Commentary

Wheat the leader on the grain board today led by the Minneapolis contract as it settled over 9.00. Spring Wheat crop tour is moving through the Dakotas this week, Scouts on Day 1 of the Wheat Quality Council’s annual spring wheat tour found an average spring wheat yield of 29.5 bu. per acre, sharply below 2019’s 45.6 bu. per acre and the five-year average of 43.3 bu. per acre. Scouts noted plants were much shorter than normal and heavy grasshopper damage. Not that this is unexpected, but it continues to keep trade focused on the historic losses in production. Spring wheat’s mission maybe to ration demand, plain and simple. Spot Minneapolis wheat futures carrying a $2.15 premium to Chicago and a $2.50 premium to Kansas City. The Russian Spring wheat crop is being watched closely as yields continue to decline; Brazilian wheat crop also potentially threatened by overnight freezes as it heads out. French wheat crop threatened by wet weather slowing harvest and possibly creating quality issues. From a demand standpoint U.S. Gulf wheat bids have been under pressure recently as demand remains very sluggish. Make no mistake, this is a supply side issue on a number of unknowns. These unknowns regarding crop sizes both here and abroad could keep the market bid until the funds get a better grasp on what this year’s spring wheat is or isn’t.

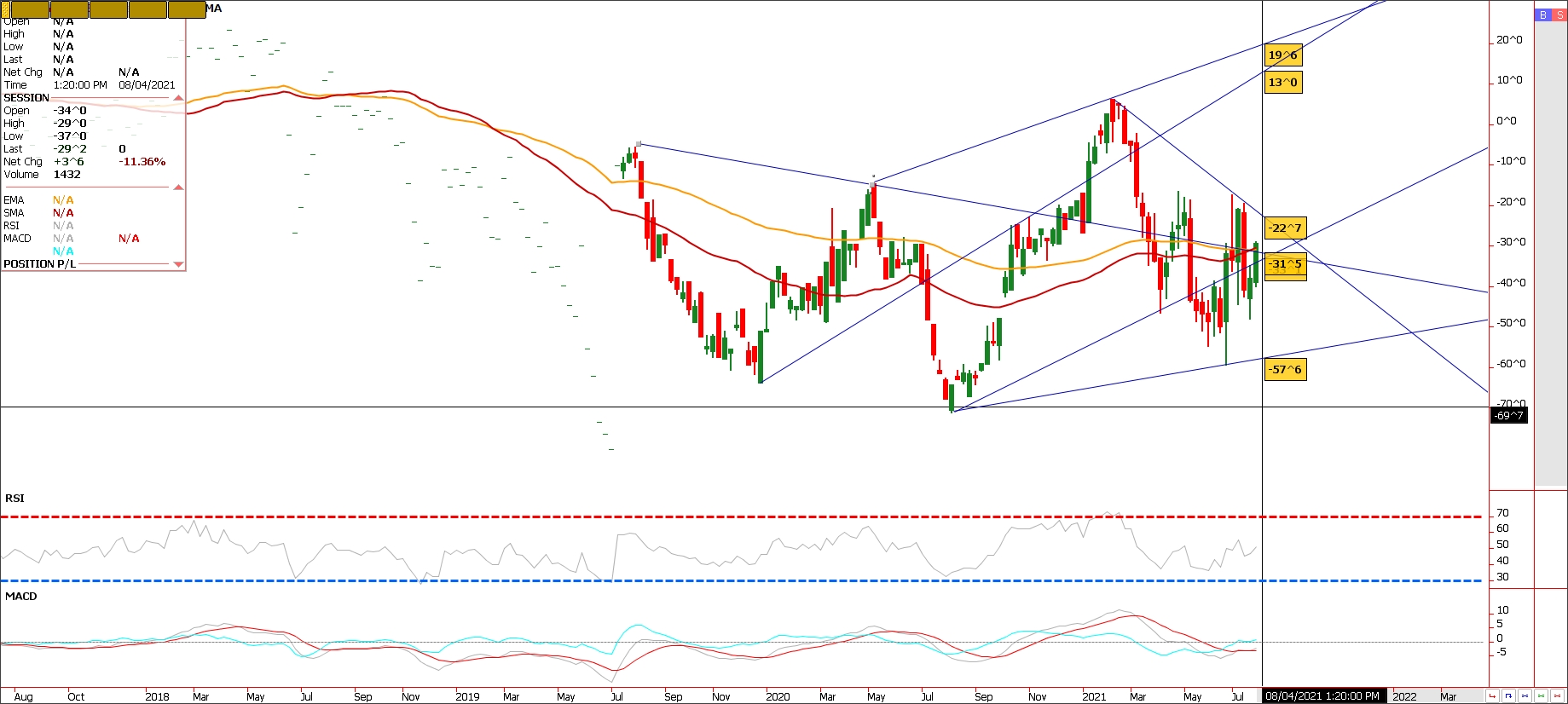

A trade I have been looking at is KC wheat vs Chicago. With abandonment a big possible issue for the Minneapolis crop, I look for better demand potential for the higher protein KC vs Chicago. Caution is warranted here if you play this spread. I think if Minneapolis continues its rally and makes a run for 10.00, it’s my opinion that KC will continue to narrow vs Chicago. Call me with questions.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a weekly grain and livestock webinar every Thursday at 3 pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604