- Commentary:

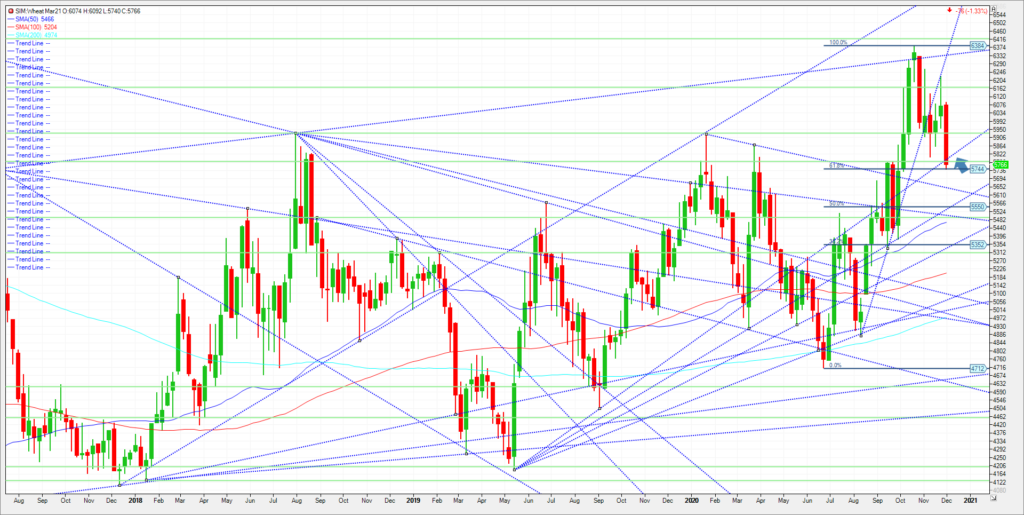

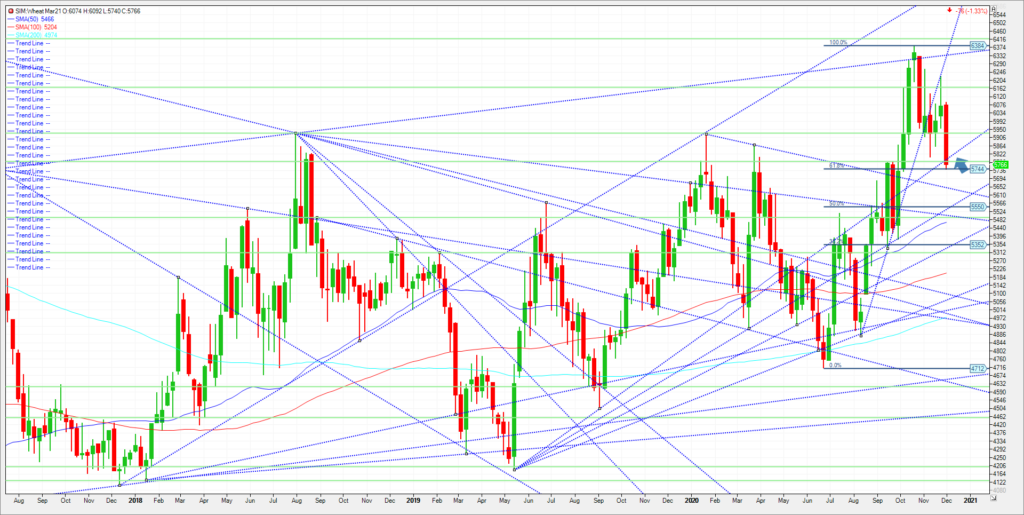

- Wheat futures finished Friday near this week’s lows after opening higher last night. The market needs to close below 574 next week to eventually confirm further weakness in my opinion as the crop enters dormancy. There is some good news abroad for winter wheat that is garnering headlines and adding potentially adding pressure. The French wheat crop is developing well, with 96% rated in good or excellent condition as of Nov. 30, steady with the week prior, France- AgriMer data showed today. That’s a dramatic improvement from last year at this time when just 73% of the crop garnered top marks, Canada wheat production was pegged at 35.2 million tonnes. The biggest crop in 7 years. And larger than expectations of 34.3 million metric tons. Traders also see big crops coming from Australia even as Australian shippers are reportedly shying away from offering wheat to the Chinese market, with Beijing’s actions on other commodities like barley and wine making shippers on either side of the ocean unwilling to do business with the other country. That adds to the Aussie supply with India of all places filling the export need into China.

More important for me is that managed funds flipped to a net short in Chicago wheat as they sold 19,696 contracts to go net short of 4397 contracts per CFTC data released this afternoon. It has been my experience that funds wont stop at just a 4K net short. They most likely will build a short of 20 to 30K in length. Given Chicago has the highest prices on the Board vs KC and Minneapolis, I contend that its overvalued. Funds are still net long KC at 44K and net long Minneapolis at 4K. All the managed position data given today was as of the close on Tuesday Dec 1st. A close under 574 on the weekly continuous chart below point to a drop to 555 and then 535 in my view. How to play it? The simple way would be to sell futures on a sell stop at 574 and see if the market closes below. This is the easiest way but also the most risky as the market could down tick, and then reverse course and trade higher without warning on something entering the market or outside grain markets rallying. It could be for a myriad of reasons. Condition data was elevated in the Soft red winter wheat states east of the Mississippi which is exact opposite of the hard red winter ratings in Texas, Oklahoma, Kansas, and Colorado. The ratings maybe the reason for going short Chicago wheat vs long corn, or long KC or Minneapolis wheat. Option idea below. Its just one idea, not THE idea.

Trade Idea

Futures-N/A

Options-Tight bet here with 20 days left before option expiration on 12/24. Buy the Jan 21 wheat 550 put option for 3 cents. Cost is 150 plus commissions and fees.

Risk/Reward.

Futures-N/A

Options-The cost of the option plus which in this scenario is 150.00 plus trade costs and fees. If the market breaks I look for wheat to trade down to 535, if so I would look to offer the option at 20 cents.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. Sign up is free and a recording link will be sent upon signup. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax