Old Crop/New Crop Corn or in this case July 20/Dec 20 corn has been wedging since early November. The spreads range is approximately from 1 cent July over to 5 cents under. A whopping six cent range. (See Chart). In my view something big for Corn is on the horizon. Whether we see an old crop squeeze vs potentially higher 2020 corn acres remains to be seen. A breakout here on the charts could simply push the spread to 10 to 20 cents July 20 over. A producer can justify adding postions on a rally on this spread as he/she sees fit. After all one would be amassing Dec 20 corn for a downside hedge, while specualting on July 20 for corn they already sold. Remember the longer the wedge, the better possibility for a larger percentage move in the market. If long I would be out on a close below 5.4 cents July under on this spread.

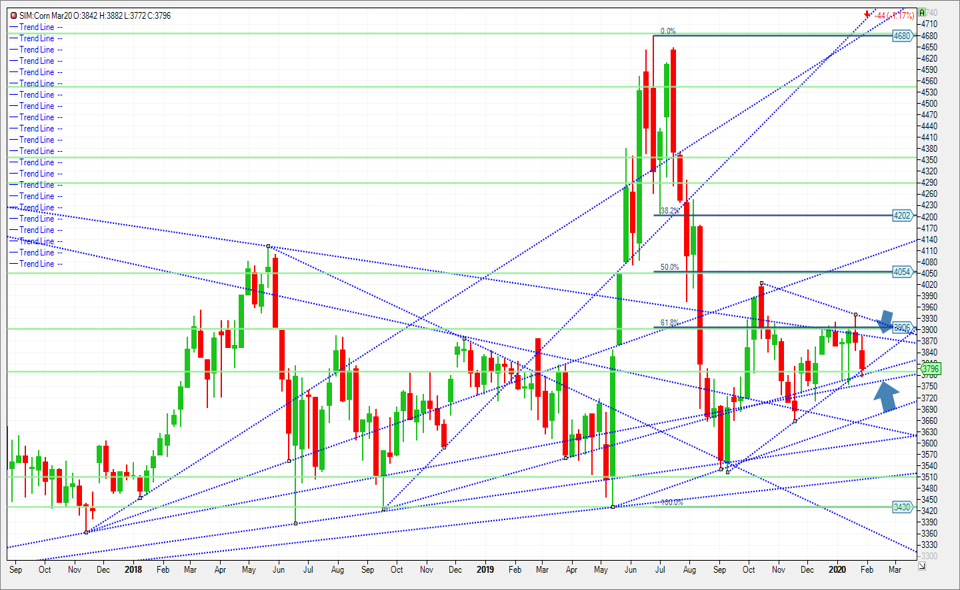

Below I have the March 2020 Corn weekly continuous chart. Similar to the July/Dec spread, March 20 corn is starting to wedge. Next week the wedge narrows further. A bigger pronounced move is coming in my view, but which way? Under 375 and the market could push all the way to 360 then 351. Over 393 next week, we should move to 4.04/05 in my opinion then 426. That’s what the charts tell me. Fundamentals come in as follows in my estimation. Export Sales like this week at least finally meet USDA expectations and perhaps surpass them through March. Sales for future shipment today came in at 1.2 million metric tons with UNKNOWN destinations in for 345K of the total. UNKNOWN in the trade is spelled C-H-I_N-A. However with the Cornona virus spreading in China, last week’s corn push higher was abruptly halted as longs exited and new shorts entered the market. In my view with if this disease is contained I would be a buyer on any dips in Corn. Brazil is sold out of exportable corn in my opinion as their largest beef and pork producers buy from Argentina. Premiums in South America therefore have risen above US Gulf offers. Second we still have a over a billion bushels to harvest thats still stuck in the field here. According to the USDA its counted. Not sure I get it. South American corn harvest wont begin until April with Argentina Corn just planted and Brazil seconf crop corn planting just beginning. There maybe an export window here for US supplies. Plus the uncertainties of weather could keep the market bid. These are reasons on why it would go higher. However it doesnt mean it will rally or that it has too. I just see a breakout here one way or the other soon. Trade the Charts.

Please join me each and every Thursday at 3pm Central for a free grain and livestock webinar. Signup is free and a recording link will be sent upon signup. We discuss supply, demand, weather, and the charts. Please email me at slusk@walshtrading.com or 888 391 7894