Commentary

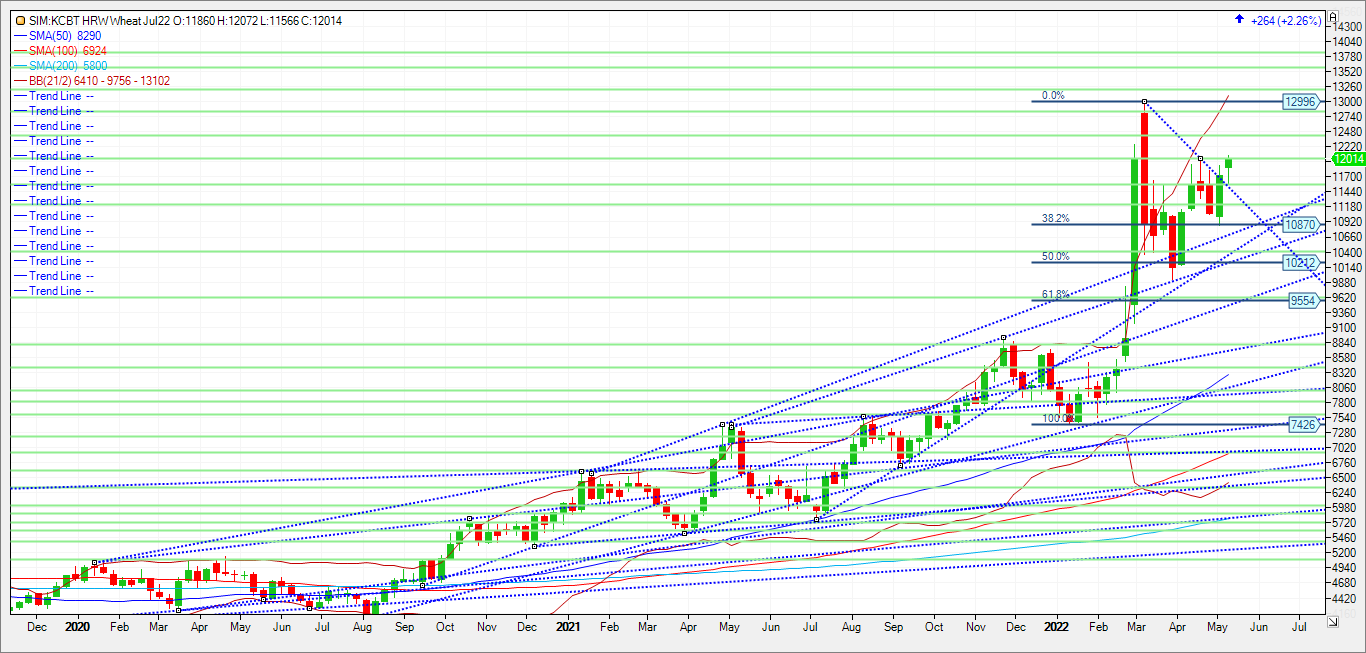

Wheat Markets continue to trade sharply higher with dips being seen as buying opportunities is the theme for the week so far in my view. Weather maps are showing dry conditions for both the EU and US Southern Plains and the wet maps for the US Northern Plains that potentially brings more delay to Spring wheat plantings. The weather concerns amid more talk of the Indian wheat crop production estimate being downgraded has in my view pushed the July Minneapolis futures (MWN22) to making new contract highs along with September 22 Paris wheat. July KC wheat closed above $12.00 today. Despite a small improvement in crop ratings this week from 29 percent good to excellent from 27 percent the week prior, the crop’s production prospects remain weak in my opinion, and persistent drought is likely leading to higher than usual acreage abandonment. Tomorrows 11am WASDE report, could see USDA playing with numbers and we could see surprises. How much they cut from Uranian exports is one number the trade will be looking at. The second will be the USDA supply/demand outlook for 2022/23. The average trade guess for new crop ending stocks is 659 million bushels, with a range from 550 on the low end to 859 on the high end. World numbers for ending stocks come in at 272 million metric tons, with a range of 261 on the low end and 278 on the high. The World numbers could be a big wild card given the situation in Eastern Europe. Post report we will have wheat crop tours starting up, and those findings could have a more of an impact on price in the weeks to come in my opinion. With that in mind, I am considering the following trade.

Trade Ideas

Futures-N/A

Options-Buy the August KC wheat 13.00 call and sell the September KC wheat 14.00 call for a 5-cent debit.

| KEU22C1400:Q22C1300[DG] |

| Risk/RewardFutures-N/AOptions-This diagonal option strategy has unlimited risk as the long August call expires one month prior to the short September call. Therefore, if one enters into as a spread, one should exit as a spread. We are looking for the Kc wheat market to test the March highs and maybe surpass them and challenge the all-time highs at 1380. Once can put a stop loss upon entry at a 5-cent credit. This risks ten cents upon entry plus all commissions and fees. Call or email me with questions. Chart attached below.Please join me for a free grain and livestock webinar at 3pm Central every Thursday. We discuss supply, demand, weather and the charts. Sign Up Now |

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604