year, but they’ve barely purchased any U.S. new-crop soybeans – choosing instead to stockpile cheap Argentine and Brazilian soybeans for possible use this fall. Simply put we need a weather rally or increased demand, or both moving forward to turn prices higher in my view

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604