Commentary

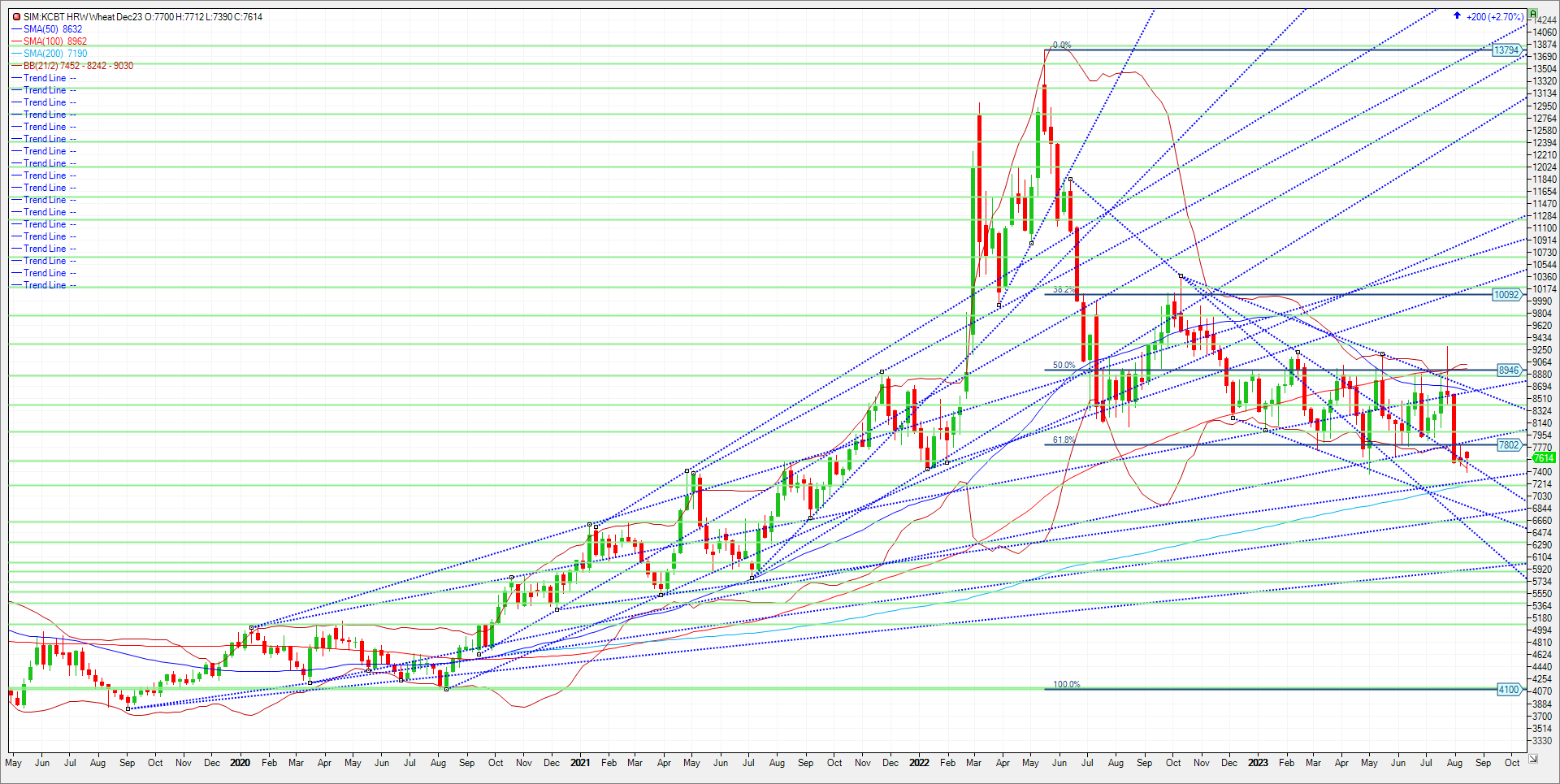

Tit-for-tat Ukrainian and Russian attacks have marked the ongoing War in the Black Sea area lately. But these attacks overall have done little to halt the price slide caused by plentiful global wheat supplies amid weak demand for North American origin the last three weeks. Since the high on July 27th at 929, KC wheat has lost 1.90 in value in less than 3 weeks. A steep drop. Therefore, I see today’s rally as nothing more that profit taking into the weekend. That said markets started higher from the onset of last night’s open and continued through today’s session. Strength was led by Chicago wheat with KC and Minneapolis following. There was an isolated report of a fire at a cargo/oil terminal in the Russian port of Novorossiysk early this morning may have contributed to the buying that has been seen but some profit taking/short covering shouldn’t be rule out. Also, there were drone attacks on Moscow overnight and now going into the weekend trade will want to see what type actions the Russians take in response potentially. What to do? Trade the charts. I attached a weekly KC Chart. The market held key support from the downward trendline at 7.53 this week. While we settled below this are twice this week, we finished the week above it, holding support. That line moves to 7.47 next week. A close below and Dec KC wheat could push lower to the next level of supports at 7.26, 7.22 and the 200-week moving average. A close below the 200 MA and its katy bar the door to 6.84. Holding support is one thing this week, but to turn friendly, Dec KC needs a closer over 7.87 next week. (Upward trendline). Should that be achieved look for the market to retest 8.00. a close over 8.00 and the potential exists for a rally to 8.44, the five percent down for the year threshold.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604