Commentary

KC wheat futures had rallied approximately $1.83 from the early May lows to the spike right before the grain corridor extension last Wednesday. Today, July KC wheat closed at 8.25 which is a 50 percent retracement from the monthly high/low. Russia continues to complain but finally agreed to the extension of the grain agreement last week. The clock restarts for another 60 days and I expect to see the usual drama leading up the July deadline. US values continue to dissuade competitive exports with US HRW (KC Wheat) $120/mt over Russian FOB. This is the issue in my view. There is no significant demand for US origin. Despite poor crop quality that has the US importing high protein wheat, demand remains nonexistent. Another shipment of about 30,000 MT of European Union origin wheat, believed to be from Poland, is expected to be shipped to the U.S. in June or July. This follows two previous shipments of Polish wheat to the U.S. – one of about 31,000 MT shipped in April and another of about 32,000 MT shipped in January both to Tampa, Florida. The price of Russian wheat with 12.5% protein content, delivered free on board (FOB) from the Black Sea in June, was $242 per metric ton, down $6 from the previous week, IKAR agriculture consultancy said.

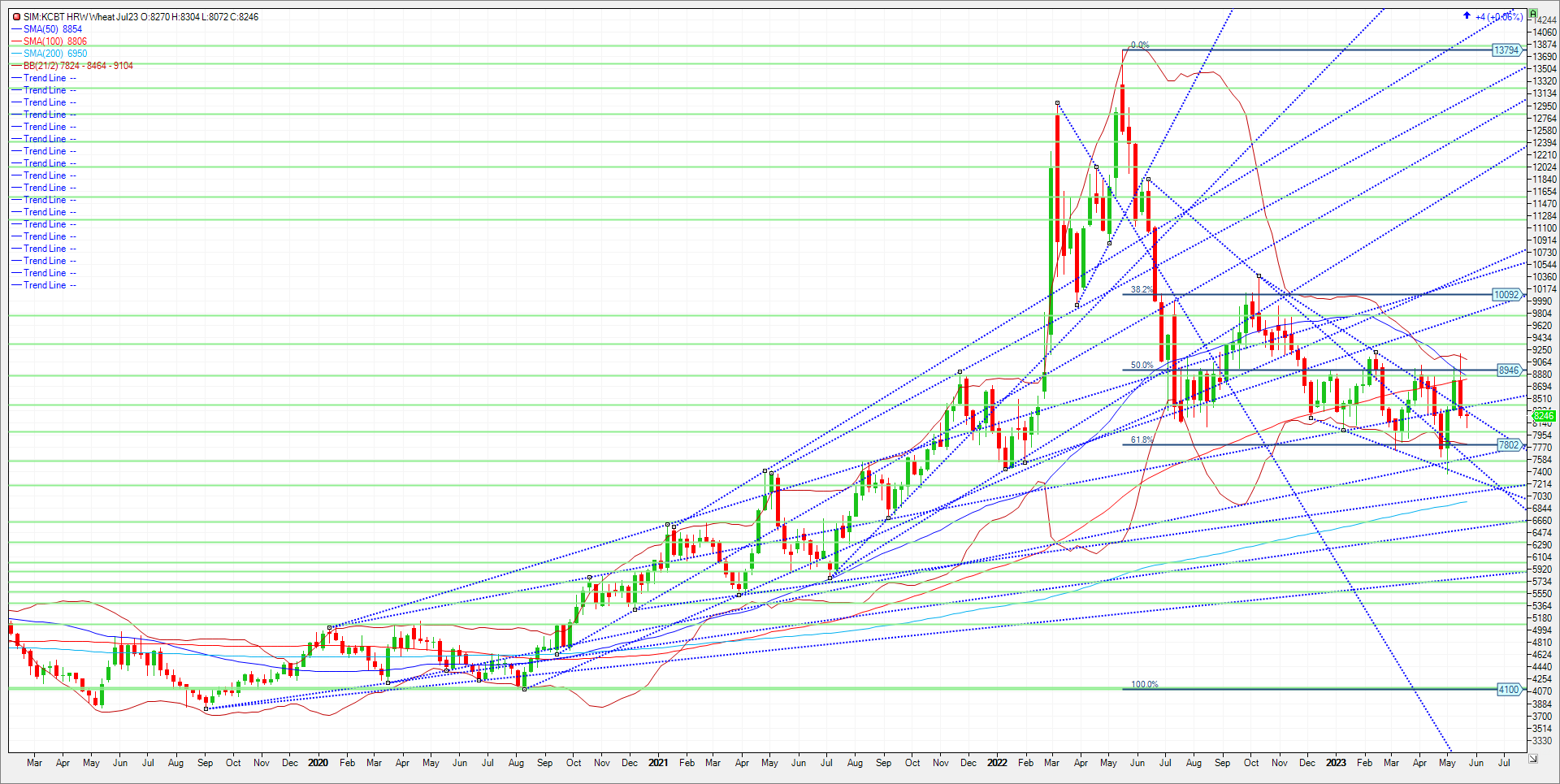

Rains forecast for the western Southern Plains over the next 10 days which could aid some of the US crop. The Wheat Quality Council tour of Kansas put the state at 30 bushels per/acre vs 45.6 bushels/acre average. However, wheat is grown on quality not quantity. Therefore, not much demand for lower protein varieties, of which the US has an abundance. It’s a big reason why KC traded to a record vs Chicago. The inter market wheat spreads have also seen significant pullbacks as KC wheat versus Chicago wheat hit a record at $2.75 KC over last week. Today it closed at $2.19. July KC wheat last week also traded a high of $3.45 over July corn but closed today at $2.54. The unwinding of these spreads has pressured KC wheat in my opinion. Technical levels to watch in July KC come in as follows. Support is 8.00. A close below and its katy bar the door to 7.61 and 7.56. A close below here and its 7.22, which represent 20% down for the year. To turn bullish in my view, the market needs to close over 3 levels. Resistance is at 8.31, 8.37, and 8.44. A close over 8.44 could send the market back up to 8.78, 888, and 892. A close over 8.92 this week and the market likely challenges 9.32 in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604