Commentary

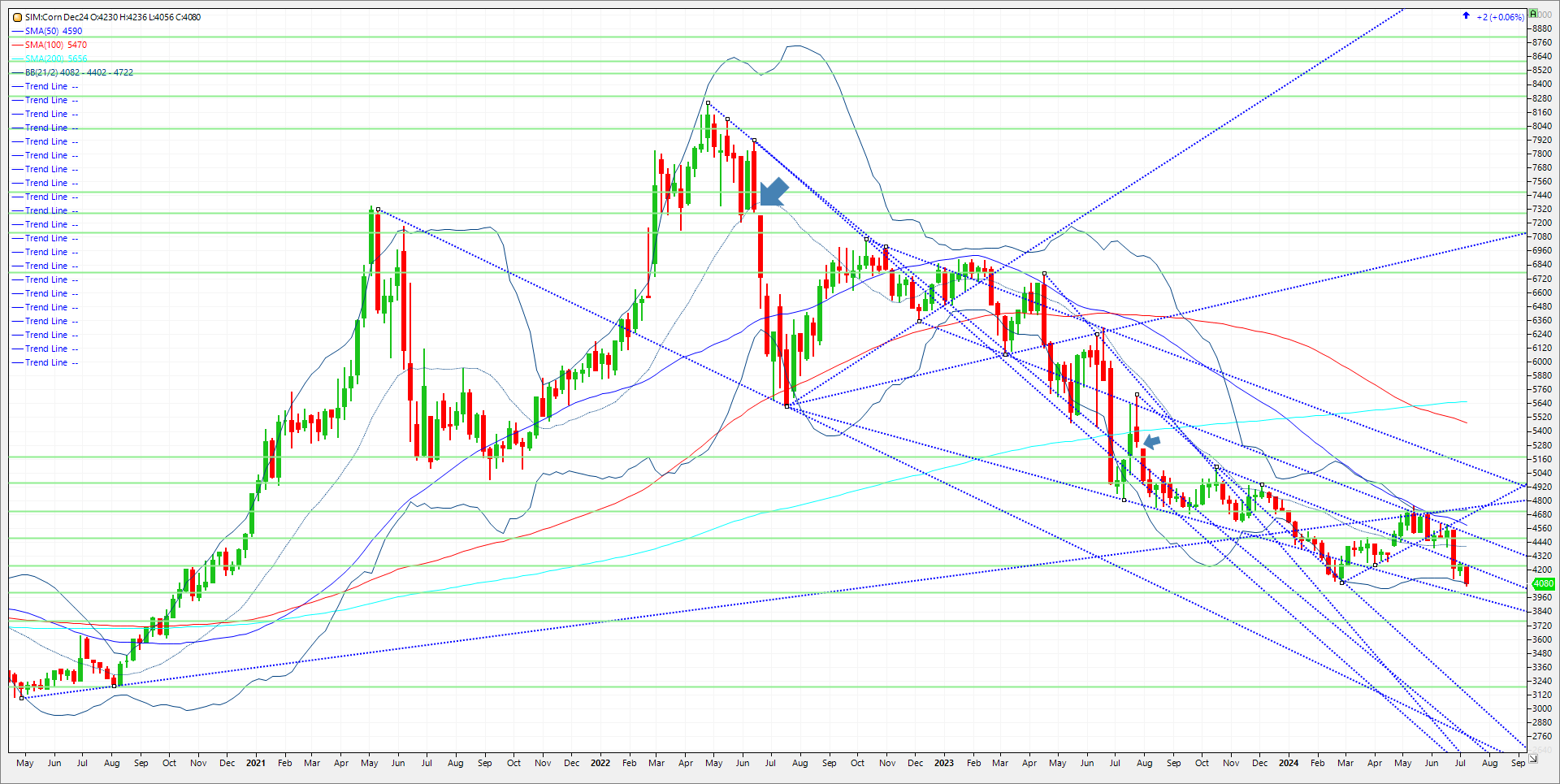

Funds are record short corn. It is the second record short for managed money so far in 2024. The first record at the end of February put managed funds at a 340K contract short and a low of 4.08 on the Board. After today’s close, its estimated that the funds are short 363K. Could they add more? Sure, why not. Weather up until now remains a non-factor given plentiful rain and no heat domes emerging in the Midwest. Crop conditions came in yesterday at 68% good/excellent, up from 55% last year and the 62% five-year average. Last year was record corn production in the US and with corn “made” in the July timeframe, funds in my view at this moment don’t have much of a reason to cover but rather add on rallies. That said, the USDA will be updating its global and domestic supply and demand estimates on Friday, while also incorporating the stocks and acreage data from its June 28th report. Should there be an acreage adjustment that sends production lower or weather turns hotter and drier after the remnants of Hurricane Beryl move out, we could see a bounce into August. One thing about the fund short is that it will take one actor to scream “fire in the theater” and the short covering emerges. Beans and corn alone are 500K short and if you add in the positions of three wheat classes, you have funds short well over 600K contracts. This week’s new record short took corn to 405.6, a new low by 2 cents. In Feb we saw a sizable rally when the selling ran dry at 4.08. Will lightning strike twice? It is hard to predict in my view as corn needs help from outside markets like wheat and beans rallying or from something else entering into the market. Without that or weather turning much more bullish, what adjustments are going to offset the USDA at a 2.2-billion-bushel carry. We have previously seen prices well in to the 3’s with that type of carry pre pandemic. Keep in mind though that the USDA yield estimate at 181 BPA is over 3.7 bushels per acre higher than last year’s record. Could that be too optimistic? If acres come in lower and weather turns bullish the answer is likely yes. For those not hedged up for the 24/25 corn crop, please consider the hedge idea below. Technical levels for Dec Corn come in as follows. Key support is at 4.00/3.97. If that doesn’t hold look for 3.76, 20 % down for the year and my downside target. Resistance is at 4.22/24. 4.24 was last week’s high, we need a close above it to turn bullish in my opinion. The next level of resistance is at 4.40 and then 4.48. Hedge idea below for unpriced corn bushels below.

Trade Ideas

Futures-N/A

Options-Work an order to sell the July 25 corn 5.00 calls while buying the October 24 4.30 puts for even money plus trade costs and fees.

Risk/Reward

Futures-N/A

Options-The hedge idea settled near a 15-cent debit today that would cost one at $750 plus trade costs. We are suggesting selling the spread on a short covering rally at even money minus trade costs and fees. This position has unlimited risk and therefore should be considered only for the corn producer who can offset his option positions versus his physical production.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604