Commentary:

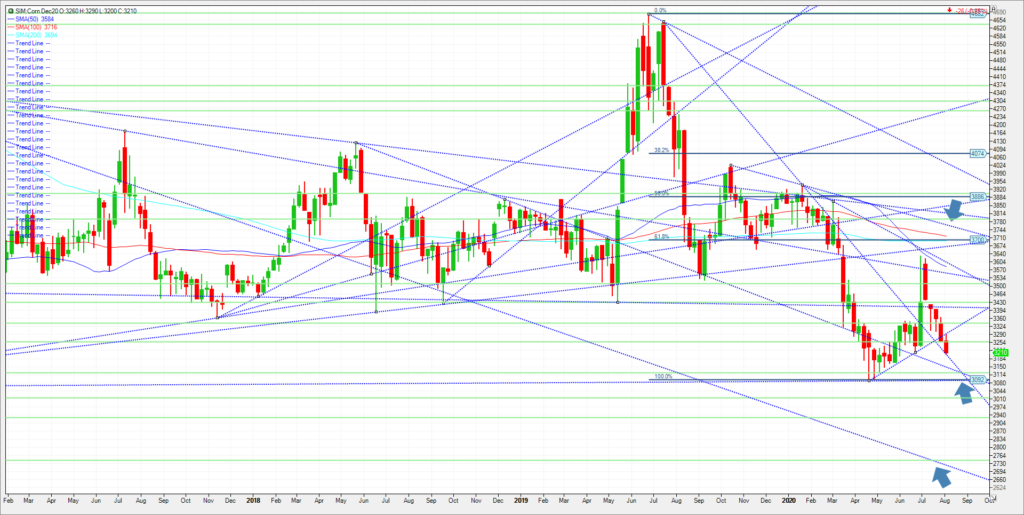

Some of the talking heads in the trade are commenting that it is only a matter of time before new crop corn has a 2 handle in front of it. Are they correct? The bearish news driven by excellent yields and production in South America this past growing season coupled with domestic demand decimated by Covid that increased the balance sheet this Spring sank corn to 3.09. That surpassed the 20 percent down on the year threshold at 311.4. 25 percent down is 2.93 and 30 percent down for the year is at 2.74. Currently we are staring at a record production here at well over 15 billion bushels should nothing else bullish weather wise enter into the market. Outside of some dry spots in Central Iowa, it looks like a bumper crop in most growing areas of the corn belt. Those producers who have not locked in new crop bushels yet may consider the following hedge below. We can still see rallies near term; strong demand, inflationary bargain buying, or a sizable soybean rally being possibilities signalling a near term corn bottom. Weather rules now and the first half of August looks optimal. While that can flip flop, please consider the following hedge below. locking in 360.0 March 2021 corn.

Trade Ideas:

Futures-N/A

Options-Buy the March 21 corn 360 put. Sell the March 21 corn 3.00/3.60 call spread. Bid even money.

Risk /Reward

Futures-N/A

Options-The cost to entry for this 3-way option strategy is even money, meaning nothing to put up except commissions and fees. Buying the ZCH21 360P and selling the call spread (300c-360c) has a max risk of 3K plus trade costs. This trade is designed for producers due to the heightened risk. An option settlement below 330 in late February would be needed to collect some reward at option expiration.

Please join me every Thursday at 3pm Central for a free grain and livestock webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.