Commentary

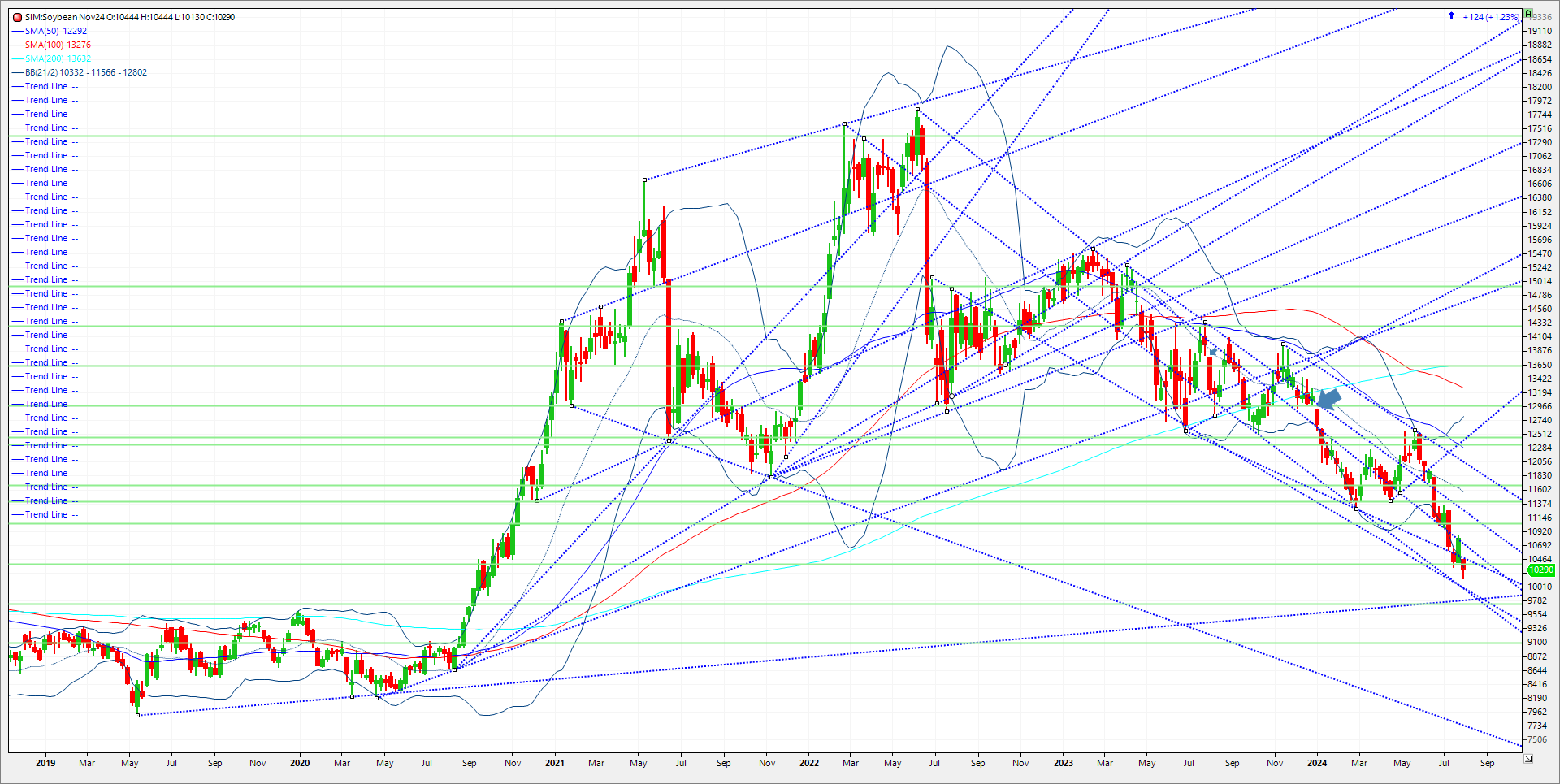

Bean prices held the early gains for once and didn’t fade late. Strength in meal helped today to close out the week. A rout in equities may have provided managed funds to cover their record net short in grains across the Board. A story worth noting is the USDA announced a 202 thousand metric sale of 24/25 soybeans to China. This sale is late and small compared to the usual accumulated commitment China usually has built with the US by this point of the season. That said it was the second day of purchases from China in a near term oversold market. I think we need to see more purchases by China to drive further short covering. However, we could see profit taking due to the Goldman roll starting next Wednesday, and ahead of the WASDE report with updated acres on August 12th. You also have the potential for a powder keg to blow in the Middle East. The flip side is that you also have plenty of soybeans that will flood the market into and through harvest. The first fifteen days of August looks non-threatening for funds to buy a weather inspired rally. The back half of the month still in question. We are going to need to move to Drought like conditions moving forward to damage this crop in the Midwest and there is nothing in the forecasts currently that presents any threat like that. Funds are fickle though, as it takes one person to scream fire in the theater and they all go a running or in this case short covering. We may see further short covering if for example China buys more cargoes for future shipment next week. That maybe just another opportunity to re-short this market. This market needs a story to sustain a rally longer term. For now, that doesn’t exist. Rallies this Summer have been limp, led by profit taking and usually not lasting more than three sessions. I suspect that continues for now. Trade the charts! (see Below). There is a lot of resistance just above todays close. Resistance is first at 1030/1031. Then we have the 20% down for the year marker at 10.38. A close over here and 10.45 is next. Should we clear these levels, key trendline resistance is 10.68 next week. This is the level that needs to be taken out to turn bullish in my view. Should that happen look for the market to challenge 11.03. I don’t have key support until 9.92. A close under and its 9.73/72. A close under here and its katy bar the door to 9.09.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.