Commentary

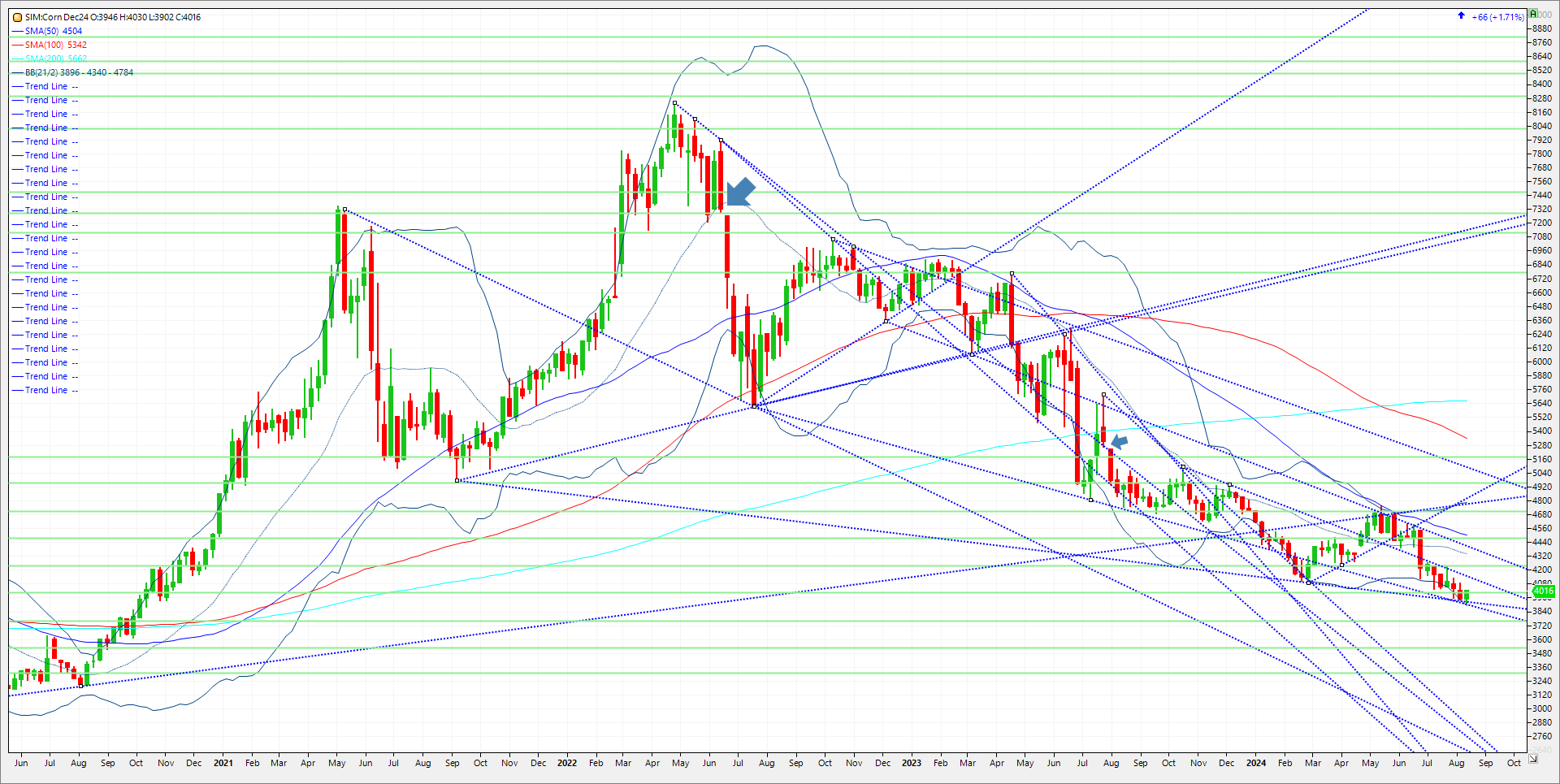

Although corn’s yield posted another record high this month per USDA at 183.1, corn futures rallied off of key support and settled back above 4.00. Managed money bought back 16K contracts today as markets short covered due the fact ending stocks for corn came in at 2.073 billion bushels vs the average trade guess at 2.119 bushels. What prompted the bullish ending stocks figure was a 700K cut in harvested acres. This offset the record yield in my view and may put a new near-term bottom in until next month’s WASDE. Dec 24 corn held major trendline support at 3.92/3.90. See weekly continuous below. Those trendlines need to hold in my view or the market most likely tests the 20% down for the year target at 3.76 and perhaps 25% down at 3.53. For this week resistance is at 4.14 and then 4.24. Global corn production was revised 1 million metric tons lower than expected but that’s a mere drop in the bucket in the big picture. Exports were revised better by 75 million bushels due to lower output in the EU and Black Sea. The question going forward for me is this. Can this crop get bigger? Can we see a 184 yield or even 185 in subsequent reports? If so, it would put a floor in ending stocks at 2.073 in my opinion with potential raises in Sept, Oct and November to 2.3-to-2.4-billion-bushel carry-outs. That remains to be seen but a continuation short covering rally this week could push the market 10 to 20 cents higher from current levels. If that happens its Xmas come August. A 2-billion-bushel carry is more than comfortable as a carry-out. For those with unpriced bushels that are going into storage, please consider the following hedge idea for protection

Trade Ideas

Futures-N/A

Options-Buy the March 25 4.20 put and sell the July 5.00 call for even money. This risk reversal settled at a 11-cent debit today, so a rally is warranted of about 10 to 15 cents on the March Board to buy the risk reversal at even money.

Risk/Reward

Futures-N/A

Options-Unlimited risk and this trade is for corn producers only. Locking in 4.20 is the goal on a small percentage hedge until end of February is warranted in our view as the major risk is July 25 corn going over 5.00. Producers may take that risk.

Please join me for a free grain webinar every Thursday at 3p Central. We discuss supply, demand, weather and charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.